According to Cathie Wood, gold rallies have been preceding significant Bitcoin breakouts, and her data indicates that this trend has happened twice in the last cycles.

According to the founder of Ark Invest, the correlation of Bitcoin with gold has been kept at a very low level, i.e., 0.14, since the beginning of the year 2020. She contends that this poor relationship aids in diversifying investors when markets are under stress.

Wood assumes that the power of gold may be used as the prescriptive power of the new demand for digital property. Her position can be used to understand why Cathie Wood is fond of Bitcoin despite safe havens that rule the headlines.

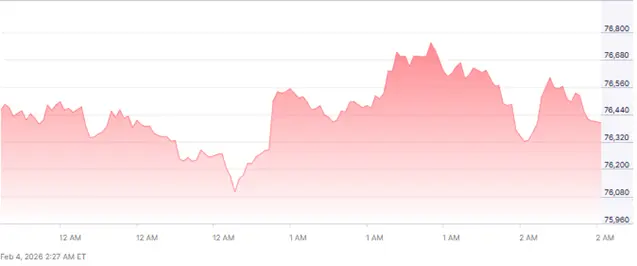

The charts of the price of Bitcoin and gold would show conflicting market trends and volatility.

Gold Moves Have Led Bitcoin In Past Cycles

According to Ark Invest research, the momentum of the gold prices was the precursor to the 2020-21 and 2024-25 Bitcoin bull markets.

According to Wood, these historical indicators are important in positioning a portfolio in the current environment. She emphasises that the investors tend to ignore early commodity strength.

Gold is the first to respond to the first increase in uncertainty. Bitcoin then proceeds with more precise gains on risk appetite recovery. This series does not discredit the opinion that cryptocurrencies may respond violently when macro hedges stabilise.

Could Cryptocurrencies Act As Diversifiers Now?

Wood identifies Bitcoin, Ethereum, and Solana as good new portfolio diversifiers. She refers to them as the big three digital assets. Such tokens do not tend to act like equities and commodities.

The fact that it is independent can lower the volatility of a portfolio. Wood proposes to add small allocations in uncertain cycles.

Uncorrelated assets might be advantageous to investors who need growth. The strategy fits Cathie Wood being a bull of Bitcoin despite the fluctuations in the short term.

The Ethereum, Solana and Bitcoin logos appear as the top crypto assets. [Forbes]

Bitcoin, Ethereum And Solana Form The Core Picks

Ark Invest is still supporting these networks due to its size and utilisation. Bitcoin is still the major store of value. Ether is decentralised, and smart contracts are supported in Ethereum.

Solana is rapid in settlement and reduced transaction fees. Wood thinks that innovation in such chains creates a long-run demand.

There has been an incremental exposure in the institutional flows. The move is indicative of the belief that blockchain assets will turn into a mainstream financial infrastructure.

What Does The Gold Price Outlook 2026 Suggest?

Gold has recently soared to a record $5,590, and thereafter dropped abruptly to $4,600. The action rekindled controversy surrounding risk assets. The surge is taken as a warning sign by some traders.

Others perceive it as a pretext for another crypto frenzy. Wood takes the strength as a sign of the early days and not as a danger.

She claims that commodities seem to reach their high point, and the capital shifts to other growth areas. Such a perspective informs the discussion of the price outlook of gold in 2026.

The stack of gold bars next to the trading screens displays the highest and pullback records. [Mint]

Analysts Warn Of Historical Risks To The Thesis

Wood is not always correct in his optimism. Cryptocurrency analyst Benjamin Cowen cautions that parabolic rises in metals occasionally cause a fall in riskinvestments. He mentions the crisis of the past in 1973 and 2008.

Commodities would rise during those times before the decline of equities. According to Cowen, investors cannot look at recent cycles, but longer history.

The opposition point is that there is confusion with timing. Nevertheless, Wood still argues that disciplined exposure and diversification are still wise measures.

Investors Weigh Strategy As Macro Uncertainty Persists

Global markets remain volatile as inflation risks, rate shifts, and geopolitical tensions cloud outlooks. Investors now reassess exposure across equities, metals, and digital assets. Wood’s framework encourages balance rather than aggressive bets.

She supports measured allocations to crypto alongside traditional hedges. Portfolio resilience becomes more important than chasing momentum.

The debate over why Cathie Wood likes Bitcoin may intensify as 2026 approaches and capital flows rotate between gold and blockchain assets.

Also Read: Bitcoin Market Outlook Signals Cautious Optimism For 2026

FAQs

Q1: Why does Cathie Wood like Bitcoin compared with gold?

A1: She believes Bitcoin shows low correlation with gold and can diversify portfolios.

Q2: What correlation did Ark Invest report between Bitcoin and gold?

A2: Ark Invest cited a correlation of 0.14 since early 2020.

Q3: Which cryptocurrencies does Wood recommend?

A3: Bitcoin, Ethereum and Solana form her preferred core allocations.

Q4: What is the gold price outlook 2026 debate about?

A4: Investors disagree whether gold’s surge signals crypto gains or broader risk declines.

Disclaimer