The NYSE, which is owned by Intercontinental Exchange (ICE), is developing a tokenised securities system that will allow investors to trade tokenised securities and ETFs around the clock. It provides real-time on-chain settlement, orders dollar valued, and stablecoin-based funding, awaiting regulatory permission.

It is not a simple blockchain experiment. The exchange is publicly displaying actual characteristics that target markets that are never closed.

This is important to cryptocurrency users as well as conventional investors.

As soon as the NYSE accepts stablecoins and tokenisation as a regular instrument, rather than a fad, the market will evolve.

NYSE (via ICE) is building a tokenised trading system for stocks and ETFs, 24/7 access, on-chain settlement, dollar-based orders, and stablecoin funding, pending approval. (Image Source: The Block)

Whatever NYSE Believes it is Constructing (In Plain English)

According to ICE, the platform will be a new NYSE location, outside the standard weekday floor, which will be available to support tokenised trading.

The primary facts that come up in any serious debate concerning market structure are:

- 24/7 Trading

Not only long or after-hours. Always on. - Instant On‑Chain Settlement

It will be resolved immediately rather than being postponed to the following working day. - Fractional Shares And Dollar Size Orders

The ICE claims that orders are counted in dollars, hence fractional participation is not a workaround as opposed to being built in. - Stablecoin Funding

The design also requires the use of stablecoins to fund trades, which reflects the confidence of the big brand. - Post-Trade Traditional Technology (Meets Blockchain)

ICE integrates its Pillar engine with blockchain post-trade systems and has the option of utilizing multiple chains in settlement and custody.

That detail matters.

It demonstrates that NYSE is not substituting Wall Street with crypto. It desires to enhance the back end of securities and leave the front end as familiar to banks.

The Actual Motive: NYSE Desires the Twenty-Four-Hour Investor

This is the emotional website of the headline.

The markets, attention and money are global.

However, in the case of US stocks, they are still on a schedule that presupposes that the world will come together.

It doesn’t.

Crypto has conditioned individuals to believe that the prices will fluctuate on Saturday evenings. World news breaks in the morning on Sundays. Even one leak of earnings can strike in an off-session and will still become the headlines.

The question is, why not then can the largest stock market in the world move as fast as the world moves?

The response to ICE is the creation of a system whereby trading, funding and settlement can operate after the old banking day.

What is Meant By Tokenised Securities?

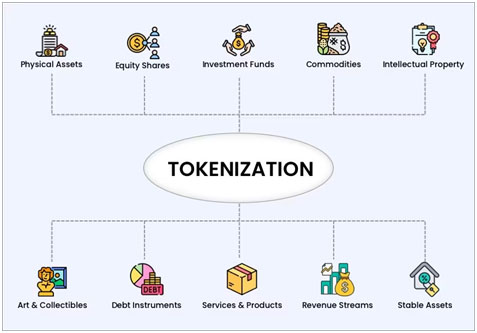

Tokenisation refers to the display of a security, such as a stock or ETF share, as a digital token in a blockchain.

It is not a matter of novelty but easy transfer and quick settlement.

A transfer may occur directly and automatically, as opposed to going through a significant number of middlemen, provided that regulators approve and individuals place their trust in the system.

According to NYSE, the tokenised assets will retain physical rights such as dividends and voting, rather than a shadow version.

Tokenisation puts stocks/ETFs on blockchain rails for faster transfer and settlement. NYSE says dividends and voting rights stay. (Image Source: Debut Infotech)

The Reason Why Stablecoins Feature in This Narrative

Crypto already has stablecoins as a settlement.

You are used to it, should you be trading on exchanges: swap, settle, collateral move, redeploy without an opportunity to wait until a bank wire comes through.

The fact that NYSE has introduced funding to stablecoins demonstrates that stablecoins are not merely crypto money. They are market infrastructure, particularly where 24/7 trading is involved and the cut-offs of banks are important.

There is another incisive question which recurs and recurs:

Assuming that stablecoins are used to finance regulated securities, what becomes of:

- Stablecoin regulation

- Issuer transparency

- Reserve standards

- And brand-to-brand competition?

NYSE does not list the stablecoins it is going to support. The danger is part of the mystery and uncertainty.

Tokenised Deposits: The Secret Power of the Platform

There is another fact of more importance to the institutions than the headline features.

ICE reports that it collaborates with large banks such as BNY Mellon and Citigroup in getting tokenised deposits supported by ICE clearinghouses.

The reason is that deposit money does not operate the same as stablecoins that are usually issued by non-banks.

