The silent change is occurring in the checkout.

Crypto is not screaming anymore.

It’s tapping cards.

Subtlety in change is becoming a momentum in fintech, payments, and digital assets. Stablecoin payment cards are no longer an experiment in the niche, but rather the tools utilised by people in practice. Not to trade. Not to speculate. To pay.

Coffee. Flights. Software subscriptions. Supplier invoices.

This change is important because it addresses the most critical, long-standing issue that crypto has: usability. Volatility terrified routine expenses. Sophisticated wallets disoriented novices. Merchants stayed cautious.

Constant change of stablecoin cards makes the difference.

They introduce blockchain money in a form familiar to the world – cards, terminals, taps, and instant settlement.

And going into 2026, the tide is rushing.

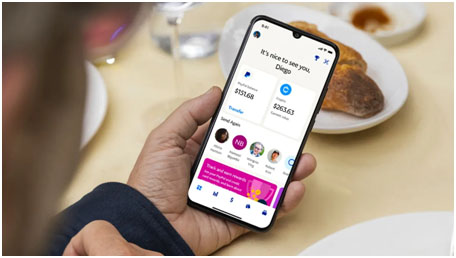

From speculation to spending: crypto goes contactless. (Image Source: Payments Dive)

What Are Stablecoin Payment Cards, and What Are They?

A stablecoin payment card is similar to a normal debit or prepaid card. The disparity is in the background.

The card uses a wallet that houses stablecoins, typically USDC or USDT, which withdraws the money without drawing it from a bank account. Once a user taps the card, the stablecoins are immediately changed to local currency at the point of sale.

It is normal for the merchant. To the user, it feels familiar. To blockchain, it is a physical transaction.

It is the breakthrough of that simplicity.

There is no movement of prices in the middle of the deal. No embarrassing accounts on checkout. Merchants would not have to take crypto.

The rails stay the same. The money changes.

Familiar cards. New financial rails. (Image Source: Transak)

The Reason Why Stablecoins Are at the Core of This Trend

Bitcoin is not constructed in groceries. Ether isn’t ideal for rent.

Stablecoins are.

They are kept constant, normally pegged to the US dollar. The psychological barrier to crypto spending is eliminated by that stability. People don’t hesitate. Businesses can plan. Accountants can reconcile.

On-chain transactions volume is already controlled by stablecoins. Speculation is surpassed by payments in a number of regions. What’s missing isn’t demand. It’s access.

The gap is bridged by payment cards.

They enable stablecoins not only to act as assets but also to act as money. It is that difference that makes stablecoins the infrastructure, and not the experiment of payment companies, fintech startups, and even traditional players in the financial sector.

Why 2026 Appears to Be the Tipping Point

This isn’t a distant forecast. The preconditions are already established.

Several forces coincide:

Infrastructure on payments is in place. Blockchain rails have now been integrated with card networks, processors, and APIs through methods of easy integration. The conversion takes place within milliseconds. There are compliance layers, which lie in the background.

The regulation is not falling but is becoming clear. Regulators use stablecoins as payment instruments instead of banning them outright. Stricter regulations also provide businesses with the assurance to scale.

Cards are already trusted by consumers. People don’t need education. They are already equipped on how to tap and pay. There is no change in behaviour and only a change in the source of funding.

Organisations desire expedited payment. Stablecoin rails decrease delays, charges, and cross-border tensions. In the case of international firms, ideology is not as important as efficiency.

This is a combination that by 2026, stablecoin cards will not justbe interesting but will be necessary.

The Reasons This Trend Is So Appealing to Crypto Natives

Crypto speaks to itself a lot.

Stablecoin cards don’t.

They attract individuals who are not concerned with wallets, chains, and gas bills. They are concerned with speed, price, and convenience.

That includes:

- The freelancers are paid with stablecoins.

- Currency remote teams.

- Companies with a presence in more than one location.

- Travellers would save on exchange charges.

- The developing economies avoid fluctuating national currencies.

To such users, stablecoin cards are not futuristic. They’re practical.

Such expediency is much more motivating to adoption than hype could be.

The Actual Value: Perfectly Smooth International Payments

Cross-border transaction is still slow and costly. Conventional systems continue to be based on third parties, banking time, and non-transparent charges.

Stablecoin cards level that complexity.

The Australian company makes a payment to a supplier in Southeast Asia. Funds move instantly. Value remains stable. Delays are not allowed; settlement clears.

The card is the last thing, not the choke.

The efficiency is not optional for companies that have international operations. It’s a competitive advantage.

Why Business Owners Hardly Mind: That’s the Thing

The best-performing payment technologies fade into the shadows.

Stablecoin cards actually do so.

New terminals are not necessary for merchants. They don’t hold crypto. They don’t manage wallets. They are paidin the local currency normally.

This invisibility matters. It removes resistance. It avoids retraining. It keeps operations smooth.

Crypto ultimately becomes integrated without permission.

