As of May 22, 2025, West Texas Intermediate (WTI) crude oil is trading at $61.60 per barrel, reflecting a modest increase from the previous day’s close of $61.23. Brent crude has also seen an uptick, moving from $64.23 to $64.56.

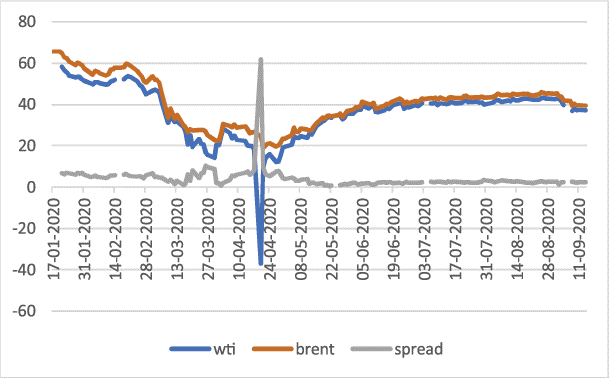

Worldwide crude oil pricing patterns. ( Image Source: ResearchGate )

Factors Influencing the Current Oil Prices

Several elements are contributing to the current state of the oil market:

- S. Inventory Builds: Recent reports indicate an unexpected rise in U.S. crude and fuel inventories, suggesting a potential oversupply in the market.

- Geopolitical Tensions: Ongoing discussions around U.S.-Iran relations and potential sanctions on Russian oil are creating uncertainties that affect global supply expectations.

- OPEC+ Production Decisions: OPEC+ has revealed intentions to boost oil output in a bid to reclaim market share lost to U.S. shale competitors.

Implications for Global Markets

The interplay of these factors is leading to cautious optimism among investors. While the increase in WTI and Brent prices suggests a bullish trend, the underlying concerns about oversupply and geopolitical risks continue to weigh on market sentiment.

Crude Oil Prices Today: Key Drivers ( Image Source: Discovery/Alert)

Looking Ahead

Market participants will be closely monitoring upcoming data releases and geopolitical developments to gauge the future direction of oil prices. The balance between supply and demand, influenced by production decisions and global events, will be critical in shaping the oil market’s trajectory in the coming months.