Asia Enters New Territory with Regulated Tokenised Money Market Fund

A major first for Asia’s blockchain and finance sectors has arrived. CMB International Asset Management, together with DigiFT, has introduced the first public-regulated tokenised money market fund in the region.

The fund is listed on Solana, Ethereum, Arbitrum, and Plume blockchains, representing a step-change in the distribution of traditional financial instruments via decentralised networks.

JUST IN: CMB INTERNATIONAL ($1T+ AUM), TOP ASSET MANAGER IN ASIA, HAS TOKENIZED CMB’S HK-SINGAPORE MUTUAL FUND ON @SOLANA.

THIS IS THE WOLD’S FIRST PUBLIC FUND ON THE SOLANA CHAIN, HOLDING SIGNIFICANT IMPORTANCE IN ASIA’S FINANCIAL MARKETS! HUGE!#SOLANA ⚡️ pic.twitter.com/Z5BQz2LjHL

— curb.sol (@CryptoCurb) August 13, 2025

A New Benchmark for Regulated Blockchain Finance

The key point here isn’t necessarily the fund’s technical scope — it’s that regulators in both Hong Kong and Singapore have given their official approval. With this twin-jurisdiction validation, it is an unprecedented case of a blockchain product that balances transparency with the full security of being compliant.

While tokenisation has been rising steadily across various asset classes, this is the first time a publicly listed money market fund has exceeded so tight criteria in two of Asia’s largest financial hubs. It’s a sign that the region doesn’t want to play second-fiddle in safe, innovative blockchain finance.

The Bridge Between TradFi and DeFi

The fund provides access to yield-generating assets such as government bonds, corporate notes, and other cash-for-equivalent products — all within the blockchain ecosystem.

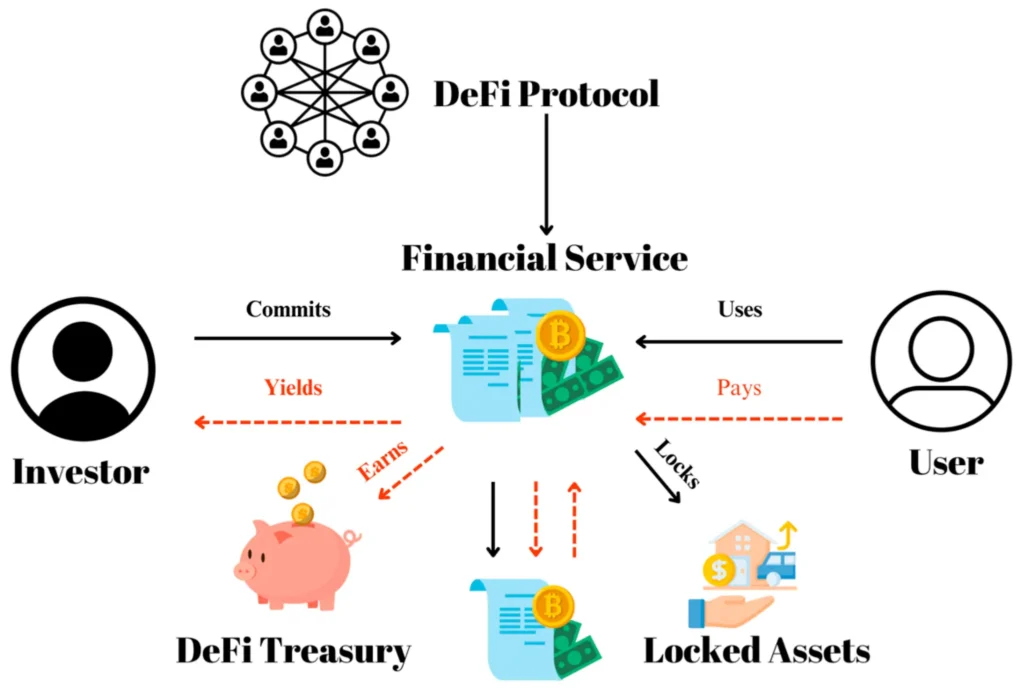

Previously, accessing these products involved banks, brokers, and settlement delay. Now they’re being tokenised and offered as units, with the security of traditional finance (TradFi) and the speed and efficiency of decentralised finance (DeFi).

A representative from CMB International summed it up simply: the fund offers a low-volatility, income-generating investment to a much wider pool of investors than before.

Blockchain fund links traditional assets like bonds and corporate notes to DeFi ( Image Source: MDPI )

Riding the Real-World Asset Tokenisation Boom

The launch couldn’t come at a more relevant time. Real-world asset (RWA) tokenisation is now one of the hottest growth areas in blockchain, with forecasts suggesting it could become a multi-trillion-dollar market within the next decade.

From real estate and commodities to art and T-bills, just about anything of value is being prepared for life on the blockchain. This fund is among the pioneers in that tide, offering a product with yield and safety — something appealing to risk-averse investors as well as risk-takers.

In the US, the GENIUS Act is pioneering open regulation of stablecoins, further establishing the case for tokenized assets with regulation across the globe.

Why Investors Must Pay Attention

For actively trading crypto traders, the fund represents a relief from the riskiness of digital tokens. It represents an added utility above blockchain technology, one that is tied to steady returns instead of speculatory price action.

For newcomers to crypto, it offers a gentler on-ramp — a regulated, income-generating asset with deep links to real holdings rather than pure digital wealth.

This blend of convenience and compliance might be the magic pill that propels blockchain finance into the mainstream.

Also Read: LayerZero Aims $110M Token-Based Stargate Acquisition

Asia’s Push for Innovation Leadership

Securing approval from both Hong Kong and Singapore is no small feat. Both places are traditional when it comes to financial products, and the fact that they’re becoming more open to backing a tokenised fund speaks of a vision bigger than themselves: of positioning Asia as the center of the future of finance.

Both cities have been on their toes, developing structures to enable the development of blockchain without compromising investor protection. This fund might well become the model that others follow.

A Strategic Global Move

While some Western regulators are still struggling to determine how to classify and regulate blockchain products, Asia is forging ahead with solutions that work in reality today.

By offering a regulated, multi-chain money market fund, CMB International and DigiFT are not only appealing to retail investors — they’re also creating a product that could arouse the interest of institutional players seeking a compliant avenue into digital assets.

What’s On the Horizon for Tokenised Funds

If interest gathers pace, these kinds of products may be created in other fixed-income asset classes, equities, and even alternative assets like infrastructure investments or green credits.

Cross-chain interoperability may make these funds even more valuable by allowing investors to seamlessly change between blockchains and asset classes without the usual settlement barriers.

This first regulated tokenised money market fund in Asia is more than just another financial product. It’s proof that decentralised and regulated finance do not need to be mutually exclusive but can complement each other — and that the future of investing can be faster and safer than ever.