The Difference Between the Stablecoin Cards and the Older Crypto Cards

Crypto cards aren’t new. Their limitations are.

The previous versions were dependent on volatile assets. When there was a fluctuation in prices, users were hesitant to spend. The use was complicated by tax implications. Friction was caused by settlement delays.

The weaknesses are remedied by the use of stablecoin cards.

They do not concentrate on speculation, but on spending. They act in a way that favours predictability instead of upside. They are in line with the real working of money.

That change in design philosophy is the reason why adoption will gain more pace now than it did before.

Old crypto cards are chased upside down. Stablecoin cards focus on spending.

Where Adoption Is Quickest at the Moment

Momentum focuses on certain applications:

Home working and online services. Stablecoin cards enable workers to spend their income immediately without transferring money via the banks.

Travel and foreign expenditure. Users save on the exchange fees and still have the price certainty.

Small and medium businesses. Companies receive international payments without elaborate systems.

Emerging markets. In places where local currencies are failing, stablecoins provide some stability.

These aren’t edge cases. They’re everyday scenarios.

The Significance of This to the Future of Money

Stablecoin payment cards do not overthrow banks in the short run. They reconfigure the circulation of money in the periphery.

They obscure the definitions between crypto and fiat. They sanction a value that is blockchain-supported. They bring control nearer to the users.

This change does not make headlines. It arrives with habits.

People tap. Payments clear. Life moves on.

That is the actual adoption.

Who Drives the Trend (and Why It Is Important)?

The emergence of the stablecoin-based payment cards is not a coincidence. There are one or two traditional and blockchain-native players driving innovation.

Cryptocurrency platforms which have an edge. Other digital asset firms have developed payment card programmes which have connected wallets to card-ready balances. These services tend to facilitate stablecoin spending; however, they are currently shifting their focus to stablecoin-first offerings.

Why it matters: Crypto is already known to these firms by their users. It is only natural that they should be transferred into real-life expenditure, rather than a marketing slogan.

Fintech challengers and neobanks. Banks that are digital with loose tech stacks are incorporating stablecoin rails to cut down on the cross-border payments expenses and introduce new functionality. They consider the stablecoin cards as a competitive advantage and not an experiment.

Why this matters: Traditional banks move slowly. Fintechs move fast. That would imply that consumers could be exposed to useful stablecoin cards before traditional institutions could respond.

Payment platforms and processors. Visa, Mastercard and other major payment processors are not retreating. Instead, they are experimenting with the incorporation of stablecoin rails and the current ecosystem, combining the convenience of crypto with the ability to spend globally.

Why this matters: With the entry of payment giants, the rate of adoption increases at a much faster pace, not as a niche use case, but as a mainstream payment method.

Regulation: Transparency Developing Trust in 2026

Regulatory systems change behaviour – without much ado. The narrative of stablecoin payment will be characterised less by fear and more by organisation in 2026.

Australia and payment-oriented clarity. Australian regulators are considering stablecoin issuers as payment service providers more frequently. That means:

- Definite issuer obligations.

- Consumer protections

- Certainty in regulation for operators.

Such an arrangement appeals to firms that are ready to innovate without having to break the law.

The global, US and EU systems. Stablecoins are considered functional tools and are not speculative by trade and payment regulators across the globe. Whereas the types of rules vary depending on the jurisdiction, the general direction is that the steps to take are framework first, restriction later, rather than express bans.

Why is it important that the users are regulated? Clarity does three things:

- Reduces risk for providers

- Builds consumer confidence

- Promotes the investment in stablecoin infrastructure.

Innovation does not scatter, but focuses when it has clear signals from regulators.

Stablecoin payments grow where rules are clear.

Still Significant Risks, and the Way They Are Addressed in the Market

No trend is risk-free to talk of. However, the dangers of stablecoin payment cards are not insurmountable and evident.

Volatility risk. In extreme markets, stablecoins may de-peg. However, numerous cards rely on supported reserves and risk-management technology to ensure the balance to spend.

How the market mitigates: Providers collaborate with several issuers of stablecoins and provide conversion buffers to ensure that the balances of users are reliable when making payments.

Regulatory uncertainty: Various nations adopt varying positions. An Australian card might require adjustments in Europe or Asia.

How the market mitigates: Active compliance layers and alliances with licensed banks contribute to international implementation.

Custody and security Attacks on crypto wallets occur. There is an extra factor that payment cards introduce – but another reason to increase security.

How the market mitigates: There is multi-factor authentication, smart cards, custodial protection, and an insurance overlay that mitigate user risk.

Merchant adoption friction: Merchants do not embrace anything that appears crypto. However, stablecoin cards do not make merchants accept crypto, but only local currency.

The result: Friction is down. Acceptance goes up. Integration is a matter of no issue.

Some Misconceptions Are Worth Clearing Up

These fables tend to retard perception:

Stablecoin cards are a mere sham. Wrong. They aren’t about hype. They have to do with a friction solution.

“Only crypto traders care” Not true. Citizens earning, spending, travelling or being paid across borders gain instantly.

