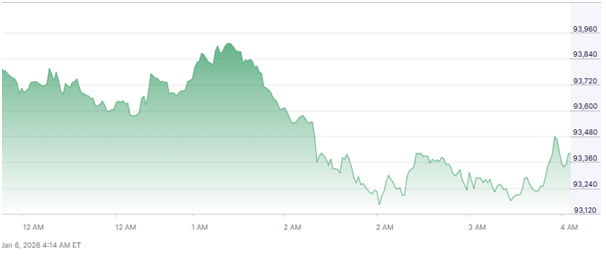

The cryptocurrency market commenced 2026 with a strong comeback, and the price of Bitcoin rose to $95,000, attracting traders all over the world. This action indicates that the digital assets are gradually becoming more attractive, but at the same time, their conviction is still mixed.

Investors are monitoring the Bitcoin price hike to see if it will be a breakthrough that lasts or just a fade into consolidation. The increase in Bitcoin price is in line with the return of the risk appetite in the global markets.

Early positioning by traders has aided the price movement, but the level of participation indicates that it is a selective engagement. Those watching the market agree that there is enthusiasm, but the sale of aggressive buying is still limited.

Bitcoin’s Rally Revives Optimism Across Crypto Markets. [Source: Mint]

What Is Driving Bitcoin’s Latest Price Momentum?

The factors that contributed to the rise of Bitcoin to the $95,000 mark are short-term in nature. The options market has witnessed a shift towards bullish positioning, which speaks of expectations of higher prices.

The improved liquidity conditions have also played a part in the Bitcoin price having a near-term upward trend. However, the futures open interest has not been a significant one, which means that the leverage used is still under control.

In fact, this is the reason why traders are behaving tentatively and cautiously rather than being committed to one side. Hence, the momentum might die down without stronger participation.

Why Are Traders Still Exercising Caution?

Though Bitcoin reached the $95,000 mark, analysts issued a warning that confirmation is still lacking. The volumes in the spot market are not going up as fast as the price surge. This discrepancy indicates that the long-term investors might be sitting on the sidelines and waiting for more explicit signals before putting their money in.

In the past, prolonged price increases depended on continuous demand in the spot market rather than being fed by derivatives. Without such backing, price increases are prone to reversals. Consequently, the traders are staying alert to any indications of weakening momentum.

Spot Market Demand Lags Behind Price Strength. [Source: Nasdaq]

How Does Bitcoin’s Move Fit Broader Crypto Trends?

Bitcoin’s ascending path corresponds to the rise in the overall cryptocurrency market. The significant digital currencies have recorded growth as well, thus confirming the recovery story of the market.

Now the total crypto market capitalisation has gone beyond $3 trillion, showing that there is a resurgence of interest from investors. Nevertheless, the technical resistance is still very much present. The area between $95,000 and $100,000 is very important. A clear breakout above this level can mean the start of a new bullish cycle.

What Signals Could Confirm The Next Breakout?

The traders are monitoring a number of indicators that will help them decide if the rally can go on. If there is continued growth in the spot volume, it will be a signal that the market can be trusted more. The increased participation of the institutions will also be a factor contributing to the bullish expectations.

The macroeconomic issues may also influence this matter. If there is a change in the expectations regarding the monetary policy or if there is a stronger inflow into crypto investment products, these may together offer more support. But until then, the main concern will be the stability of the price.

Confirmation Levels Will Shape Bitcoin’s Near-Term Direction. [Source: Finance Magnates]

Will Bitcoin Sustain Momentum Above $95,000?

The views of the market players regarding the short-term prospects of Bitcoin are still split. Some traders think that there will be a period of consolidation during which profits earned by the traders will be digested. Others think that continuous accumulation can lead to another upward movement.

If the price of Bitcoin stays above the current level, it might result in an even more positive sentiment. On the other hand, the failure to keep up the momentum could trigger another round of volatility. At this time, the Bitcoin trading insights indicate that patience is the primary strategy.

Also Read: Will Bitcoin Go Above $100,000 in 2026? Key Scenarios Unveiled

FAQs

Q1. What does Bitcoin hitting $95,000 indicate for the market?

A1: It signals strong short-term momentum but does not confirm a long-term breakout.

Q2. Is the current Bitcoin price move sustainable?

A2: Sustainability depends on stronger spot demand and broader market participation.

Q3. What resistance level matters most next?

A3: The $100,000 level is widely viewed as the next major psychological barrier.

Q4. Should traders expect higher volatility?

A4: Yes. Volatility often increases near major resistance zones like $95,000.