Hype is no longer sought in the crypto market. It is chasing structure. Coinbase, currently one of the most powerful digital currency exchanges in the world, has a well-defined view on where it thinks the next wave of influence will emerge. The shift is not coming from meme coins or laboring speculation, but from industries that develop the rails of the digital finance future. (CoinDesk)

Capital flows are transforming at the moment. Institutional actors are acting intentionally, while retail investors are increasingly becoming discriminating. Builders are switching the emphasis from sound to utility. The recent perspective from Coinbase indicates three crypto sectors that are the most promising to take over the market by the year 2026. This is not a far-off prophecy; it is a mirror of what is being done on-chain, in venture funding, and in global adoption today.

For investors, this is significant. The following step in crypto development will not receive attention in the first place; it will reward positioning.

Crypto is moving beyond hype, with Coinbase highlighting real-world sectors shaping the future of digital finance. (Image Source: CoinGape)

The Macro Level: Crypto Matures

Crypto is in a maturity phase. Still, the market is volatile, yet it no longer reacts to panic as much as to fundamentals. Projects that have poor use cases do not survive, while solutions to real problems still bring capital, users, and developers.

The thesis of Coinbase is congruent with this fact. It does not look at individual tokens, but instead expands to sectors that are the foundations of the whole ecosystem. These industries have three characteristics in common:

- Real-world utility

- Strong developer activity

- Increasing institutional concern

These are the staples of the next generation of crypto growth.

Sector One: Blockchain Infrastructure and Layer 2 Networks

If crypto were a city, infrastructure would be the roads, power lines, and transport systems. Nothing moves without it. Coinbase is confident that blockchain infrastructure, or Layer 2 networks, will take over due to its ability to address the most intractable crypto issues: speed, cost, and scalability.

At this moment, users desire quicker transactions and lower expenses. Developers desire solid platforms to develop, and institutions desire networks that may be loaded with volume. That is what Layer 2 solutions provide. They are placed above the big blockchains, such as Ethereum, and are more efficient in transactions, helping to reduce congestion while remaining secure. This is not a theoretical advancement; it is happening live.

Layer 2 networks are increasing in terms of daily transaction volumes. Applications are being deployed by developers at an unprecedented rate. These networks are becoming more connected with users without their explicit understanding of the underlying tech. The fact that the technology is becoming invisible is a mark of maturation.

Why is Infrastructure Picking Up Momentum Today?

Infrastructure was once a drab affair, but now it is essential. Some forces are contributing to this change:

- Increasing User Expectations: Users anticipate blockchain applications to be as comfortable and seamless as regular platforms.

- Institutional Demand: Large financial entities require predictable performance and stable transaction costs.

- Regulatory Transparency: More transparent regulations are better suited to strong, foundational networks.

Consequently, capital is being invested in projects that reinforce the foundation rather than pursue headlines. Infrastructure provides investors with something uncommon in crypto: longevity.

The Implication for Investors

Development of infrastructure projects is a gradual process that does not happen all at once. That is enticing to long-term investors. These networks regularly generate income in the form of transaction fees, staking, or enterprise partnerships. They increase in value as their use throughout the ecosystem increases.

Investors get exposure to everything built on the network rather than a single isolated app. That puts infrastructure as one of the most strategic plays in the present market cycle.

Sector Two: DeFi 2.0 and Tokenization of Real World Assets

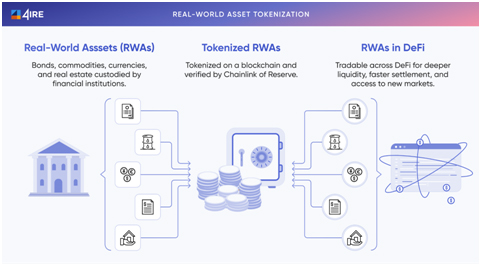

Decentralized finance is being developed further. The early stage was a time of experimentation, but the second stage is geared towards integration. Coinbase views DeFi 2.0, and in particular the tokenization of real-world assets, as one of its key growth factors by 2026.

The concept of tokenization converts real or tangible financial resources into tokens on the blockchain. These include property, bonds, commodities, invoices, and even carbon credits. The impact is profound. Illiquid assets are converted into tradeables, global access expands, and settlement times are reduced to minutes. Trust is shifted from the middlemen to the code.

DeFi is entering its next phase, with Coinbase highlighting real-world asset tokenisation as a key driver of growth toward 2026. (Image Source: 4IRE Labs)

The Reason Tokenization is Going Viral

Several trends are colliding to drive tokenization:

- Institutional Adoption: Banks and asset managers desire efficiency without compromising on compliance.