Cryptos must be accepted by merchants. Not at all. Local currency – just like a bank card, in the view of merchants.

Knowing these facts makes readers (both knowledgeable and amateur) look beyond all the hype and perceive real value.

Real Life Examples of the Use of Stablecoin Cards

Cryptopaid freelancers have finally stopped converting before spending their money. The graphic designer’s salary in Melbourne is paid in USDC. She does not spend the money on converting it to AUD at a fee, but connects to a stablecoin card. Her daily shopping is carried out without being held up by the bank and is carried out with minimal charges.

Customers who save on currency transfer fees. A software developer has three months in a foreign country based in Sydney. Using a stablecoin card, he would not need to pay bank forex fees and is open to visible conversion.

A small business that handles cross-border payments of suppliers. The product company pays international suppliers. Stablecoin card supports payment timing and limits the FX risk.

These tales are the ones experienced by the people in the current world and not in the future.

The Place of Stablecoin Cards in the Wider Financial Behaviour

It is not only the transition to crypto. It is the changing of money ways.

Consumers are growing fond of online, cross-border payments. The new generations have become familiar with digital assets. International business demands instant payment.

The payment cards based on stablecoins are on the edge of these trends: Ease of use + reliability + international access.

The combination of those three is not commonplace–and effective.

How It Will Work in 2026 to Common Users

Stablecoin payment cards transform the user experience in such a manner that people notice it instantly:

Faster settlement. Contrary to the days that some corridors take to process bank payments, it only takes a matter of seconds to settle a payment made using a stablecoin.

Lower fees. Users would not have to go through layers of bank charges, foreign exchange markup costs and intermediary charges.

Experience in making payments. Swipes, taps and contactless payments are as successful as they are expected to be.

Increased financial availability. Individuals in the nations that have minimal access to banking can still access digital payment rails.

It is these advantages that make adoption not a theoretical belief, but it is taking place.

The Direction in Which the Trend Can Take in the Future After 2026

Combination with digital identities. Cryptocurrencies and digital identity requirements might accelerate the onboarding process.

Cryptocurrency loyalty and rewards. Stablecoin cards can provide benefit cash back and programme rewards in a crypto-native format and across borders.

Merchant incentives. Companies may utilise dynamic pricing, settlement options or automation based on blockchain rails.

IoT payments and machine-to-machine expenditure. Automatic payment of cars, vending machines, metered services and smart devices may come in the future through stablecoin cards.

All these paths are the result of one understanding: Stablecoin cards combine crypto versatility and practicality.

Also Read: Cryptocurrency Trends: Stablecoins May Replace Bitcoin Utility

The Break We Were Waiting For

Stablecoin payment cards are not dystopian fantasy. They are a new reality that has feasible consequences.

In 2026, there is no blurred line between crypto and traditional money; there is a convergence that people experience when they spend, travel, pay, and run a business.

It is not the trend of crypto overthrowing banks. It is regarding crypto and making money more efficient, stable and borderless.

And when money is made more convenient to utilise, it takes notice of the world.

Closing Thought

Stablecoin payment cards are not a trend.

They are a postulate regarding the future of finance – where value flows as naturally as data does today.

It is possible that the next time a person taps a card, he or she will not think of blockchain. But they will know the difference.

Frequently Asked Questions (FAQs)

- Are stablecoin payment cards safe?

Ans: Providers apply the same security standards used by traditional cards, including fraud monitoring, transaction limits, and spending controls. In addition, crypto wallets often provide extra security layers such as multi-factor authentication and real-time alerts. - Do merchants have to accept crypto to use stablecoin cards?

Ans: Merchants receive payments in local currency. The crypto component operates entirely in the background and remains invisible to the merchant. - Is it legal to use stablecoin payment cards in Australia?

Ans: Existing regulatory structures allow compliant providers to operate, especially when stablecoins are used as payment tools rather than investment products. - Are stablecoin payment cards offline-enabled?

Ans: They rely on conventional card networks, meaning they function the same way as standard debit or credit cards within the existing payment infrastructure. - Does a user need a crypto wallet to use a stablecoin card?

Ans: However, modern integrations simplify the experience so the wallet operates seamlessly in the background. - Do banks offer stablecoin payment cards?

Ans: Some banks are already experimenting with crypto payment rails. However, fintech companies and neobanks are more likely to adopt stablecoin cards first, with traditional banks following later. - Are cryptocurrency debit cards better than stablecoin payment cards?

Ans: Not for everyday spending. Stablecoin cards prioritise price stability and practical use, whereas crypto debit cards expose users to asset volatility. For daily transactions, this distinction matters. - Are stablecoin cards stored inside a crypto wallet?

Ans: In most cases, yes. That said, modern solutions are designed so that the wallet layer is barely noticeable to the user. - Are transactions made with stablecoin cards traceable?

Ans: Blockchain provides transaction transparency, while privacy safeguards and compliance layers help protect sensitive personal information.