The crypto market booms as an open-ended narrative takes hold: machine-learning network and compute and data marketplace-bound tokens set the pace, with the rest of the market following suit. In the last 24 hours, AI-bound tokens head a broad-based market bounce, propelling overall 14% gains in crypto indices as investors turn into narrative-driven altcoins. (CoinCentral)

The move is less speculative mania and more structural shift. Institutions — mutuals to exchange-traded funds — build exposure to areas offering utility over data, computation, and intelligent agents. That appetite creates true liquidity and fuels sharp price action when a basket of tokens shares the same story. (AInvest)

Crypto jumps 14% as data and compute tokens lead, fuelled by growing institutional demand (Image Source: Coinfomania)

Which tokens are leading the advance?

A handful of names lead the pack: established infrastructure tokens offering compute or data, and identity and agent projects that make the headlines. Renders (RNDR), Fetch.ai (FET), SingularityNET (AGIX) are some of the high flyers, and more recent identity plays that see explosive upward surges — Worldcoin, for example, spikes on reserve buy headlines and announcements. (ethos.io, New York Post)

Why does that matter? Such tokens sell a simple promise: they are not money; they buy access to a service — rendering, model training, data marketplaces, or automated on-chain agents. When institutional investors see a viable path to revenue, they invest capital at scale. That demand increases price and liquidity and encourages those projects to become more attractive to other funds and retail traders.

Institutional flows are the tailwind

Institutional demand for crypto assets continues to lead the pack. Reports and fund flows show rising commitments and fund launches aimed at tokenised infrastructure and emerging sector ETFs. Institutional exposure that closes on-exchange supply and tightens price action when narrative pressure builds. (AInvest)

A real-life illustration: a recent institutional investment in a leading agent-network project removes supply from exchanges and gives traders confidence to push prices up. Another recent report quotes committed flows to crypto infrastructure funds across the region. Those flows speed up the effect when retail takes cues from momentum.

Institutional demand is reshaping the crypto market.

With ETFs attracting billions in inflows, liquidity and legitimacy are being reinforced.

The question is no longer if institutions enter, but how deep they will go. pic.twitter.com/tqF9DndqTz

— Capy Post (@CapyPostX) September 9, 2025

What is driving buyers to these tokens today?

Three real-life triggers are responsible for the sudden pop.

- Listings and liquidity events. Listings on exchanges, custodial relationships of note, and token unlock schedules can change supply/demand balances overnight. Markets prefer access and perceived security. One recent “Coinbase effect” type action shows how listings and deep liquidity pull in institutional peso on the buy side.

- Partnerships and launches. When a token is also unveiling actual product innovations — a new compute marketplace, cross-chain integration, or a partnership with traditional finance rails — expectations for future revenue are set.

- Portfolio rotation. As Bitcoin and the top-cap coins stabilize, capital will find itself streaming into theme pockets of the market. The AI infrastructure and data tokens are currently getting that rotation. Markets are fast to react when many traders clamor for the same narrative. (io)

A high-profile example: identity and utility crash

Not all tokens in the rally have the same fundamentals. Worldcoin, a biometric identity play, makes exaggerated moves on institutional reserve buys and corporate action. The token’s spike is an example of how narrative, augmented by big buys or treasury buys, can cascade through an ecosystem and shift connected names. That’s part of the reason why the whole sector looks strong on a short-term horizon.

4⁰“Bots vs. Baby Blues”⁰The real clash isn’t sci-fi anymore:⁰ Silicon circuits/chips trying to simulate human feeling ⁰️ Human eyes still holding infinite depth, “windows into the soul”

Will the algorithm capture our essence, or does the soul remain beyond code? pic.twitter.com/c1lWlFSnx8— James Sullivan (@SullivanJam) September 8, 2025

Institutional cheque sizes: Fetch.ai example

Institutional capital isn’t just noise — it does cause markets to move. Recent reporting shows a $55m institutional investment in Fetch.ai having a material impact on supply and investor sentiment. When institutions pull stakes off the open market, that shortage can cause short-term squeezes and attract momentum traders. (AInvest)

Are profits sustainable or a short-term rotation?

Short answer: Both dynamics are happening simultaneously.

Short term: Stories decompress and compress rapidly. One headline or a large whale purchase can send prices sharply higher. Volatility and rapid reversals are expected in the short term. (CoinCentral)

Medium-term: Only through actual adoption and generating revenue will sustainability occur. Tokens based on actual product adoption — making jobs completed, data licensed, agent transactions — have a better chance of consolidation at more elevated levels.

This dualism necessitates the market rewarding those projects that can translate hype into consistent usage. Traders chase that translation; investors wait to see it.

