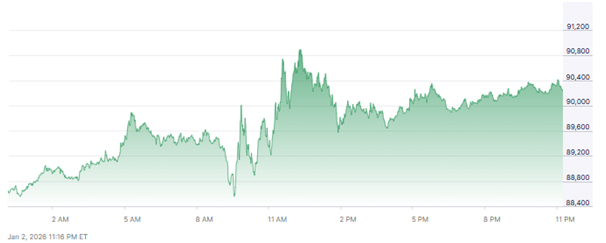

Bitcoin (CRYPTO: BTC) is still trading around the $90,000 mark, and instead of giving a clear indication of either a bullish or bearish trend, investors are left to assume if 2026 will be a year of significant breakout or just another cycle of prolonged consolidation. The analysts point out the volatility in the market and mention that the next few months could possibly decide the next big move.

Bitcoin hovers $90K; 2026’s trend remains uncertain. [Source: CWallet]

Why Is Bitcoin Rising in 2026?

The cryptocurrency has started 2026 in a tight consolidation, but is not showing any clear direction, either up or down. According to CryptoQuant, the very same factors of uneven capital flows, ETF-driven activity, and derivative trading are the ones that are keeping the price in such a narrow range.

The sideways trading, however, does not worry the experts in the long run, as the structural supply limitations and growing ETF market are still taking part in the cryptocurrency’s long-term potential. Investors are tirelessly monitoring macroeconomic indicators and the U.S. political situation, as those factors can trigger near-term price movements.

What Are the Likely Scenarios for Bitcoin in 2026?

In its report, CryptoQuant has identified three key scenarios for Bitcoin this year. The one with the highest probability is the range-bound market, where BTC will be fluctuating between $80,000 and $140,000, with $90,000-$120,000 as the core zone.

The medium-probability event includes a macro shock, like a recession or a sharp risk-off movement, which could take Bitcoin below $80,000 and possibly down to the $50,000 level. The least likely but most cheerful scenario is a risk-on breakout, where early monetary easing and sustained ETF inflows drive Bitcoin up to the $120,000-$170,000 range.

CryptoQuant outlines three Bitcoin scenarios for 2026. [Source: Coinfomiania]

How Will ETF and Derivatives Activity Impact Bitcoin?

ETF flows, exchange reserves, and futures open interest are very important to Bitcoin’s price eventuality. The analysts opine that the behaviour of both short- and long-term holders is equally important.

On the one hand, ETFs provide easy access to the market and draw in funds, while on the other hand, trading through derivatives might keep the price from going too high. At present, the market does not have any strong confirmation signals, thereby neutral to slightly bearish on the near-term outlook. Investors are warned to keep an eye on the trends of ETF adoption and liquidity conditions.

Bitcoin Could Reach New All-Time Highs

Stockmoney Lizards predicts that Bitcoin will first stay within its range before breaking out to record levels later in the cycle. When Bitcoin dominance is at its peak, capital rotation might lift the altcoins that are already oversold.

According to one group of analysts, the constant inflows into the ETFs would not only increase the Bitcoin share in the total market but also raise the overall market valuation. The gradually growing infrastructure for digital assets is a reason for optimism, although the timing is still a question mark.

Bitcoin may range first, then surge later. [Source: Nasdaq]

Is Bitcoin a Good Investment in 2026?

The volatility is there, but still, Bitcoin is a very alluring investment for people who want to get into the digital asset space. Trading within the range does create entry points, while the macro situation can very well lead to rapid price changes.

The demand from structural supply constraints, ETF adoption, and wider market participation may all contribute to long-term price increases.

However, the analysts warn that the political and economic uncertainties might affect the short-term performance. For those investors who are willing to take the risk, Bitcoin, nevertheless, is still a significant part of diversified portfolios.

What Investors Should Watch in the Coming Months

Key indicators include capital flows, ETF activity, derivatives positions, and holder behaviour. Macro events such as U.S. political changes or global economic shocks may impact BTC prices significantly.

Traders should observe technical and on-chain metrics to anticipate potential breakouts. While immediate gains may be limited, Bitcoin’s infrastructure expansion and ETF adoption signal strong long-term prospects.

How Global Sentiment Shapes Bitcoin Prices

Investor sentiment across global markets is increasingly influencing Bitcoin’s price action. Positive news, regulatory clarity, or institutional adoption can boost confidence and drive inflows.

Conversely, geopolitical tensions or economic uncertainty may trigger risk-off behaviour, pressuring the cryptocurrency. Traders should track global market trends alongside on-chain metrics to anticipate potential volatility.

The Role of Altcoins in 2026 Market Dynamics

As Bitcoin consolidates, altcoins could see notable relief rallies, especially when capital rotates away from BTC dominance. Analysts expect oversold altcoins to recover, offering traders opportunities to diversify within the crypto space.

Expanding ETF access and infrastructure growth may further distribute investment capital, supporting broader market gains beyond Bitcoin.

Also read: Trump Crypto Influence: How 2025 Shaped the Cryptocurrency Market 2026

FAQs

Q1: Will Bitcoin go above $100,000 in 2026?

A1: It is possible, particularly under a risk-on breakout scenario with favourable macro conditions.

Q2: Why is Bitcoin rising in 2026?

A2: Bitcoin gains are driven by ETF adoption, capital flows, and structural supply constraints.

Q3: Is Bitcoin a good investment in 2026?

A3: Yes, for investors seeking digital asset exposure, though volatility remains high.

Q4: What risks could affect Bitcoin this year?

A4: Macro shocks, political uncertainty, and derivatives-driven trading may influence price.