Introduction

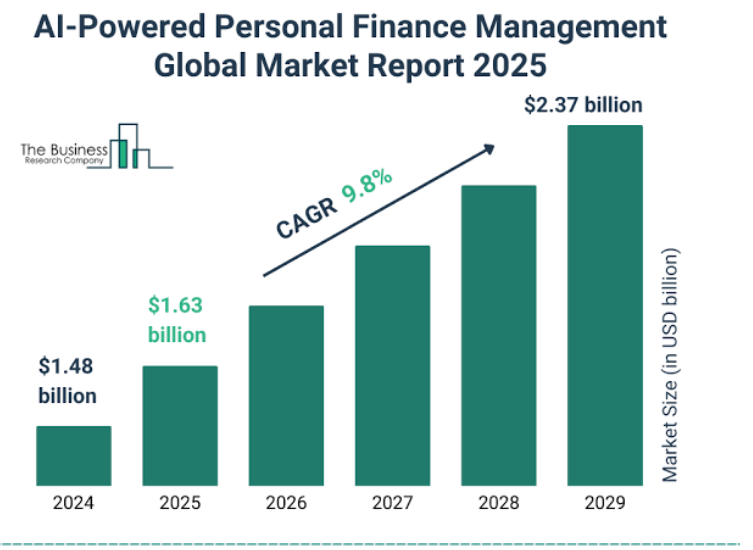

Source: The Business Research Company

Money management has never been simple. From paying bills in a timely manner, monitoring investments, paying down debt, and attempting to save some for the future, it’s obvious to experience the feeling of juggling too much at one time. For decades, all of us used spreadsheets, paper trackers, or simple apps that didn’t do much more than hold numbers. But 2025 is shifting the playing field. Throughout the United States, United Kingdom, Canada, Australia, and Europe, artificial intelligence is quietly inserting itself into our wallets—not as some glamorous buzzword, but as a functional, daily assistant.

Consider AI more of a back-stage fiscal pal. It can learn your spending patterns, guide you towards wiser decisions, and even assist in making investment plans via apps and robo-advisors that actually learn what works for you. It can catch you when you are on the verge of overspending, advise you on how to save, and even provide solutions to pay off debt faster.

In this article, we’ll look closer at how AI is transforming personal finance in 2025—how it’s revolutionizing the way we handle money, the benefits and potential drawbacks, the tools individuals are leveraging globally, and what may be in store for AI-driven financial advice.

Understanding AI in Personal Finance

Source: Freepik

In simple terms, AI-based personal finance uses machine learning, data analysis, and automation to help people make smarter financial decisions. Unlike traditional finance tools, which mostly record and display numbers, AI systems analyze patterns, make predictions, and even take action when appropriate.

For instance, a smart AI finance tool doesn’t just tell you how much money is in your account. It can suggest adjustments to spending before you overshoot your budget, recommend which debts to pay off first, and even rebalance your investment portfolio according to market fluctuations.

The major applications of AI in personal finance include:

- Budgeting and Expense Tracking – Apps that sort every transaction, predict future expenses, and show potential savings.

- Automated Investing – Robo-advisors that create and maintain investment portfolios according to your goals and risk appetite.

- Debt Management – AIs that create repayment plans that adapt strategically and even negotiate with loaners for you.

- Digital Finance Assistants – AI assistants that respond to inquiries, process payments, and provide real-time financial consultations.

What makes AI in finance special is proactive capabilities, assisting you in planning ahead instead of just recognizing past events.

Key Use Cases of AI in Personal Finance

1. AI Budgeting Apps

1. AI Budgeting Apps

Budgeting can be tedious. Many people start the month with good intentions but quickly lose track. AI-powered budgeting apps solve this problem by analyzing spending patterns automatically.

For example:

- Mint (US) tracks bills, subscriptions, and daily spending. Its predictive analytics can warn you if you’re likely to overspend this week.

- Plum (UK) moves small amounts into savings automatically based on your spending habits.

- Business transactions by Pocketbook (Australia) are classified by them whilst also pinpointing subscriptions or secret fees that are siphoning your funds.

These technologies enhance control for users by removing guesswork and anticipating issues before they arise.

- Automated Investing and Robo-Advisors

Incorporating more than the standard low-cost options, robo-advisors are a common sight now in 2025. Some features include:

- Automatic portfolio rebalancing based on real-time market data.

- For ethically-driven investors, ESG investing options.

- Inclusion of crypto-assets, equities, and stocks alongside traditional bonds and stocks.

In the US, Betterment; UK has Nutmeg and Wealthsimple in Canada. With the algorithms set in place by these platforms, even the most novice of investors are relieved of high advisory fees and can enjoy a well-diversified and algorithmically managed portfolio.

