The US economic growth beat estimates in the second quarter on a wave of artificial intelligence infrastructure on an epic scale. It sliced through data centers, expensive chips and power deals, and that relegated GDP and recession jitters to the side. The outcome: a dramatic reversal of growth, driven by digital technology and high-tex expenditure.

AI Infrastructure Fuels U.S. Economic Expansion ( Image Source: Apricitas Economics )

Big Tech’s CapEx Push

Early mover AI technology pioneers have economic growth led the way on AI chip investments by a wide margin. Alphabet parent Alphabet Google, Amazon, Meta, and Microsoft are committing tens of billions of dollars into making AI-powered stronger. Alphabet alone committed over US$85 billion for 2025 alone, where much of it will go into powering data center expansion and cloud infrastructure.

Not only are the investments placing technology in a position to do better, they’re also reshaping the economic growth composition of the nation’s economy. AI-capital investment will be up to 2% of American overall GDP in the current year, adding on estimated 0.7 percentage points of growth. That is real growth based on real infrastructure and not speculators’ gains.

Building a New Industrial Base

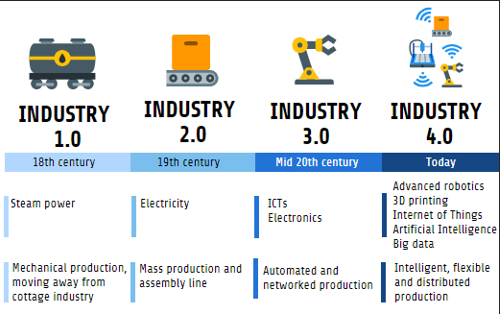

It’s digital re-industrialisation, as economists say. All of the previous technology revolutions of the last few decades or so have been immaterial ones, software and phones, for example, but now they’re all hard things, physical infrastructure. Capital is pouring into hard hubs: power networks, chip factories, transmission grids, data centers.

This revolution is creating waves across sectors. Power generators, construction and building companies are seeing end-end demand. And as ever-larger projects are being taken over by AI, so does industrial and building-end power demand fuel capital spending in core sectors that have remained untouched by digital technology yet.

AI boom sparks U.S. industrial revival, grids, chips, and data hubs lead ( Image Source: ICTs for Development )

The Broader Economic Impact

The impact of AI infrastructure goes beyond Silicon Valley. PwC has already invested in its latest survey that the proportion of U.S. GDP controlled by the market for data centers doubled over more than from 2017-2023. That includes local jobs and tax paid back to the community where buildings stand.

Maturing energy and industrial equipment service providers Generac and Honeywell are venturing into AI-peripheral spaces such as data center cooling solutions and backup power. Their entry is the border of AI infrastructure, beginning at city-level initiative and progressing up to industrial-level planning.

Also Read: Trump’s U.S. AI Supremacy Dream

Energy Infrastructure Under Pressure

All that artificial intelligence powered expansion comes at a price: energy consumption. AI is an energy-guzzling monster, and data centers are the nation’s biggest energy-using buildings today. The federal government projected electricity prices will rise 9% to 58% by 2030 if the power grid isn’t significantly expanded.

That demand has been fueled by utilities spending a record sum on capital outlays. They’re investing most of it in acquiring cleaner high-capacity generating equipment such as solar farms, grid-smart technology and battery storage. The plan is to meet increasing tech-industry demand without triggering a national energy crisis.

GDP Projections and Long-Term Growth

Investment in data centers will be 0.1 to 0.3 percentage points of US GDP in 2024 by investment companies like J.P. Morgan. Investment will rise in later years when infrastructure development picks pace and advanced AI systems become operational.

In the future, the spending on AI infrastructure in the world could be worth over US$7 trillion in 2030. It is. It is a diversion of funds outlay from consumption in the short run or repairing the software to digital infrastructure in the longer run.

.Why It Matters Beyond Tech

This six-sided wave of AI investment has the bigger implications of cutting across industries. To economic planners, it is a model to be replicated for growth. To investors, it is industrial and hard tech investments. And to the crypto and blockchain community, it is giving opportunity to take advantage of these high-throughput platforms as a vehicle to roll out decentralised architectures, staking activity and host nodes.

As compute cost goes down and supply goes up, there is room for even more innovation in Web3, DeFi, and enterprise blockchain applications, all of which require scaling infrastructure.

What to Watch For

A number of milestones will drive this trend in the next several quarters:

- Energy Grid Developments: Will infrastructure build-out match increasing demand?

- Tech CapEx Announcements: Follow-ups to billion-dollar hyperscaler spending by Google, Amazon and Meta.

- Power Market Trends: Geographically local power demand-and-supply patterns and price could influence where new-generation data centers are sited.

- Crypto Integration: Increasing compute capacity can support blockchain hosting, staking, and infrastructure deployments.

A New Growth Roadmap

The second-quarter stimulus did not occur by accident but was a result of smart, AI-driven investing. The massive investment in capital expenditures on infrastructure, including data center and chip-making manufacturing spending, building and power grid construction, propelled the economy away from potentially stagnant path.

That is where it is turned on its side. This is not a technology column; this is an economic development column. The nations that are quick to want to be on the leading edge of AI are nations that have made a first and significant investment in infrastructure and see the biggest economic payoff.

Stay informed with Crafmin.com — your destination for global news in Crypto, Mining, Tech, AI, Forex and the world of Business News.