With the ability to use tokenised deposits as collateral or settlement, 24/7 trade is more likely to operate smoothly without having to rely solely on stablecoins.

It further demonstrates that it is not a crypto side quest. ICE is dragging banks down a design, which is market hours and time zone-tested.

ICE says it’s working with Citi and BNY Mellon on tokenised deposits for ICE clearinghouses, a bank-native alternative to stablecoin-only funding for 24/7 markets. (Image Source: CoinJournal)

The Idea of Instant Settlement is Ideal Until You Consider the Trade-Offs

Instead, instant settlement is a win.

Reduced counterparty risk, reduced settlement risk, expedited access.

However, the plumbing has changed and incentives as well.

Conventional cycles enabled companies to net and bulk, offset commitments, and transfer lesser cash and collateral, and control liquidity within scheduled sights.

Instant settlement is able to reduce risk and increase liquidity pressure since obligations must be met now.

Thus, should NYSE be successful, the question is to whose balance sheet, collateral workflows, and treasury operations does real-time prosper.

This is where the crypto markets and traditional markets really appear more similar than one might expect.

The Place of DTCC and Post-Trade Control in the Discussion

The healthy markets run smoothly or break in post-trade.

The strategies of the NYSE are directly associated with that fact. There are also reports of connections to the post-trade firms like DTCC as the giant moves towards blockchain settlement.

Provided tokenised security settlement develops, it will alter the trading hours, among other things.

It alters the clearing, custody, collateral flow, compliance, and observance of the market by regulators.

This is why it is not merely stocks on the blockchain.

It might restructure the operation of the new markets.

It is not just the NYSE that is not alone.

When it is an element of a bigger competition pattern, stories like this only become real.

In recent months, Nasdaq has been seeking to have tokenised equity plans approved by the regulators, and numerous platforms are considering tokenised asset proposals.

Also, proposals to add tokenisation to mainstream products are being filed by asset managers, including F/m Investments, seeking the SEC to permit tokenised shares in a Treasury bill ETF.

Combined, the image is more evident: this is not a singular act of doing something strange. It is a market structure race.

Tokenised settlement could rewire post-trade and NYSE isn’t alone. This is a market-structure race. (Image Source: LinkedIn)

The Crypto Effect: Would Anything Change in Case NYSE Succeeds?

Cryptocurrency markets will experience three rapid transformations in the event of a regulated market that provides 24/7 tokenised trading with stablecoin capital and fast settlement.

Even more influential will be the stablecoins.

Stablecoins will cease to be the dollar on the exchanges; they will be used to trade regulated securities. The demand will grow, and the inspection will intensify.

The tokenisation will cease being an RWA story and become a form of standard.

At the moment, tokenised assets are primarily found in crypto groups as “RWA.” An institutionally supported venue by the NYSE drags it into the mainstream, where institutions make the decision about whether tokenisation is a feature or a standard.

The liquidity expectations will vary.

Cryptocurrency traders already trade 24/7. Equity traders do not. When NYSE normalises always-on trading, investment will index risk over weekends, holidays and quiet periods. It might have an impact on crypto volatility as well.

What the Regulators Are Going to Be Concerned With, and Why It is Not That Easy

The term subject to regulatory approval is repeated numerous times.

- Market integrity: Does round-the-clock trading increase the risk of manipulation in the thinly liquid market?

- Disclosure parity: Is equal price information available to all investors in the event of a liquidity breakup?

- Custody and settlement: What is final settlement, and how do disputes get solved?

- Stablecoin risk: What happens to a stablecoin in case of high settlement traffic?

- Operational: Does the system withstand stress, downtime or cyber-attacks?

These are not just ideas. These are real concerns that determine whether this will turn out to be a real infrastructure or a pilot that never lands.

Why NYSE Emphasizes Instant Settlement

NYSE, through ICE, does not advertise it as fun late-night trading.

It depicts the platform as a full stack: trade execution, post-trade, custody, settlement, and funding. This is not accidental, as it is impossible to trade 24/7 without 24/7 post-trade, as it would be like a half-built bridge.

When you are in old cycles, you may trade at midnight, and can not, however, complete the trade properly until the next banking hour.

With approvals to go, ICE would like to eliminate that bottleneck by shifting settlement to a blockchain and funding it with stablecoins.

Instant settlement changes absorb risk and transfer the risk elsewhere.

The modern equity system has been adopted so that delayed settlement dispersion of risk across time, which provides such benefits as netting, batching, and certain liquidity planning.

Immediate settlement lowers the risk related to counterparty, but strains intraday liquidity, collateral flow, margin, and resilience.