- AI for Debt Payoff

Managing personal debt can be extremely daunting. This AI Tool solves the problem using these techniques:

- Diverting excess income towards higher interest debts.

- Previewing the long-term cost of various repayment strategies.

- AI-created contract negotiation for repayment terms with lenders.

These technologies are extremely useful in balancing rising global consumer debt, especially for young professionals dealing with student loans and mortgages.

4. Tax Filing Bots

In Canada and the US, tax-filing bots now scan receipts, bank feeds, and employer forms automatically. By 2025, AI assistants can model “what-if” scenarios, showing consumers how decisions (like moving states, changing jobs, or making charitable donations) impact tax liabilities.

Growth of AI in Personal Finance (2020–2025)

| Year | Global Market Size (USD Billion) | Key Developments |

| 2020 | 3.2 | Rise of robo-advisors and automated budgeting apps |

| 2021 | 4.1 | Wider adoption of AI chatbots in banking |

| 2022 | 5.6 | AI-driven fraud detection tools expand |

| 2023 | 7.8 | AI starts personalising financial coaching |

| 2024 | 10.5 | Integration with voice assistants (Alexa, Google) |

| 2025 | 13.9 (Projected) | AI-powered wealth management goes mainstream |

Regional Insights: How AI Finance Tools Vary Around the World

The adoption and availability of AI personal finance tools differ by region, reflecting regulatory environments and consumer needs:

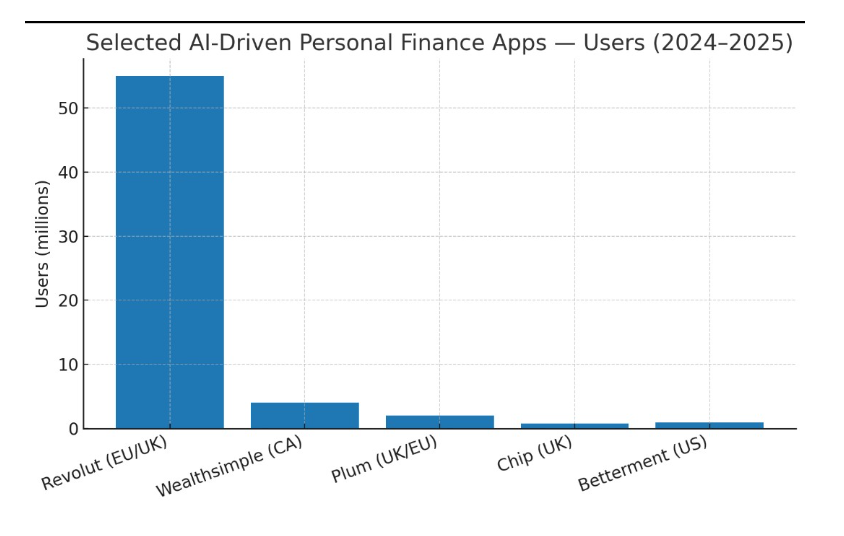

- United States: Mint and Betterment dominate budgeting and investing. AI-driven debt management apps are also widely adopted.

- United Kingdom: Plum and Chip automate savings and investments, popular among millennials navigating high rent costs. Nutmeg leads in robo-advisory.

- Australia: Pocketbook is the go-to budgeting app. AI tax bots help navigate self-assessment obligations.

- European Union – Markets such as Germany and France are embracing digital finance assistants connected through the EU’s Payment Services Directive (PSD2). Startups like N26 are pioneering AI-driven cashflow alerts across multilingual markets.

- Canada – While slower in early adoption, Canada now has emerging tools like Wealthsimple expanding beyond robo-advisory into AI-driven tax optimisation.

Regulatory Considerations and Data Privacy

With AI technology becoming more prevalent in the personal finance sector, oversight has undoubtedly increased:

FCA (UK): Maintains the right to explanation for AI-based recommendation systems.

ASIC (Australia): Applies rules for the protection of consumers to robo-advisors.

FinCEN (US): Applies supervision to AI-powered banking services for fraudulent activities and money laundering.

EU: GDPR: Guarantees consent of data for automated processes involving algorithms.

People are more knowledgeable regarding tracking and privacy. Privacy entails data storage, data sharing, and data monetization. Firms need to achieve the right balance between personalization and ethics relating to data.

