The trends of the Bitcoin market took a sharp downturn on Monday when investors started to sell off their riskier assets due to the imposition of new tariffs by U.S. President Donald Trump.

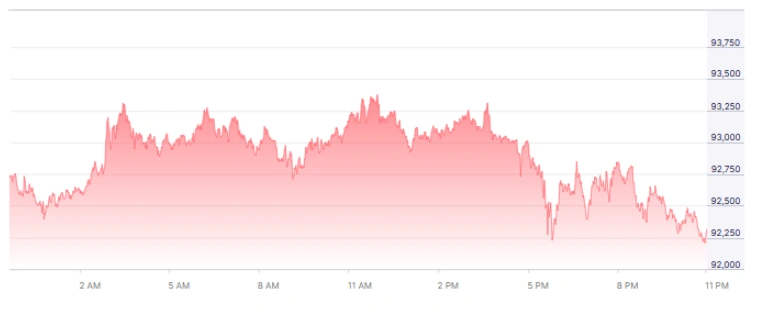

The price of Bitcoin today experienced a dip of up to 3.6% to drop down to below $92,000 during the early hours of trading, which caused a move to sell off more of the digital assets while the safe havens gained. Ether, in the meantime, also faced a drop of 4.9% and Solana, 8.6%, according to the market data, whereas the crypto market as a whole was close to $100 billion less in value based on the figures from CoinGecko.

Bitcoin Share Trend. [Nasdaq]

Why Did Bitcoin Market Trends React To Tariff Fears?

The old-time volatility made its comeback after Trump, on the one hand, was separating the main issue between the U.S. and the E.U. by imposing a 10% tariff on eight European countries’ goods starting on Feb. 1, which will increase to 25% in June unless negotiations over the so-called “purchase of Greenland” get positive and smooth ensuing the protracted issues on the continent.

The announcement caused the U.S. equity-index futures to fall at the open of the week, while gold and silver prices rallied to record high levels, taking part in a quick move towards defensive positioning. The European leaders were very assertive in their opposition and indicated that there might be a further delay in the ratification of the trade agreement signed last year, which added to the uncertainty in the global markets.

Historically, Bitcoin market trends have reacted to macro risk factors such as the tightening of currency flows and rising volatility across equities and commodities. The same old scenario was repeated as the traders took quick actions, leveraged positions were unwound, and liquidity was thinned out on the major exchanges.

Digital Assets Face Broad Risk-Off Pressure

The Bitcoin price today was a clear reflection of the broader retreat from speculative assets as institutional traders re-balanced their portfolios. The liquidation has had a massive impact on total crypto value, which has dropped by around $100 billion, while derivatives markets reported heavy liquidations.

The data from CoinGlass indicated that approximately $790 million in bullish positions were liquidated in the last 24 hours due to the swift momentum shift in prices. Richard Galvin, a hedge fund DACM co-founder, stated that the previous rally was an upward correction from oversold levels caused by tax-loss selling and year-end liquidation. He further explained that the tariff shock disrupted that recovery phase, while gold setting new records was an indication of a general risk-off move rather than a crypto-specific collapse.

Among various crypto assets, Solana was the least performing one, as the high-risk tokens were subject to even deeper selling pressure. Ether was very closely following Bitcoin but remained prone to macro-driven movements. The short-term sentiment is still cautious as traders are waiting for better trade negotiations and possible policy responses to be clear.

Liquidations accelerated as leveraged traders exited long positions. [iPlaeaders Blog]

Liquidations accelerated as leveraged traders exited long positions. [iPlaeaders Blog]

Can Institutional Demand Stabilise Bitcoin Market Trends?

Analysts are still tracking institutional demand as potential downside support, even though there was a sharp pullback. Bitcoin skyrocketed to nearly $98,000 on January 14th as a result of great inflows into funds traded on US exchanges.

Those inflows were telling us that there was a consistent interest coming from long-term allocators who were diversifying their portfolios and hedging against inflation. Rachael Lucas, an analyst at BTC Markets, said that the $90,000 level is a key psychological level if the current support is broken, but institutional buying could help maintain a price floor.

Market trends for Bitcoin usually stabilise after the leveraged trades have cleared, although the volatility might continue until there is less macro uncertainty. As traders were re-evaluating their positioning and risk appetite for the short term, Bitcoin was being traded at $92,531 at 6:27 a.m. in London.

ETF inflows previously supported price resilience during January’s rally. [Markets.com]

ETF inflows previously supported price resilience during January’s rally. [Markets.com]

What Does BTC Price Analysis January 2026 Signal?

The price analysis for BTC in January 2026 points to the market being very sensitive to geopolitical news, currency changes, and commodity price fluctuations. The simultaneous strengthening of demand from havens and the shrinking of equities usually puts a burden on crypto inflows, especially among traders who follow the momentum.

The short-term technicals show that there are very tight liquidity zones of $90,000 and $95,000, which could result in sharp intraday swings. Participants in the market are careful as the tariff negotiations are taking place, and the central banks are watching the inflation expectations closely.

The trends in the Bitcoin market may remain within a range until the issue of trade policy direction gets clarified and the sentiment towards risk in the wider market stabilises.

Investors Watch Macro Signals And Liquidity Conditions

The factors of liquidity depth, derivatives funding rates, and ETF inflows will be the ones that decide the near-term price discovery. Gold and silver movements are still being followed by traders as the leading indicathttps://crafmin.com/bitcoin-market-trends-slide-below-9/ors for capital rotation.

The price of Bitcoin today shows that there is a very thin balance between the institutional buyers and the global portfolios that are selling off due to macroeconomic factors.

Also Read: US Senate Delays Crypto Legislation 2026 After Major Opposition

FAQs

Q1: Why did Bitcoin fall below $92,000?

A1: Bitcoin declined after tariff threats increased risk aversion and triggered heavy liquidations across crypto markets.

Q2: What level are traders watching next?

A2: Analysts identify $90,000 as the next key support if current levels fail.

Q3: Are institutional investors still buying Bitcoin?

A3: ETF inflows earlier in January showed strong institutional demand, which could support prices during volatility.

Q4: How does the BTC price analysis for January 2026 look?

A4: The outlook remains volatile with strong sensitivity to macro risks, trade policy shifts, and liquidity conditions.

Disclaimer