These pressures do not stop on the weekends or holidays in a 24/7 model.

The tokenised deposits are associated with ICE: when money is passed during hours outside the banking industry, clearing members find it easier to handle their margins and meet their obligations across time zones.

The stablecoins are a market fuel and not a crypto side feature.

This is the point at which the story is structural.

When regulated securities are funded by stablecoins, they cease to be crypto dollars and are settlement fuel.

This gives rise to new competitive pressures:

What will be the accepted stablecoins? What are the reserve requirements that please regulators and institutions? What would be the effect in case a stablecoin goes wobbly during stress? What will happen to redemption in times of settlement demand explosion?

The plan of the ICE involves the funding of stablecoins, which places the regulation and credibility of the issuer of stablecoins in the limelight.

The Silent War: Tokenised Deposits Versus Stablecoins

Stablecoins make headlines, and banks favor bank money.

That is why the collaboration of ICE with banks like Citi and BNY Mellon in tokenised deposits is relevant. It is a premonition of a hybrid future in which stablecoins are not the sole 24/7 settlement option.

Think of it like this:

Stablecoins: quick, 24/7, crypto markets.

Tokenised deposits: bank money, which can act as if constant liquidity in case the infrastructure is available.

In case tokenised deposits increase, the institutions may depend on them since the risk is similar to that of traditional treasury policies.

The market is not going to select one overnight. It will be exposed to pressure in public.

Stablecoins grab attention, but banks prefer bank money. ICE’s tokenised deposits hint at a hybrid 24/7 settlement future. (Image Source: Ledger Insights – blockchain for enterprise)

When the Markets Do Not Close, Price Discovery Becomes Weird

Closing bells are not just indicators of tradition. They squeeze out price discovery in known periods, establish overt open/close points of reference, and push risk to reprice at the open.

Pricing in a 24/7 world is more continuous. Continuous pricing can also imply continuous panic, even though that might sound serene.

A shock caused at a thin session may be overreacted to. That action is filtered and it becomes the story. The test of liquidity then comes, or it does not.

This is a risk that regulators and exchanges are aware of. That is why approvals are significant.

Weekend Arbitrage is Becoming a Profession

By exchanging tokenized stocks 24/7, whereas the old markets open only at specific times, the opportunity to earn money on the difference in prices is increased.

Example scenario:

A stock is taken into the market on a Saturday following a dramatic news item.

The conventional venues have been shut down.

Cryptocurrency assets and ETFs respond.

The actual market must be up to speed by Monday morning.

That gap is a target for:

- Market makers

- Prop desks

- Advanced retail clients

- Even cross-venue trading bots

It can soon result in efficiency in markets, but in the meantime, it can increase the volatility of prices as everyone trains to set prices outside of normal hours.

NYSE is not the only one to desire twenty-four-hour trading. The competition is strong. The pending approvals will see Nasdaq trade almost 24 hours a weekday.

The rest of the system is evolving too: after trade infrastructure such as DTCC will assist in clearing trades around the clock as markets extend to longer hours.

This is important since the tokenized venue of NYSE is also a part of a wider trend towards extended working hours and tokenization assists in making that trend operational.

The Reality About Dollar-Sized Orders

It could be considered insignificant, yet it can impact the users a lot. Ordering in dollars: There is no need to calculate the number of shares to purchase and then order it. Your way of thinking is as if you were an average individual: I want 200 exposure to this stock, not 0.0347 of a share. It also enables one to feel like fractional buying naturally, which can expand the retailer participation without the broker-side fractional logic. ICE puts a special emphasis on the platform design by mentioning dollar-sized orders.

Questions Of Custody: The Who, Where, What?

The new form of the classic finance problem is the custody of tokenized securities. Even with on-chain assets (even permissioned), you must answer: Who is the custodian? And what is the matching of ownership records? How does a fork or outage or chain-level event happen? What about the clean management of corporate activities? ICE implies multi-chain settlement and custody, which means that there is flexibility as well as complexity. It is at this point that the retail readers are surprised: the most difficult issues are not glitzy. They are functional, legal and boring. That determines the mainstreaming of tokenization.

The Bridge Product is Tokenized ETFs, and Everybody Receives It

Although tokenized stocks are dramatic, tokenized ETF shares can prove more feasible. It is why the F/m Investments SEC filing to tokenize shares of its Treasury bill ETF (TBIL) comes squarely in the middle of this trend. The explanation is straightforward: tokenized shares retain the protection of their same-investor, but the ownership is owned and maintained on a permissioned blockchain. Not crypto replacing ETFs, it is. It’s “ETFs adopting new rails.” And that is what NYSE is putting across: streamline the infrastructure, retain the asset.