Most Popular AI-Powered Finance Apps in 2025 (US/UK/Canada/EU)

| App/Platform | Main Function | Regions Popular |

| Cleo | Budgeting & financial coaching (chat-based) | US, UK |

| Plum | Automated saving & investment | UK, EU |

| Mint (AI-upgraded) | Budgeting & bill reminders | US, Canada |

| Wealthsimple | Robo-investing & tax tools | Canada, UK |

| Revolut | AI-driven personal banking | EU, Global |

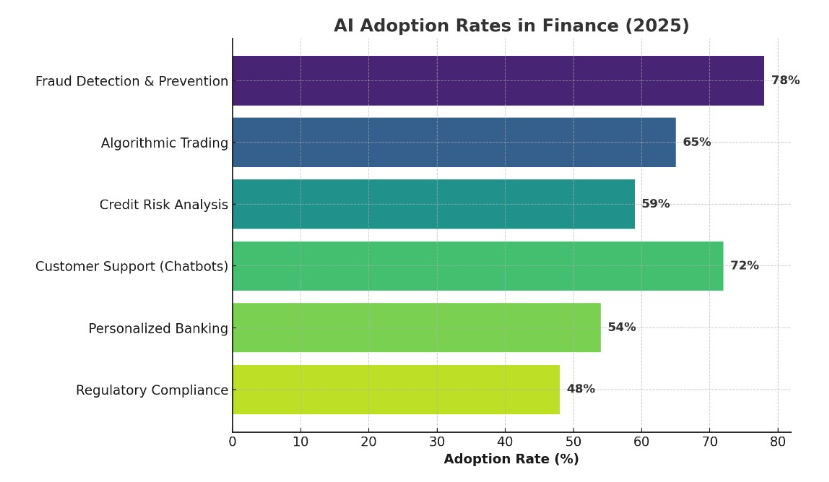

Benefits and Risks of AI in Personal Finance

Benefits:

- Personalised financial guidance at scale.

- Lower costs compared to human advisers.

- Faster decision-making, from savings to investing.

- Increased financial literacy via conversational AI.

Risks:

- Over-reliance on opaque algorithms (“black box” finance).

- Data misuse or breaches.

- Algorithmic bias—for instance, penalising consumers with irregular income.

- Reduced human oversight in complex financial planning.

Summary

Table: Benefits & Risks of AI in Personal Finance

| Benefits | Risks |

| Real-time budgeting insights | Data privacy concerns |

| Smarter debt repayment strategies | Over-reliance on automation |

| Early fraud detection | Algorithmic bias in credit scoring |

| Affordable wealth management | Regulatory uncertainty |

| Accessible to more people | Tech literacy gap |

Real-World Case Studies

United States: Betterment

Betterment’s AI integrates tax-loss harvesting, risk rebalancing, and ESG investing. Managing billions in assets, it attracts hundreds of thousands of users seeking automated, smart investing.

United Kingdom: Plum

Plum analyzes spending patterns to set aside savings automatically. Young professionals in London, juggling high living costs, find it indispensable.

Australia: Pocketbook

Pocketbook links directly with local banks, categorizing expenses and spotting hidden spending. Its predictive tools are popular among students and young families.

European Union: Revolut

Revolut goes beyond banking with AI tools for currency exchange, crypto trading, and savings goals. Real-time alerts prevent overspending and assist in financial planning.

Canada: Wealthsimple

Wealthsimple’s AI portfolio management includes tax optimization and even Sharia-compliant investments, reflecting diverse user preferences across the country.

Looking Ahead: Emerging Trends in AI Personal Finance (2025–2030)

The coming five years hold the promise of even more entrenched roles for AI in personal finance:

- Voice-Activated Finance: Commanding a virtual assistant to pay bills, rebalance investments, or plan savings objectives.

- Predictive Savings: AI transfers money into savings automatically before recognized high-spending occasions.

- Open Banking Integration: Frictionless interfaces between banks, fintechs, and payment systems under the canopy of AI-driven ecosystems.

- Emotional AI in Finance: Financial stress detection and providing personalized assistance, combining technology with compassion.

By 2030, dealing with money could become next to easy, with AI as a perpetual mentor, advisor, and backup plan.

Conclusion

The field of AI appears to have made strides in personal finance tools because of investment AI technology, and automation features like budgeting tools, investment trackers, comprehensive debt, and tax payment features. Nevertheless, the true potential of these tools lies in their ability to take care of repetitive tasks while we stay vigilant about privacy and risk which demonstrates the importance of a keen understanding of finance.

There is a consensus that AI will have a major impact in the coming years. By the year 2030, technology will be seamlessly built into our daily activity routines to the point that managing personal finance will become a trivial task. People will not be inundated with a barrage of choices, instead, they will have clarity and assurance to make decisions that ensure their future. Provided, AI aids with personal finance, it will not only simplify financial tasks but also help in achieving profound financial stability and tranquility in an overwhelming financial world.