Bitcoin’s exchange reserves have dropped to their lowest level in seven years, a development that many analysts interpret as a bullish indicator for the cryptocurrency market. This trend suggests a shift in investor behavior towards long-term holding, potentially setting the stage for future price appreciation.

Understanding Bitcoin Exchange Reserves

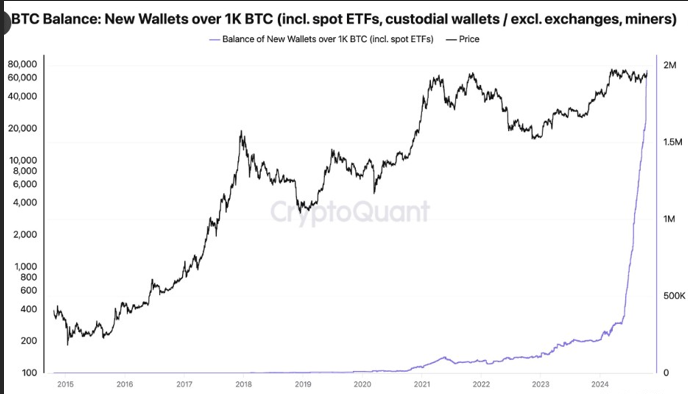

Blockchain data from CryptoQuant shows that the total number of new institutional wallets \Source: CryptoQuant CEO

Exchange reserves refer to the amount of Bitcoin held on centralized cryptocurrency exchanges. These reserves are crucial indicators of market liquidity and potential selling pressure. When reserves are high, it implies that more Bitcoin is available for trading, increasing the likelihood of selling activity. Conversely, declining reserves suggest that investors are moving their holdings off exchanges, often into cold storage, indicating a preference for long-term holding over short-term trading.

The Current State of Bitcoin Exchange Reserves

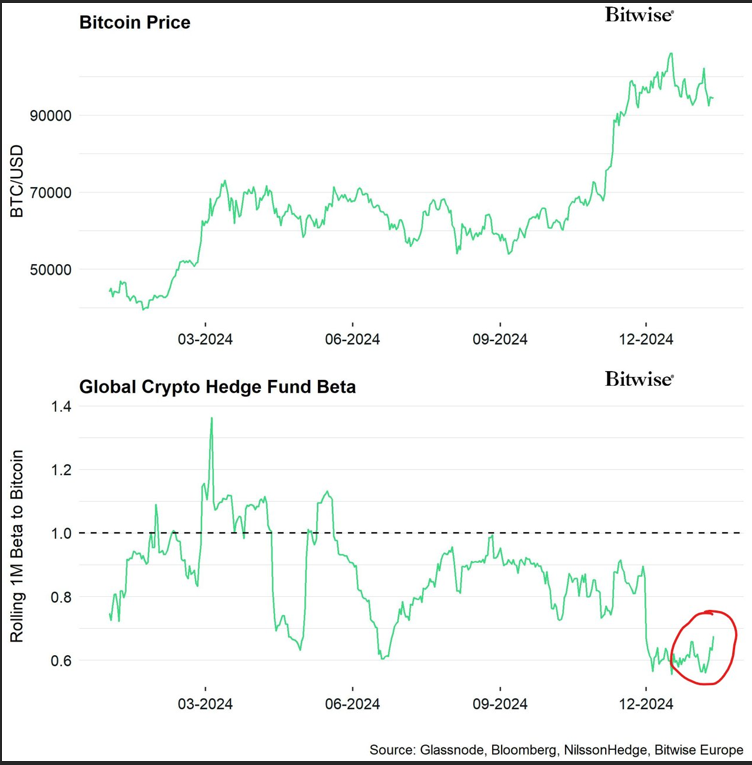

Global crypto hedge fund beta. Source: Andre Dragosch

As of June 2025, data from CryptoQuant reveals that Bitcoin exchange reserves have fallen to approximately 2.38 million BTC, marking the lowest level since August 2018 . This represents a significant decline from the 3.11 million BTC held on exchanges a year prior, indicating a 23.5% decrease.

This downward trend in exchange reserves has been consistent over the past year, with a notable acceleration in recent months. Analysts attribute this to increased accumulation by both retail and institutional investors who are transferring their holdings to secure, offline wallets.

Implications of Declining Exchange Reserves

Reduced Selling Pressure

A decrease in exchange reserves typically leads to reduced selling pressure in the market. With fewer coins readily available for trading, the likelihood of large sell-offs diminishes, contributing to price stability and potential upward momentum.

Increased Investor Confidence

The movement of Bitcoin from exchanges to cold storage suggests that investors are confident in the asset’s long-term value. This behavior indicates a belief that Bitcoin’s price will appreciate over time, reducing the incentive to sell in the short term.

Potential for Supply Shock

If demand for Bitcoin increases while the available supply on exchanges continues to decline, the market could experience a supply shock. This scenario often leads to significant price increases as buyers compete for a limited number of coins.

Institutional Involvement and Its Impact

Institutional investors have played a significant role in the recent decline of exchange reserves. Companies like MicroStrategy and Tesla have made substantial Bitcoin purchases, moving their holdings into long-term storage. Additionally, the approval and adoption of Bitcoin exchange-traded funds (ETFs) have facilitated greater institutional participation in the market.

These developments have not only reduced the amount of Bitcoin available on exchanges but have also signaled to the broader market that major financial players view Bitcoin as a viable long-term investment.

On-Chain Metrics Supporting Bullish Sentiment

Several on-chain metrics corroborate the bullish interpretation of declining exchange reserves:

- HODL Waves: An analysis of HODL waves shows an increasing percentage of Bitcoin being held for longer periods, indicating a trend towards long-term holding.

- Realized Cap: The realized capitalization of Bitcoin has been rising, suggesting that newer coins are being held at higher prices, reflecting investor confidence.

- Net Transfer Volume from/to Exchanges: There has been a consistent net outflow of Bitcoin from exchanges, reinforcing the narrative of accumulation.

Also Read: Trump Family Denies Involvement in New ‘Official’ Crypto Wallet

Market Sentiment and Price Action

Despite the positive on-chain indicators, Bitcoin’s price has experienced volatility, recently trading between $103,000 and $106,800 . However, the declining exchange reserves provide a strong foundation for potential price appreciation.

Analysts suggest that if the trend of accumulation continues and demand increases, Bitcoin could break through current resistance levels, leading to new all-time highs.

Conclusion

The significant drop in Bitcoin exchange reserves to a seven-year low is a compelling indicator of bullish sentiment in the market. As investors increasingly move their holdings off exchanges into long-term storage, the available supply for trading diminishes, potentially leading to price appreciation. Coupled with growing institutional involvement and supportive on-chain metrics, the current landscape suggests a favorable outlook for Bitcoin’s future performance.