The Implication of This to Crypto Markets Today

In case the plan of the NYSE is passed, crypto is automatically affected.

- Change of narrative: tokenization ceases to be a crypto slogan and is replaced by a strategy of delivering legacies in finance.

- Stablecoin legitimacy pressure: Stablecoins are under pressure to have more reserves, transparency, and resilience since they are no longer exchange collateral.

- A new standard of settlement speed: when regulated markets shift to instant settlement, the question of why this requires days unleashes on the whole of finance.

- A new spurt of builder focus: in which institutions follow, infrastructure builders follow- custody tools, compliance monitoring, chain analytics, permissioned chain technology, identity overlay.

The Implication of This for Australians Who Are Just Watching

Australia lies within a time zone where the US market moves are frequently viewed as an overnight occurrence. A 24 hrs tokenized venue alters it. It can provide investors with more localized given wake trading hours that require more vigilant risk management since prices can change anytime. This isn’t investment advice. It is a market structure fact: the access is extended, and the responsibility is extended as well.

For Australians, a 24/7 tokenised venue could bring US-market moves into local waking hours, but it also means managing risk anytime prices move. (Image Source: Reuters)

Conclusion

NYSE’s 24/7 tokenised trading plan is a signal that tokenisation is moving from theory to market plumbing. If ICE gets regulatory approval, the real shift won’t just be longer trading hours — it will be faster settlement, new funding rails, and a serious push to modernise post-trade infrastructure. Stablecoins may power the first wave, but tokenised deposits hint at a bank-friendly hybrid future. Either way, the direction is clear: markets are testing what “always-on” really means and the winners will be the systems that can handle speed, liquidity, and trust without breaking.

Frequently Asked Questions (FAQs)

- Is NYSE moving stocks to crypto?

Ans: ICE says it’s developing a new NYSE venue for trading and settling tokenised securities. It would run alongside existing market structures and still requires regulatory approvals. - What does “orders sized in dollar amounts” mean?

Ans: You can place an order by value (e.g., $50 worth) instead of buying whole shares only. This makes fractional exposure easier. - What does instant settlement change for trading?

Ans: Trades can settle in real time, which cuts settlement delays. But it also means funding and collateral must be ready immediately. - Why use stablecoins at all?

Ans: Stablecoins can move money 24/7, which suits always-on trading where bank cut-off times can slow funding. ICE includes stablecoin-based funding in its concept. - What are tokenised deposits, and why do they matter?

Ans: They are bank deposits represented as digital tokens. They can make funding and collateral flows smoother inside regulated markets. ICE says it’s working with Citi and BNY Mellon on tokenised deposits at clearinghouses. - When does this platform launch?

Ans: There’s no confirmed launch date. ICE describes it as under development and subject to regulatory approval. - Does 24/7 trading reduce volatility or increase it?

Ans: It can do both. Over time, more trading hours can improve price discovery. Early on, thin liquidity windows (late sessions/weekends) can amplify price swings. - What’s the biggest operational risk with instant settlement?

Ans: Liquidity and collateral pressure. Instant settlement reduces counterparty risk, but it requires firms to be funded continuously. - Are tokenised stocks the same as normal stocks?

Ans: The goal is equivalent economic rights (like dividends) and governance rights (like voting), but the exact structure depends on approvals and final implementation. - Why keep mentioning stablecoins for funding?

Ans: Because they can move value at any time, which helps a 24/7 market operate without being limited by bank operating hours. - How do stablecoins differ from tokenised deposits?

Ans: Stablecoins are usually issued by non-banks and pegged to a currency. Tokenised deposits are digital representations of bank deposits, which institutions may find easier for settlement and margin in regulated systems. - Is this definitely launching soon?

Ans: No definite public launch date is confirmed. It’s still a developing project and depends on regulatory approvals. - What role does DTCC play in the shift to longer trading hours?

Ans: DTCC sits at the centre of US post-trade processing. If markets move toward longer hours and faster settlement, DTCC’s clearing and settlement systems (or new supporting rails) need to adapt to handle more continuous post-trade activity.With the market pushing for longer trading times, the systems to clear the trades have to deal with more continuous clearing. DTCC is set to promote the ongoing trade clearance in the future, which is in 2026, to enable the industry to extend its hours. - How do tokenized securities have the best chance of a first big win?

Ans: The first to come normally are tokenized cash-like products and ETFs, which are less complicated to work with and are already commonly deployed to provide collateral and parking liquidity. An example of such a direction is the filing of the TBIL tokenized ETF.