Can Apple Regain Its AI Edge?

Apple is on the verge of staging a comeback in the artificial intelligence race, with lots at stake. Reports have it that developing tabletop robots and a more humanlike Siri is on course. And so the assault on competitors from OpenAI, Google, and Amazon has commenced.

This bold strategy could be the turning point for Apple in consumer robotics. The expectation is that these devices would become the best use of AI combined with Apple’s design flair and ecosystem integration. For investors, it means Apple has shored itself up to enter a game theorised to reshape consumer technology.

Apple nears AI comeback with high stakes

How Will Tabletop Robots Work?

The robots are said to be small, interactive devices for use in the home and office. They are likely to have high-resolution displays, cameras, and the ability to move around. The ultimate goal is for the machines to be able to interact with humans in a fairly natural way.

Apple’s new-age Siri will be able to recognise and analyse human emotions, change voice tone, and remember user preferences big step forward from the present A.I. voice assistant, which has been tainted by complaints of its conversational incompetence.

With social and functional features in place, Apple hopes to take the platform into the everyday realm. Such a shift could also strengthen its ecosystem lock-in, encouraging users to stay within Apple’s product family.

Why Is the AI Market Attractive?

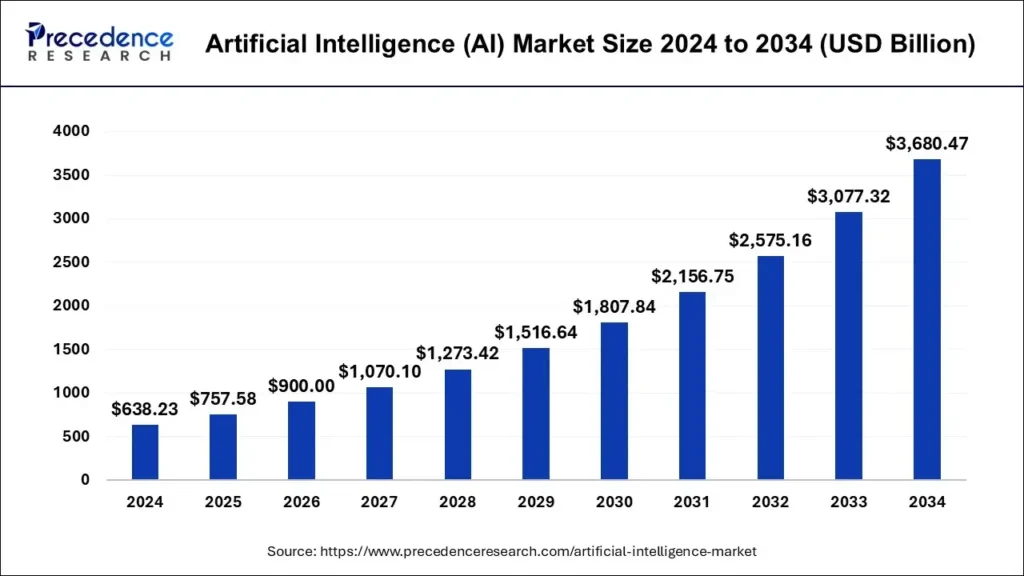

The global market for AI is booming, having been valued at more than USD 638.23 billion in 2024 and anticipated to rise to USD 3,680.47 billion by 2034. The evolution of consumer robotics will claim a great slice of that pie, with automation, personal assistance, and smart home integration being the main factors driving interest.

Apple’s renewed vigour in the world of AI now fits well into this theme. Its huge user base and an already established supply chain for hardware-right from enchanting the chips-will surely give it a leg up. With careful execution, this product lineup could open new revenue avenues beyond iPhones and Macs.

Market watchers opine that gadgets propelled by AI will bring in billions for Apple in annual revenues in just a few years. Early adoption by loyalists may set the momentum for a larger takeoff in world markets.

AI Market Share

What Challenges Could Apple Face?

Nevertheless, Apple is up against some very stiff competition in AI. It is a battle lawfully going on between the two philosophers: since Alexa and Google Assistant already have mature AI ecosystems, Robots ChatGPT from OpenAI and Copilot from Microsoft have set the conversational AI bar extremely high.

Another issue is pricing. Apple is seen as a maker of high-end products, but consumer robots will need to combine prestige with price accessibility, or the market will reject them.

Increasingly, regulatory agencies would seem to be proceeding with an investigation of AI privacy regarding data. Apple, therefore, ought to reassure the customers that their robots would work in data processing with security and ethics. This is consistent with the reputation that Apple has for being strong on privacy, but any slip-up could damage that perception in the minds of consumers.

Apple’s Strategy Signals Long-Term Vision

Industry insiders suggest that Apple\’s AI push is part of a larger vision. Apart from tabletop robots, the company is developing wearable AI devices and mixed-reality integration. These, in turn, could intermingle with the Vision Pro headset to produce an interconnected AI environment.

Thus, by uniting hardware, software, and services, Apple could achieve a truly seamless AI experience from device to device, substantially improving user engagement while also generating recurring revenue streams from app subscriptions and AI services.

From a more general perspective, Apple’s entrance could kick off yet another wave of competition. The competitors may speed up product development to bring about rapid AI innovation in industries.

Also Read: Perplexity’s $34.5 B Bid for Google Chrome Shakes Tech Industry

Investor Outlook Remains Optimistic

Investor sentiment towards Apple\’s AI ambitions is cautiously optimistic. Analysts believe the initial reactions from the stock market might be subdued until the prototypes are shown. Yet, in the longer term, it is projected that successful AI integration could add a few hundred billion dollars to Apple\’s market cap.

Also, the move somewhat balances Apple\’s portfolio Robots at a time when slow growth is expected in the smartphone segment. Targeting the AI and robotics market, Apple is setting its foot in a high-growth sector with much upside potential.

Product unveilings that would probably take place at the next developer conference by Apple are being watched closely by investors. A successful launch could change the AI landscape drastically, firmly cementing the position of Apple as a central innovator in the field.