Profits look both short-term and lasting. Quick headlines or whale buys fuel sharp spikes, but only real adoption and revenue can keep tokens at higher levels (image Source: Hmsa Consultancy)

What this rally signifies for traders and everyday holders

If you’re exposed to crypto via holding or trading, the current rotation is risk as well as reward. The good: strong short-term returns for those who bet on the right names early on. The bad: steep drawdowns if narrative momentum is lost or macro conditions revert.

Pragmatic metrics to watch:

- On-chain activity: Are network addresses increasing? Are network transactions correlated with top-line-generating activities increasing?

- Exchange flows: Is the token being withdrawn from exchanges to cold storage or are inflows into exchanges increasing? Withdrawals can be a precursor to price strength; inflows can increase selling pressure.

- Institutional filings and trust products: Look for filings, fund introductions, or custody announcements favored by institutional investors. They tend to result in long-term inflows. (AInvest)

The marketwide effect: altcoin season or just a flash

When a theme drives a step-change in liquidity, the overall markets move with it. A concentrated rally in one sector can enhance correlated assets — at times between ecosystems. The commentators state that in this cycle, AI-related tokens add much of the altcoin rally to power the overall 14% market rise. Yet correlation turns around faster than people appreciate; caution remains required. (ethos.io)

Most alts move slow for a long time, then out of nowhere, they run hard.@blockchaincent’s index shows:

➢ 404 “altseason” days

➢ 953 “BTC season” days

…so alt rallies are short windows inside long, quiet stretches.When the bid returns, it’s usually explosive, let’s take for… pic.twitter.com/4p6C4nCIun

— THEDEFIPLUG (@TheDeFiPlug) September 5, 2025

Quick FAQs (concise, high-value)

Q: Does a 14% rally equate to long-term returns?

No. A big rally indicates investor demand now, but long-term returns rely on user adoption and token use.

Q: Are institutions buying Bitcoin alone, or altcoins as well?

Institutions increasingly invest in certain altcoin categories when they observe real utility — infrastructure, tokenised assets, and markets for data. This rally demonstrates that trend. (AInvest)

Q: Which metrics are most important when considering AI-connected tokens?

Take into account real usage (work done, data sold), active addresses, exchange supply shifts, and institutional comments.

Where markets go from here — three possible scenarios

Markets move on liquidity, headlines, and real usage. Expect one of these things to occur over the next few weeks.

- Sustainable rotation into infrastructure (base case).

Institutions continue to commit to tokenised infrastructure and data markets. Tokens with real use — work done, data sold, agent transactions executed — settle at higher levels. Volatility still exists, but net flows set a new floor price for the strongest projects.

- Temporarily narrative spike (bearish for the theme).

A cluster of whale buys or sells propels prices upward, but utilization does not follow suit. Profit-taking comes quickly; associated tokens reverse in sympathy. The rally fizzles, generating whipsaw price action and heavy short-term losses for followers.

- Macro shock reverses momentum (wildcard).

Wider macro moves — risk-off equities or liquidity squeeze — trigger generalized sell-offs in crypto. Solid fundamentals tokens get caught down as the capital leaves. Institutional buying gets some rest while rebalancing happens.

Likely which? The market is behaving like base case now, but it doesn’t hurt to stay with the hard data: on-chain activity, custody and institution filings, exchange reserves.

Tradeable signals: what to look at (and do)

These are tangible, actionable signals that can be applied by investors and traders. I rank them from the most immediate and accurate.

- Balance changes in exchanges (high accuracy).

Monitor whether institutions and wallets remove tokens from exchanges. Persistent withdrawals tend to create price strength; large inflows can result in sell pressure. Use exchange net flow dashboards to spot abrupt supply shifts.

- Custody and product releases (high impact).

A custody partnership or ETF vehicle foreshadows easier institutional onboarding. When a quality custodian lists a token, expect new demand from funds waiting on the sidelines.

- On-chain utility statistics (medium reliability).

Don’t simply glance at wallets and price: are networks performing jobs or requests that generate fees? Watch the number of rendering jobs, data marketplace trades, or agent interactions. Growing utility supports valuation.

- Whale wallet activity (medium/high).

Large one-wallet purchases will ignite momentum. Observe whether whales accumulate gradually (bullish) or execute rapid buys and sells (conservative).

- Correlation of Bitcoin and macro asset (contextual).

If the token gains while Bitcoin is stable or increasing, the rally probably signifies drawn-out demand. If Bitcoin falls and altcoins continue to increase, expect small, shallow rallies.

Action ideas: For traders, use short-term position sizes and close stops at technicals. For buy-and-hold investors, dollar-cost average (space out purchases) and focus on tokens with increasing real-world adoption.

Risk checklist — red flags that matter

Before risking capital, check these red flags.

- No increase in usage: Price gains without attendant increases in network usage or revenues indicate speculation.

- Concentration risk: If a small number of addresses control a high percentage of supply, the token is vulnerable to serious manipulation.

