Market Speculation Intensifies as XRP Gathers Momentum

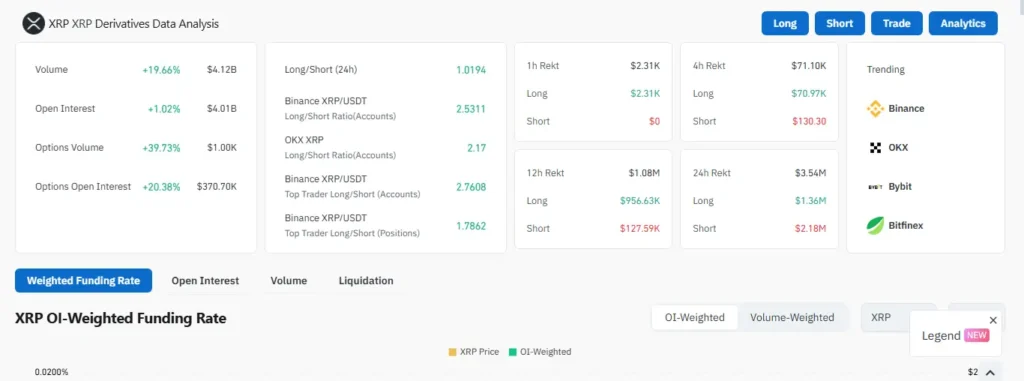

Ripple’s XRP token has seen a sharp increase in open interest recently. Open interest represents the total value of active contracts in the derivatives market, showing how many traders have positions betting on XRP’s price movement. According to Coinglass data, open interest on XRP exceeded $4 billion and even reached nearly $5 billion over the past weekend. This rise points to growing speculation and signals that many traders expect a significant price shift soon.

Ryan Lee, chief market analyst at Bitget, told CoinDesk that this surge in open interest reflects increased confidence among investors. Traders are taking larger positions, indicating preparation for a breakout. XRP’s price is currently trading within a narrow band, a phase known as consolidation. This often happens before a strong price move either up or down. In addition to this, steady buying pressure in the spot market is supporting bullish sentiment.

Image 1: XRP Open Interest score (Source: Coinglass)

Ripple’s Vision for Cross-Border Payments Driving Long-Term Potential

Beyond trading activity, Ripple’s broader strategy to transform international payments plays a crucial role in XRP’s future outlook. Global cross-border transactions are expected to grow significantly, potentially reaching $300 trillion annually by 2030. Currently, many international payments are slow, costly, and prone to errors. Ripple aims to solve these problems by using blockchain technology and XRP as a bridge currency, making transfers faster and cheaper.

Pegah Soltani, who leads Ripple’s payments product division, has outlined how the company is working to improve this space. For example, when a business in the UK wants to send money to the Philippines, XRP can act as a connector between currencies, speeding up the process and lowering costs.

If XRP gains widespread adoption in the cross-border payments market, the demand for the token could rise substantially. Analysts suggest that even a modest share of this enormous market could lead to significant price increases for XRP. This long-term adoption story remains a key factor driving investor interest.

Next, ChatGPT calculated the token’s potential price. It divided that $3 trillion value by the 58.75 billion tokens in circulation. This resulted in an XRP price of about $51.06. Interestingly, analysts at crypto resource Changelly expect XRP to reach $51 by August 2033.…

— TheCryptoBasic (@thecryptobasic) June 3, 2025

Price Predictions and Market Sentiment

While XRP’s price is up by just over 2% recently, market watchers remain optimistic. Analysts at Crypto Basic have discussed XRP’s potential price growth if the token captures a growing portion of the global payments sector. Using projections about transaction volume and token usage, some models estimate XRP could reach prices well above current levels.

In one hypothetical scenario, if XRP were to process all $300 trillion of cross-border payments annually by 2030 — an extremely ambitious assumption — the token’s price could theoretically reach over $50. This estimate depends heavily on how often each XRP token is reused during transactions. Higher “velocity” or reuse means fewer tokens are needed at any time, lowering the price estimate, while slower reuse pushes prices higher.

Even if XRP only captures a fraction of this market, such as 5% or 10%, the increased utility and demand for the token could still result in significant price appreciation. Institutional interest and technological improvements within the XRP Ledger further support the possibility of sustained growth.

Image 2: Ripple’s XRP (Source: Unsplash)

Market Dynamics and Risks

The current surge in open interest and strong fundamental developments create a unique environment for XRP. However, it is important to remember that high open interest can also lead to increased volatility. Without a clear market trigger, prices could move sharply in either direction.

Ryan Lee from Bitget has noted that a sudden price increase might spark a “short squeeze,” where traders betting against XRP rush to close positions, pushing the price even higher. On the other hand, if profit-taking or negative market sentiment takes hold, large liquidations could drive prices downward rapidly.

Given these factors, traders and investors should watch for upcoming catalysts, such as institutional announcements, regulatory updates, or significant developments in the XRP Ledger. These could provide the momentum needed to push XRP decisively in either direction.

Read Also: Riding the Ripple: Unpacking XRP Market Trends and Whale Activity

Looking Ahead

XRP’s current situation—combining strong speculative interest, solid technical factors, and Ripple’s ambitious payment solutions—sets the stage for potentially major price movements in the near future. The token’s ability to solve longstanding issues in international money transfers gives it a compelling use case, which may continue to attract buyers.

While the exact timing and direction of the next big price move remain uncertain, the foundations for growth are clearly in place. Market participants should monitor key levels of open interest, spot buying trends, and news surrounding Ripple’s technology and partnerships.