In the ever-evolving world of cryptocurrency, the exchange rate between Bitcoin (BTC) and the Australian Dollar (AUD) holds significant importance for Australian traders. Understanding the factors that influence this rate can empower traders to make informed decisions and navigate the crypto market more effectively.

Understanding the BTC to AUD Exchange Rate

The BTC to AUD exchange rate represents the value of one Bitcoin in Australian Dollars. This rate is subject to fluctuations based on various factors, including market supply and demand, regulatory changes, and global economic events.

Market Supply and Demand Dynamics

Like any asset, Bitcoin’s price is influenced by supply and demand. When demand for Bitcoin increases, its price tends to rise, and vice versa. Factors such as investor sentiment, media coverage, and technological advancements can drive demand. Conversely, regulatory crackdowns or security breaches can dampen enthusiasm and reduce demand.

Figure 1: Australia Crypto Exchange

Regulatory Environment in Australia

Australia has been proactive in establishing a regulatory framework for cryptocurrencies. The Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO) have implemented guidelines to ensure transparency and protect investors. These regulations can influence the BTC to AUD rate by affecting investor confidence and market participation.

Impact of Global Economic Events

Global events, such as geopolitical tensions, economic crises, and policy changes, can impact the BTC to AUD exchange rate. For instance, inflation concerns or currency devaluation in other countries can lead investors to seek refuge in cryptocurrencies, affecting demand and, consequently, the exchange rate.

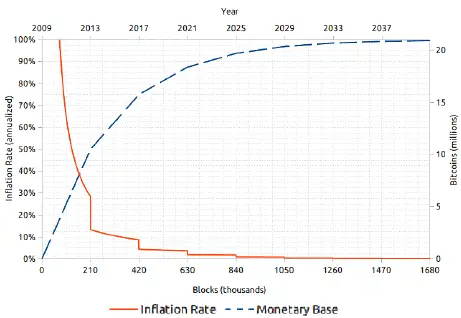

Inflation and Bitcoin

Inflation erodes the purchasing power of fiat currencies, prompting investors to look for assets that can preserve value. Bitcoin, with its capped supply of 21 million coins, is often viewed as a hedge against inflation. As inflation rises, demand for Bitcoin may increase, influencing its value relative to the AUD.

Figure 2: Bitcoin’s Inflation Trend Over Time

The Role of Decentralised Currency

Bitcoin operates on a decentralised network, free from central authority control. This decentralisation appeals to those seeking financial autonomy and protection from traditional financial system vulnerabilities. The decentralised nature of Bitcoin can attract Australian traders, impacting the BTC to AUD exchange rate through increased demand.

Geopolitical Events and Their Influence

Geopolitical events, such as changes in government policies or international conflicts, can create economic uncertainty. In such times, investors often turn to alternative assets like Bitcoin. For example, policy shifts in major economies or tensions in global markets can lead to increased Bitcoin demand, affecting its value against the AUD.

Practical Implications for Aussie Traders

Understanding the BTC to AUD exchange rate is crucial for Australian traders. It affects the profitability of trades, investment strategies, and tax obligations. Traders must stay informed about market trends, regulatory changes, and global events to make strategic decisions.

Staying Informed and Adapting Strategies

Given the volatility of the crypto market, staying updated is essential. Utilising reliable news sources, engaging with the trading community, and employing analytical tools can help traders anticipate market movements and adjust their strategies accordingly.

Conclusion

The BTC to AUD exchange rate is a dynamic metric influenced by a myriad of factors, including market dynamics, regulatory frameworks, and global events. For Australian crypto traders, understanding these influences is key to navigating the market effectively and making informed trading decisions.