The cryptocurrency market experienced wild volatility as Remittix registered one of the sights and speculators exclaimed over the 510% hike in the year 2025. This sharp rise pushed volumes to their zenith and sudden sell-offs were initiated.

Why did Remittix record a 510% surge in 2025?

The sudden surge in either demand or speculation from investor interest in Remittix was interrelated. Analysts cited the DeFi adoption, and the need for cross-border remittance kept the rally intact. As momentum gathered, the traders piled into the asset, making Remittix go beyond the expectations. This sudden rise underscored the power of retail inflows in an unstable market. However, with too much increase in a short time, the market gives chills of overheating.

What triggered heavy sell-offs after the surge?

The staggering 510% hike caused early investors to immediately consider their profits. The whales started selling into strength along with the institutional sales, thus creating volatility. This scenario is usual in the digital asset space where huge rallies tend to attract speculative entrance, which makes these exits very sudden. Sell-offs were further amplified by automated trading systems that reacted to various technical thresholds. Due to these factors, the prices went through very rapid swings with intraday sell-offs following intraday rallies.

How are investors responding to market volatility?

There remains quite a split among investors as to how they interpret this situation. On one side, the 510% surge just blankly cemented Remittix’s prospect for the long run. Others remain wary of sharp corrections and liquidity risk. Retail investors are still attracted to the expected upside despite the volatility. Institutional participants observe the price action very closely for signs of stabilisation before undertaking broader allocations. Polarized sentiment menunjukkan ketidakpastian menempatkan aset spekulatif.

View this post on Instagram

Remittix trading volumes hit record levels

The spike pushed Remittix volumes to levels never seen before. Exchanges experienced record activity, and liquidity providers struggled to keep up with order flow. Higher volume amounted to more demand along with fiercer selling pressure. Analysts have argued that such lofty levels of activity point to increased adoption as well as its speculative churn. This record turnover will almost certainly reconfigure the market’s views of Remittix, thereby attracting a lot more global traders to it.

Market outlook remains uncertain amid 2025 volatility

Despite the historic surge of 510%, the outlook in 2025 remains in a state of uncertainty. Regulatory changes, macroeconomic conditions, and investor behaviour will dictate future movements. Some analysts see continued growth if adoption goes on. Others warn that an overextension may lead to deep corrections. The surge has put Remittix on the radar of almost all crypto watchers, but questions of sustainability remain.

Remittix positions for global adoption in remittances

Cross-border payments are still a major area of focus for Remittix Network. Its system is designed for cost-efficient remittances between developing countries. Increased demand for cheaper transfer systems should provide for sustained growth. If additional partnerships emerge, Remittix may even take a bigger role globally beyond short-term volatility. Developers remain upbeat about the fundamentals of the asset and emphasize the advantages of security and speed.

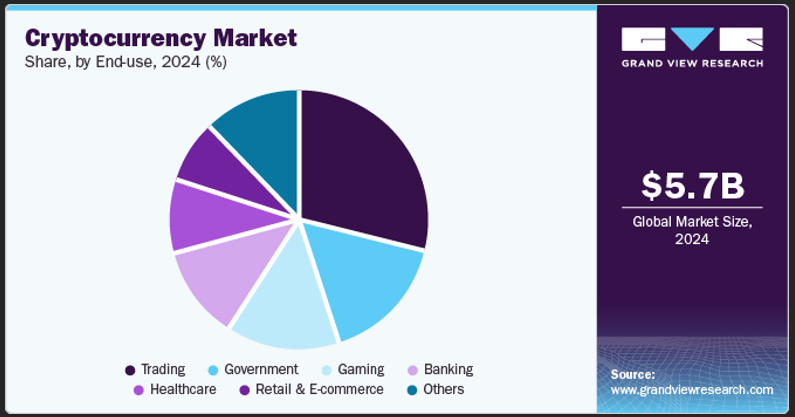

Cryptocurrency Market Share

Investor Outlook

The world cryptocurrency market shall exceed the USD 11.71 billion mark by 2030, supported by adoption and digital finance innovation. Amid this spectrum, Remittix has set upon carving an oblique position camouflaging crypto trading with remittance-oriented solutions. The 2025 510% surge speaks volumes about the speculative energy that powers this industry.

Institutional interest will increase should a regulatory framework ever seek to clarify cross-border crypto transfers. Retail investors will be attracted to the potential for exponential gains, though volatility will remain. Remittix, theoretically, has been acknowledged by analysts as both a disruptive payment mechanism and a speculative digital asset.

Also Read: Bitcoin ETF continues to rise, DOT miners earn up to $19,800 a day from cloud mining

Conclusion

From a Remittix crypto perspective, the 510% surge in 2025 is both a reward and a risk: trading to record volumes, scaring off sellers, movers, and accelerating remittance complexity. While all say that the hype is good for adoption in the long run, it would still be prudent for investors to take a cautious approach during such periods of volatility. Remittix still continues to carve a path for itself as a revolution in this ever-evolving digital economy.