Despite Bitcoin recently climbing past $110,000, altcoins remain stuck in bearish territory, showing no signs of revival yet. The long-anticipated altcoin season delay has left many traders questioning if the rotation to smaller assets will arrive soon. On June 18, CryptoQuant analyst Burrakesmeci highlighted a striking figure signalling ongoing weakness in the altcoin market. The 1–Year Cumulative Buy/Sell Quote Volume Difference for altcoins, excluding Bitcoin and Ethereum, sits at –$36 billion.

$36 Billion Withdrawal Reveals Weak Altcoin Demand

This metric reflects the net difference between buy and sell quote volumes on altcoin trading pairs across exchanges globally. When positive, it typically signals strong interest from crypto investors, often near local price tops or momentum surges.

In December 2024, this figure briefly flipped positive during a period of heightened market enthusiasm and speculative inflows. Since then, however, the trend has reversed completely, showing consistent crypto outflows and investor hesitation in altcoin markets. The latest figure, –$36 billion, shows that capital is still exiting altcoins, reinforcing current altcoin market weakness.

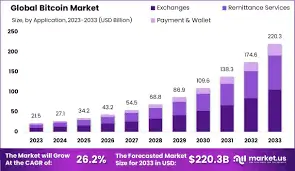

Global Bitcoin Trend from 2023-2033

Altcoin Season Delay Amid Bitcoin’s Dominance

Bitcoin’s post-halving rally in April 2024 marked the bull cycle’s early phase, drawing strong investor attention. Traditionally, after Bitcoin surges, investors rotate profits into altcoins, creating momentum for Ethereum and niche token sectors. This classic pattern fuels altcoin rallies through memecoins, AI tokens, and other trend-driven projects within the broader crypto ecosystem.

However, in 2025, the anticipated shift to altcoins has not occurred, extending the altcoin season delay despite Bitcoin’s strength. Altcoin activity remains subdued while Bitcoin dominance continues climbing, currently holding firm at 64% of total market capitalisation.

Altcoin Season Index Points to Market Stagnation

The Altcoin Season Index, which tracks when 75% of top coins outperform Bitcoin, remains below 30 at this stage. This is far from the required threshold of 75 that typically signals an official altcoin season across the market. Although Ethereum has slightly outperformed Bitcoin over the past 90 days, broader trends do not reflect strong market rotation. The ETH/BTC ratio has risen to 0.02405, but analysts argue these signals are early and inconclusive. The lack of follow-through across altcoins suggests that investor sentiment remains cautious and selective amid macroeconomic uncertainty.

Investor Sentiment Still Shows Caution in Altcoin Market

Crypto investor sentiment toward altcoins is closely tied to liquidity and perceived risk during each market cycle. While some gains in Ethereum hint at potential change, investors remain reluctant to take bigger risks in smaller tokens. This continued delay stems from the –$36 billion withdrawal from altcoins, highlighting widespread caution across the market. Without a clear reversal in these crypto outflows, experts say lasting bullish momentum in altcoins will likely remain elusive. This hesitance is reflected in low volumes, minimal token launches, and weak performance in previously trending sectors like DeFi.

Macroeconomic Conditions Also Affect Market Recovery

External economic pressures play a major role in the altcoin season delay and ongoing stagnation across the crypto market. Central banks worldwide continue quantitative tightening, limiting liquidity in speculative sectors such as crypto markets. High interest rates further dampen investor appetite for high-risk altcoin exposure and long-term positions. Analysts suggest that meaningful altcoin gains may only return if central banks ease rates or adopt dovish policies. Until such economic shifts occur, many expect the current altcoin market weakness to persist well into late 2025 or beyond.

What Could Trigger a Reversal in Altcoin Flows

A true altcoin season may only begin once Bitcoin consolidates and market participants begin reallocating profits into altcoins. Increased trading volume, higher investor engagement, and stronger Ethereum performance could shift the balance away from Bitcoin. Some analysts expect a possible change if Ethereum leads a market rally or regulatory clarity boosts investor confidence. Others believe the altcoin season could arrive in 2026, depending on global economic conditions and capital market reactions. Until then, the current data clearly signals an altcoin season delay driven by cautious investor sentiment and massive outflows.

Conclusion

The ongoing altcoin season delay reflects a cautious crypto market, shaped by $36 billion in capital exiting altcoin trading pairs.Despite Bitcoin’s dominance and modest Ethereum gains, crypto investor sentiment stays cautious due to weak market fundamentals. Until outflows reverse and broader enthusiasm returns, altcoin markets may continue underperforming against major digital assets.