Bitcoin Hash Ribbons Flash Rare Buy Signal as Miner Pressure Eases

Bitcoin may be gearing up for another major rally—if the latest signal from one lesser-known technical indicator is anything to go by.

As June rolls in, Bitcoin’s hash ribbons have flashed a rare buy signal. This tool, widely respected among long-term holders and on-chain analysts, is often seen as a telltale sign of miner health and broader market momentum. With the signal now turning green, it’s no surprise that bullish whispers are starting to spread across the crypto space.

But what does this signal actually indicate—and why is it generating so much buzz right now?

Hash ribbons flash rare BTC buy signal as miner stress fades ( Image Source: Stopsaving.com )

Understanding the Bitcoin Hash Ribbons Indicator

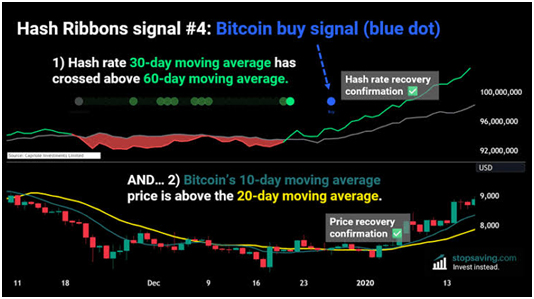

At its core, the hash ribbons indicator tracks two moving averages of Bitcoin’s hash rate—typically the 30-day and 60-day averages. It’s designed to measure miner stress, and in doing so, offer insight into the broader network’s strength.

When the 30-day average dips below the 60-day average, it suggests miners are struggling—possibly switching off machines or exiting due to rising costs. But when the shorter average rises back above the longer one, it’s a bullish signal. It shows miners are coming back online, costs are being managed, and the network is regaining strength.

That crossover—often called the “buy signal”—just reappeared this week, and historically, it’s been a precursor to strong upward price action.

Miner Capitulation: The Calm After the Storm?

Miner capitulation isn’t just technical jargon—it’s often viewed as the emotional low point of a market cycle. When inefficient miners exit, it tends to reset the system and hand control back to stronger, long-term operators.

This period, sometimes called the “buy zone,” has historically presented a golden opportunity for strategic investors. The recent crossover in hash ribbons indicates we may have passed through the latest wave of miner stress—and Bitcoin could be in the early stages of recovery.

With network difficulty steadying and the hash rate beginning to rise, confidence is quietly returning.

Also Read: Bybit Strengthens Digital Defences Following $1.4 Billion Crypto Breach

Why This Matters in 2025

The crypto landscape in 2025 looks very different from just a few years ago. Bitcoin has cemented its place as a key player in global finance, with institutional players and sophisticated tools shaping market movements.

The timing of this hash ribbons buy signal couldn’t be more relevant. After a period of sideways trading and moderate volatility, this signal, combined with positive on-chain trends and consistent ETF inflows, is strengthening the case for a bullish breakout.

In a world increasingly driven by data and signals, hash ribbons are no longer niche—they’re trusted markers that influence everything from retail sentiment to hedge fund positioning.

Market Sentiment: Measured Optimism

Across the crypto community, confidence is ticking upward. On-chain metrics show stable wallet accumulation and increased holding behaviour among whales. More importantly, other technical indicators are beginning to align with the hash ribbons signal.

The RSI sits in neutral-to-bullish territory. Network mining difficulty has stabilised, and volatility has decreased. This convergence points to a market that has absorbed recent shocks and is preparing for its next move.

Identifying the Buy Zone

For long-term investors, signals like hash ribbons serve as more than technical cues—they’re strategic tools for identifying market bottoms. Unlike short-term indicators used by day traders, hash ribbons operate on a broader timeframe, making them ideal for deep-cycle analysis.

A buy signal from the Hash Ribbons !

I haven’t seen many people talking about it, but we recently got a new buy signal from the Hash Ribbons indicator.

This metric helps us assess the level of stress in the Bitcoin mining ecosystem.— It’s not a big surprise considering… pic.twitter.com/zmUL5K9qOk

— Darkfost (@Darkfost_Coc) June 4, 2025

Previous buy signals, such as those seen in 2019, 2020, and post-crash 2022, preceded significant price gains. In 2025, with traditional markets experiencing uncertainty and investors seeking alternative stores of value, Bitcoin is again becoming a calculated bet—not just a speculative play.

Those with high risk tolerance are now evaluating whether this could be one of those rare windows of opportunity.

A Bullish Signal, But Caution Remains

Of course, no indicator is foolproof. While the hash ribbons suggest recovery among miners, the broader market remains vulnerable to external forces. Regulatory pressures, global economic uncertainty, or disruptions in energy markets could all impact Bitcoin’s trajectory.

Still, when on-chain data, miner activity, and broader technical patterns all start aligning—it strengthens the argument for a bullish outlook.

What to Watch Next

Bitcoin’s ability to hold above key support zones and break past resistance levels in the coming weeks will be critical. If momentum builds and investor confidence continues to grow, analysts say a breakout could follow—potentially setting the stage for new all-time highs later in the year.

With miner stress easing and hash rate climbing, this latest hash ribbons signal could mark the beginning of a fresh leg up in the market cycle.

Final Thoughts

In an industry full of noise, Bitcoin’s hash ribbons offer a quiet but consistent signal of change. They don’t promise certainty—but they highlight shifts in network resilience, miner behaviour, and long-term sentiment.

Whether you’re an active investor or a curious onlooker, one thing is clear: Bitcoin is stirring once again. And if history is any guide, this “buy signal” might just be the calm before the next major wave.