- Token unlock schedules: Upcoming unlocks can flood supply; always check vesting tables.

- Exchange listings only hype: Listings pump short-term price; they don’t guarantee sustained adoption.

- Weak governance or unclear treasuries: Without transparent on-chain treasury activity or token economics, long-term risk is high.

- Regulatory news: Identity or biometrics become projects attracting additional attention. Unexpected regulatory pronouncements can flip the mood in a conventional overnight fashion.

Multiple red flags in combination may result in reduced exposure or selling out.

A plain-English explainer for non-crypto readers

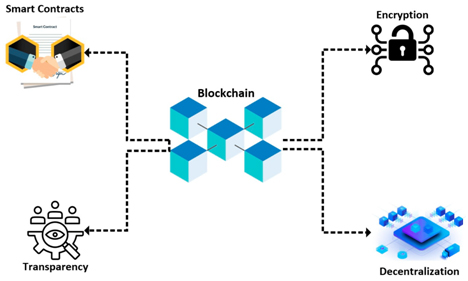

Think of these tokens as keys to open digital services. Certain tokens buy processing power to train models or deliver graphics. Others enable developers to access markets of data or connect software agents on behalf of users.

Institutions — corporate treasuries, hedge funds, pension funds — buy tokens when they see a path to real revenue or useful services. Their demand unleashes a lot of capital that moves markets more reliably than retail momentum.

Bulls currently desire tokens that show two things: they’re being used, and people using them generate fees or revenue. If that usage keeps expanding, the token’s value is viewed as an underlying business. Otherwise, the market prices the token as a gamble on future possibilities.

Tokens are like keys to digital services. Institutions back those with real use and revenue, while others remain speculative bets (Image Source: MDPI)

Practical playbook: what to do now (by type)

Day trader/swing trader:

- Trade the momentum but keep position sizes small.

- Use a 1–3% portfolio per trade and tight stops (5–10%).

- Monitor exchange flows and wallet major activity intraday.

Medium-term investor (3–12 months):

- Select 2–4 projects with explicit adoption metrics.

- Stagger buys, hold during volatility, and re-evaluate after quarterly protocol upgrades or usage reports.

- Avoid allocations greater than you can stomach losing.

Long-term investor (12+ months):

- Invest in networks with recurring revenue streams and clear token economics.

- Anticipate volatility; employ dollar-cost averaging.

- Consider custody solutions and institutional-grade wallets.

Non-investor curious reader

- Learn the fundamentals: what the token enables as a service, what consumes it, and how the token accomplishes that by capturing value.

- Consider all exposure speculative unless usage proves otherwise.

Also Read: Top 5 Gold Tokens Powering Digital Gold Growth

Enlarged Frequently Asked Questions (expert + non-expert)

Q: Why do institutions invest in tokens instead of equity or bonds?

They need asymmetric payoffs and diversification. Tokenized infrastructure tends to offer exposure to digital network effects and the potential for on-chain accruing fees to be captured directly. Token markets also facilitate quicker settlement and novel custody options.

Q: How do tokens capture value from utility?

When a network charges fees in local tokens for service use — compute, data access, or agent action — demand for the token rises as service usage rises. That link aligns token demand with genuine economic activity.

Q: Are identity tokens (biometrics) riskier?

They risk catching the eye of regulators. Privacy, consent, and compliance issues make them more sensitive; projects must demonstrate robust governance and legal certainty.

Q: Is this altcoin season?

Not really. A robust thematic drive will buoy many altcoins, but widespread, sustained altcoin seasons require sustained cross-sector flows and macro calm.

Q: How quickly can one announcement move prices?

Very quickly. Listings, large custody confirmations, or whale buys can move markets in a matter of hours. That quickness makes monitoring newsfeeds and on-chain alerts essential.

Q: What instruments are employed to track these signals?

On-chain explorers, exchange flow monitoring, custody announcement feeds, and trading view charts for liquidity. Traders use several dashboards to triangulate signals.

Final takeaway — clean, actionable perspective

Today’s 14% market gain, led by machine-learning infrastructure and data markets tokens, is a capital rotation into projects with rational trajectories to revenues. Institutions are pushing this rotation because they can — and because tokenized utility translates into real demand when networks operate.

That makes the moment now a possibility, not a guarantee. The survivors will be projects that capture a story in repeated usage and transparent revenue. For traders, the rally is a short-term profit if you trade risk tightly. For investors, the rally shows where to begin more thorough due diligence: usage statistics, custody arrangements, tokenomics, and transparent governance.

Be practical: observe on-chain activity, watch institutional custody movements, and consider big headlines as signs — not certainties. If the token proves the usage test successful and you are aware of the risks, it’s a good allocation in moderation. Otherwise, consider the rally noise and look elsewhere.