Auric Mining has confirmed the acquisition of the Munda gold project from Win Metals, reinforcing its expansion into one of Western Australia’s most active mining belts. The deal gives Auric full control of the near-surface gold deposit, seen as a strategic asset due to its proximity to existing infrastructure and its development potential.

The agreement was finalised earlier this week, with Auric acquiring the remaining 49 per cent stake in the project. It already held a 51 per cent interest and had been operating Munda under a joint venture structure.

Advancing a Key Growth Asset

The Munda deposit, located near Widgiemooltha in WA’s Goldfields region, has been part of Auric’s broader strategy to build up gold resources that are close to surface and near production-ready. By moving to 100 per cent ownership, the company gains operational flexibility and simplifies its planning process.

While the deposit has been the subject of past exploration, Auric’s team believes there is more to uncover. Historical drilling has defined mineralisation, but recent studies suggest extensions may lie beyond current boundaries.

A Move That Aligns with Auric’s Long-Term Strategy

In a statement, Auric Managing Director Mark English called the acquisition “a logical and important step” in the company’s growth. “We’ve always believed in Munda’s potential,” he said, “and with full ownership, we’re in a stronger position to realise it.”

English pointed to the project’s location as a key factor. Munda sits within haulage distance of regional processing options and close to other assets in Auric’s portfolio. That geography could support a hub-style development plan if further drilling results are favourable.

Terms of the Deal

Auric will make a cash payment to Win Metals and has agreed to issue a package of shares and options as part of the purchase. While the total value of the transaction has not been publicly disclosed, the structure mirrors other recent junior gold deals in the WA market.

The completion of this deal also signals Win Metals’ shift in focus away from gold and toward its other interests in the base metals sector.

Aerial view of Munda gold project area, WA (The Sydney Morning Herald)

Regional Context: A Busy Patch of Ground

Auric’s latest move comes as activity ramps up across the Goldfields. The Widgiemooltha region, long known for nickel exploration, has recently seen renewed interest in gold assets, especially those with shallow oxide mineralisation.

Several juniors are reviewing past drilling data from tenements once held by larger producers. Auric’s success in securing full control of Munda gives it a potential head start in advancing a project that has been on exploration maps for years but lacked focused development.

Technical Planning to Follow

Now that the acquisition is complete, Auric is expected to focus on a new round of technical assessments. The company will likely begin with resource model updates, followed by pit design studies and a review of potential processing routes.

Industry sources suggest Auric may consider toll treatment options in the short term while it evaluates longer-term plans, including standalone development.

A Tight Capital Approach

Auric has taken a measured path since listing, focusing on modest, staged development rather than high-capex plays. The Munda acquisition fits that pattern. With the deposit already drilled to a basic understanding and located near haul roads, the economics may support an early cash flow model — particularly if gold prices remain stable.

Investors will now watch for updated resource statements or scoping studies to give more clarity on timelines.

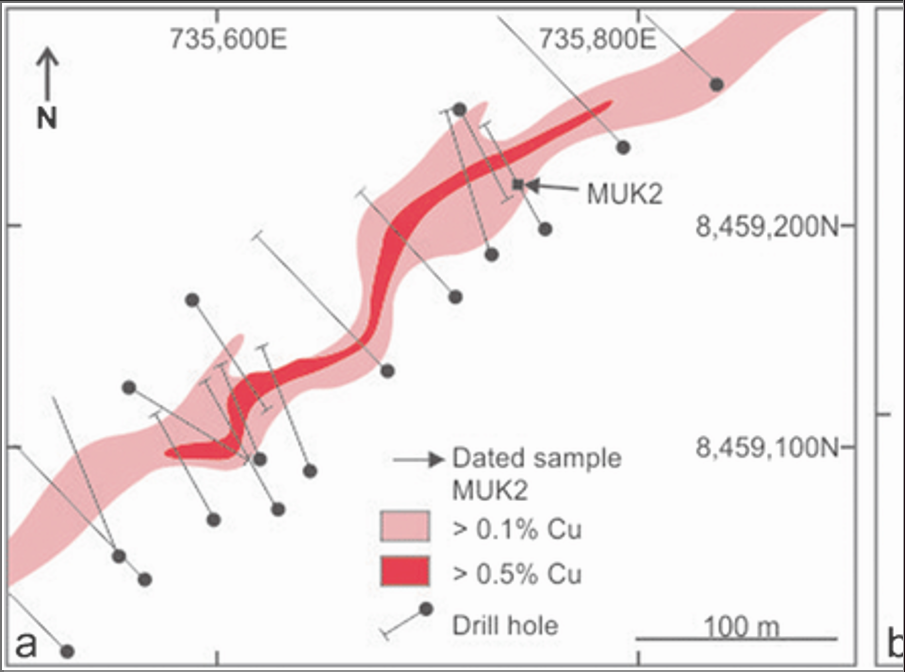

Munda mineralisation zones. (ResearchGate)

Final Word

The Auric Munda acquisition strengthens the company’s WA position and gives it full control over a project that aligns with its resource development strategy. With the deal now closed, attention will shift to how quickly Auric can turn Munda from a known deposit into a producing asset.

While not a blockbuster transaction, the move reflects the type of focused, strategic growth that small and mid-tier explorers are relying on to stay competitive in a fast-moving sector.