Austral’s Big Copper Gamble: The Lady Loretta Takeover

Source: Redpath Mining Contractors and Engineers

Something substantial has just occurred in the north-west Queensland copper belt—and if you blinked, you could have missed it.

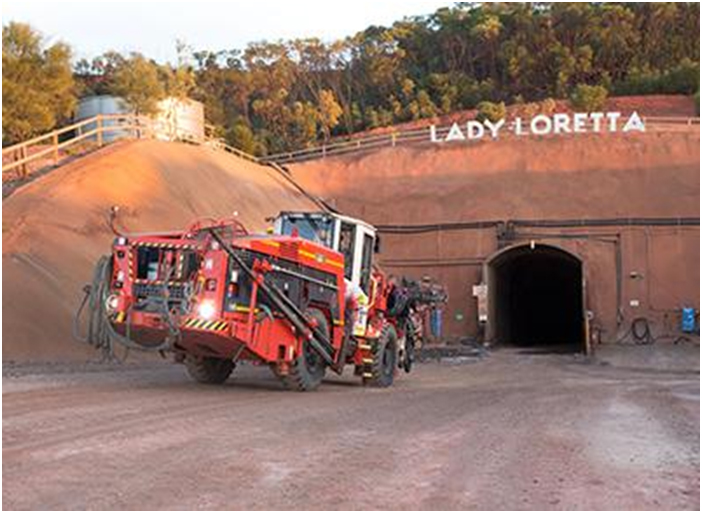

Austral Resources has acquired a deal that has the potential to alter the beat of copper mining in the region. The firm has signed a binding memorandum of understanding (MoU) to take over the Lady Loretta mine lease from Glencore, and although that name may sound like some antiquated affair with zinc and silver, don’t be deceived—it’s all copper.

To Austral, it’s not merely another location on the map. It’s a smart, contemplative step to expand its presence throughout the Eastern Isa copper complex. More to the point, it introduces welcome feed to its current Mt Kelly processing plant, so it can run hot and tight for years to come.

What’s the Big Deal?

So why is Lady Loretta a big deal?

First off, this mine is literally hemmed in by Austral’s Lady Annie tenement. The two deposits almost shake hands over the fence. That is significant—a very significant factor. From previous drilling results, mineralisation trends do not end at fences. Copper oxide zones high in copper have been intercepted close to the mutual lease boundary, which is indicative of a geological handshake that could go on deeper below ground.

If it all works according to plan, Austral will pipe ore from Lady Loretta into the Mt Kelly SX-EW (Solvent Extraction–Electrowinning) plant—a 30,000-tonne-per-year copper cathode-producing plant.

Let that just stand for a minute. That’s enough copper to wire some 375,000 average Australian homes, by today’s household usage.

Not Just a Mining Lease—It’s a Strategic Puzzle Piece

Glencore, the world’s mining industry titan, had already rebuilt Lady Loretta in 2018 following a brief three-year idle period in 2015. But with mine life dwindling fast—Glencore is closing by December 2025—Austral saw the opportunity. The purchase brings Austral established infrastructure and drill-established ground. It’s much like purchasing a stadium after the game has been called off—apart from the seats are still vibrating and the floodlights are still on.

And there is the strategy’s cutting edge.

By way of Lady Loretta, Austral has access to new copper oxide ore that sits nicely with its processing capacity.

The mine geology in particular is suited to Anthill, Lady Annie, and the newly acquired Rocklands assets—enabling the company to mix feedstock, flatten levels of ore, and maximise recovery rates.

It lowers cost per tonne by eliminating long-distance trucking and consolidating within a single mineral district.

In plain English? It’s more affordable, quicker, wiser—and greener.

A Look at Numbers

Austral isn’t betting on potential. They are constructing a serious copper project:

Cathode Production Target: Exceeding 40,000 tonnes per year from multiple sources of feed

Processing Capacity at Mt Kelly: Expandable to 30,000+ tonnes/year

Combined Tenement Coverage: Now more than 1,500 square kilometres in Northern Queensland

Copper Prices (July 2025): At around US$9,500 a tonne, copper is the “new oil” of electrification

That is, Lady Loretta is no side hustle—it’s a sustainable growth driver that’s strategically-positioned in one of humankind’s most copper-starved decades.

Why Copper?

We’re electrifying the world quicker than we’re extracting it. From electric cars to renewable energy networks, copper demand is on the rise.

BloombergNEF forecasts demand for copper globally to double by 2035, fueled by the transition to green energy. And as the world struggles with ensuring supply, Austral is quietly building a vertically integrated copper corridor in its own backyard.

Smart, just smart—is visionary.

The Human Impact: Beyond Tonnes and Charts

Excellent, this is great news for investors—but what about the people on the frontlines?

As Glencore shut down, there were real fears that Lady Loretta would face job losses. But Austral coming in may save hundreds of local jobs, especially for contractors and service providers in Mount Isa and Cloncurry. The business has already indicated it may collaborate with Redpath, the existing underground contractor, to ensure continuity on site.

That is:

- Job saving to 2026 and beyond

- An expected increase in local purchases and services

- More sustained stability for families residing in mining boom towns reliant upon the boom-bust cycle of regional enterprises

In an industry where boom and bust is more of a rule than an exception, it’s a welcome respite.

What’s Next?

The MoU might not be signed and sealed yet, but all indications are that handover will be smooth. Austral will have some commercial negotiations to complete and the Queensland Government lease renewal to arrange, but momentum is on their side.

Secured in safe storage, Lady Loretta’s oxide ore would be capable of feeding Mt Kelly in 18 to 24 months, greatly adding value to Austral’s processing plant’s life.

And with their ability to short-work development (as demonstrated at Anthill), that’s not such a big ask.

Final Thoughts

A revolution is quietly happening in Queensland copper country—and Austral Resources is at its very heart.

This’s not simply about another mine being offloaded. It’s about a typical Australian player playing well beyond its station, securing itself in a strategic foothold in an industry which is increasingly becoming more and more central by the day.

Lady Loretta may not be ringing a bell. But to those interested in the future of copper, green power, and mining in Australia—it’s impossible not to take notice suddenly.