Bitcoin never ceases to capture attention. Just when the market seems steady, it shatters records again. On 22 May 2025, Bitcoin surged to a staggering all-time high of AUD $111,970, sparking excitement and speculation across the cryptocurrency community. While investors celebrated, experts at Bitfinex cautioned that the outlook for Q3 could be far less predictable.

Bitcoin peaks amid Q3 uncertainty ( Image Source: Finance Magnates )

So, what lies ahead? Should investors prepare for a period of calm consolidation, or are we on the brink of another major rally? With a mixture of institutional inflows and macroeconomic factors at play, this article dives deep into the Bitcoin Q3 2025 outlook to provide clarity for traders and long-term holders alike.

Chapter 1: What Drives the Current Record High—and Can It Last?

Bitcoin’s recent price surge wasn’t an isolated event. The rally was fuelled by a combination of growing institutional adoption, easing regulatory frameworks in key markets, and enhanced access through spot Bitcoin ETFs. This powerful combination sharply increased demand.

Yet, as analysts from Bitfinex point out, steep rallies are often followed by phases of price consolidation. The excitement now may prompt short-term investors to cash in profits. Indeed, during May alone, more than AUD $11.4 billion worth of gains were realised by sellers.

This profit-taking is significant. It tends to tighten supply and puts downward pressure on prices unless fresh buying interest emerges to balance it out.

Chapter 2: Learning from History — Why Q3 Is Traditionally Tricky for Bitcoin

Historical data reveals a pattern worth noting: since 2013, Bitcoin’s third quarter has generally underperformed compared to the second and fourth quarters. On average, Q3 returns sit around a modest 6.03%, while Q2 returns average 27.25%. This contrast highlights Q3 as a challenging period for the cryptocurrency.

The reasons aren’t crystal clear, but psychological factors likely contribute. Following a strong mid-year rally, traders often become cautious, anticipating regulatory updates or economic reports. Many also choose to take profits during what is traditionally a quieter “summer lull.”

Bitfinex analysts attribute this cyclical cautiousness as a key reason why Bitcoin may not replicate Q2’s explosive gains in Q3.

Q3 often challenges Bitcoin after strong rallies ( Image Source: Obiex Blog )

Chapter 3: Critical Price Threshold — The $95,000 Support Level

For those monitoring Bitcoin price action, one figure stands out above the rest: $95,000. This is the average cost basis for short-term holders — investors who have owned Bitcoin for less than 155 days.

Maintaining prices above this support level suggests that recent buyers remain profitable and thus more likely to hold their positions. However, if the price dips below $95,000, it could trigger panic selling from these short-term holders, leading to accelerated declines.

Market participants are watching this key level with intense scrutiny. Bitcoin currently hovers just above $95,000, but volatility remains a looming risk.

Bitcoin tests $95K — key support under watch ( Image Source: InvestingCube )

Chapter 4: Institutional Money — The Pros and Cons of ETF Inflows

While retail investors seem inclined to take profits, institutional players are stepping up their buying. Spot Bitcoin ETFs, especially BlackRock’s IBIT fund, have absorbed much of the recent price dips. In the last week of May, IBIT attracted AUD $2.4 billion in inflows alone.

These large-scale purchases suggest institutions see long-term value, despite short-term price fluctuations. ETFs also simplify crypto exposure for traditional investors who prefer not to manage wallets or private keys.

However, institutional strategies are often opaque. Their trading decisions can pivot swiftly due to changes in macroeconomic policy, central bank actions, or geopolitical developments. A sudden reversal could rattle the market and amplify volatility.

Chapter 5: The Broader Economic Context — The Macroeconomic Wildcard

Taking a step back from crypto, the broader economic landscape remains complex. Inflation rates are easing but still present challenges. The U.S. Federal Reserve has hinted at potential interest rate cuts, though confirmation won’t come until the June 18 meeting. Meanwhile, Australia grapples with ongoing cost-of-living pressures and a slowing property market.

How do these factors influence Bitcoin?

Historically, Bitcoin thrives amid economic uncertainty and inflationary pressures, often seen as a hedge. Yet, with inflation stabilising and tech stocks gaining favour, Bitcoin now faces competition for investor attention.

Any unexpected shifts in central bank policies—whether from the U.S., Australia, or Europe—could trigger price swings. Investors should keep a close watch on these macroeconomic levers that often dictate crypto market sentiment.

Macro shifts may jolt Bitcoin ( Image Source: WallStreetMojo )

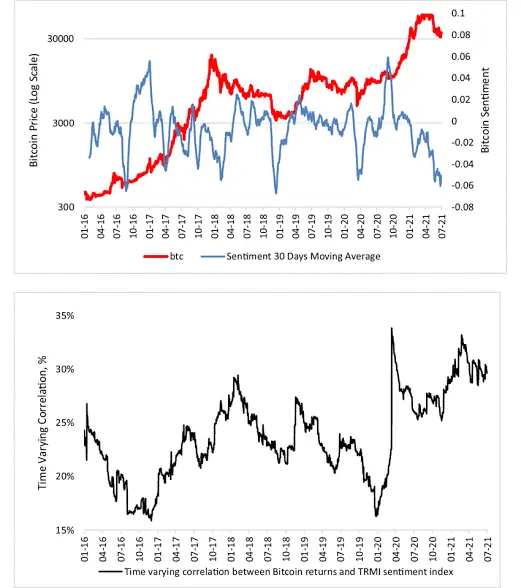

Chapter 6: Current Bitcoin Market Trends and Investor Sentiment

The cryptocurrency market is maturing. Gone are the days when a single celebrity tweet could cause massive price upheavals. Instead, more sophisticated indicators such as ETF flows, exchange reserves, and on-chain analytics now shape market understanding.

Key Bitcoin trends to observe include:

- Declining exchange reserves: Bitcoin balances on exchanges are falling, indicating longer-term holding and reduced sell pressure.

- Stablecoin movements: Rising stablecoin inflows onto exchanges suggest accumulating buying power waiting to be deployed.

- Mining difficulty increases: Growing mining difficulty signals confidence from miners, who are investing more in hardware and infrastructure.

Together, these trends reflect a cautiously optimistic market environment.

Bitcoin sentiment steadies as long-term holding rises ( Image Source: ResearchGate )

Chapter 7: Declining Volatility — A Sign of Maturity or Boredom?

One of Bitcoin’s defining traits has always been its volatility. However, Bitfinex analysts note that Bitcoin’s price swings are becoming less extreme—a sign of increasing market maturity.

Lower volatility attracts more risk-averse investors, who now consider Bitcoin a viable portfolio asset rather than a speculative gamble. For these investors, this is good news.

On the other hand, traders looking for quick, high-risk opportunities may find fewer explosive moves to profit from. Ironically, Bitcoin’s transition into a “boring” asset could be exactly what it needs to achieve widespread adoption.

Chapter 8: How to Approach Bitcoin Investing During Consolidation

With all this uncertainty, what should investors do as Bitcoin potentially enters a consolidation phase?

Long-term holders may find Q3 offers an ideal window to accumulate Bitcoin at steadier prices, away from the frenzy of previous quarters. Here are some practical tips for navigating this phase:

- Avoid chasing hype: Don’t rush into buying on price pumps. Wait for price stabilisation.

- Set stop-loss orders: Protect your investment by planning exit points to minimise downside risk.

- Diversify holdings: Consider balancing Bitcoin with other cryptocurrencies like Ethereum or promising layer-2 solutions.

- Stay informed: Monitor macroeconomic developments, ETF inflows, and expert analysis such as Bitfinex’s insights.

Chapter 9: Can Bitcoin Still Reach New Heights in 2025?

Despite the current uncertainty, Bitcoin still has the potential to hit new record highs this year.

If macroeconomic conditions improve and institutional demand remains robust, the next few months could redefine the cycle’s trajectory. Alternatively, the market may settle into a prolonged consolidation, with prices oscillating between $95,000 and $115,000.

While consolidation may seem less exciting, many seasoned investors view it as a golden opportunity to build positions without the stress of sharp corrections.

Analysts’ Bitcoin predictions for 2025 ( Image Source: Investopedia )

Final Thoughts: Stay Grounded and Think Long Term

The Bitcoin Q3 outlook is best described as cautious optimism. The buzz and demand remain, but the market is evolving. Volatility is moderating, institutions are reshaping dynamics, and macroeconomic factors continue to influence sentiment.

For those seeking quick profits, caution is warranted. But for patient investors focused on the long game, this period could be an excellent time to learn, adapt, and position for the future.

Ignore the noise, trust the data, and keep your long-term vision front and centre.