- Regulatory Cooperation: Structures are emerging rather than outright prohibitions.

- Yield Beyond Speculation: Shareholders want to earn more than just speculative gains; tokenized assets provide predictable returns.

DeFi is no longer simply about trading tokens. It is turning out to be a connector between old-fashioned finance and blockchain infrastructure. Such a bridge opens trillions of dollars in potential value.

Application in the Real World is Increasing

This change is already evident. Institutional capital is attracted to tokenized treasury products. Real-world collateral is incorporated into on-chain lending platforms, and asset-backed instruments are stored in decentralized exchanges. These changes introduce sanity into a market characterized by extremes. To normal users, it translates to access. For institutions, it implies efficiency. It is a sign that DeFi is no longer an experiment, but an industry.

What This Implies for Investors

DeFi 2.0 provides an incentive to wait and learn. Real-world asset projects are usually concerned with compliance, security, and transparency. The growth might seem less rapid, but it is more sustainable. Rather than pursuing volatile yields, investors get exposure to systems that replicate traditional finance but improve upon it. It is at this point where crypto starts competing not against itself, but against traditional financial infrastructure.

Sector Three: Web3 Applications and Digital Ownership

Web3 is about control: control over data, identity, and value. Coinbase points to Web3 applicationssuch as decentralized identity, creator platforms, and digital ownership toolsas sectors set to take over. This is not about speculation; it is about user behavior. Individuals spend more time on the internet than ever, yet what they produce and use is hardly theirs. Web3 changes that dynamic.

The Reason Why Web3 Adoption is Picking Up

The transition is subtle yet strong. Customers are seeking openness, producers desire just remuneration, and communities desire ownership rather than reliance on centralized systems. Web3 solutions react by providing:

- User-owned identities

- Creator-driven economies

- Token-based governance

With these tools, users have a vested interest in the platforms they use. This feeling of ownership creates loyalty, toughness, and permanence.

The Role Of NFTs is Changing

NFTs are taking a new turn beyond digital art. They have now become symbols of access, credentials, memberships, and intellectual property. They are used by brands to build relationships and by musicians to monetize content directly. Developers use them to control digital rights. This development fits into the perspective of Coinbase; Web3 is a rearrangement of the flow of value on the Internet.

Implications For Investors

Web3 investments reward those who look beyond the charts. Successful projects resolve human issues: identity, trust, community, and compensation. Investors interested in platforms with active users, robust ecosystems, and well-defined revenue models will benefit as these platforms gain traction.

Web3 puts control back in users’ hands, with Coinbase highlighting it as a key driver of the next digital economy. (Image Source: Digital Currency Traders)

The Black Box Accelerator: AI and Blockchain Integration

Artificial intelligence is not just a crypto buzzword; it is a catalyst. When added to blockchain technology, AI improves:

- Predictive analytics

- Smart contract optimization

- Market sentiment detection

- Decentralized decision-making

This alliance provides crypto systems with an added advantage of agility and flexibility. This is important since crypto markets are becoming more data-driven as opposed to being purely speculative. Consider AI as the roadmap of blockchain systems. Without it, networks lack a sense of context. With it, they are made smarter and more efficient. Automated risk modeling can identify suspicious behavior in DeFi, and AI-driven oracles make information fed on-chain more reliable.

AI is powering smarter, more efficient blockchain systems as crypto becomes data-driven. (Image Source: LinkedIn)

New Subtrend: On-Chain Data Analytics

Crypto is transparency-rich. Anything occurring within the blockchain is transparent, verifiable, and measurable. This provides a market for on-chain analytics toolsplatforms that transform raw blockchain information into valuable insight. Institutions and sophisticated traders now demand metrics for network usage, liquidity flows, wallet behavior, and smart contract performance. These instruments show real-time capital flows, shifting decision-making from gut feel to data-driven strategy.

The Difference Between Layer 1 and Layer 2

The relationship between Layer 1 and Layer 2 will characterize market dynamics in 2026. The base ledger is found on Layer 1 blockchains, such as Ethereum, while solutions at Layer 2 enhance that ledger’s performance.

Imagine a highway: Layer 1 is the main road, and Layer 2 is the express lane, which reduces congestion. The two complement each other; Layer 2 growth is advantageous to Layer 1 ecosystems, and the success of Layer 2 indicates general network adoption. Investors should avoid the false dichotomy of believing they must choose one over the other.

Evaluating DeFi 2.0 Projects: What Counts

Not every DeFi 2.0 project is equal. Investors should consider:

- Regulatory Foresight: Projects that proactively embrace compliance are positioned for longevity.

- Real World Asset Partnerships: A close partnership with established finance organizations implies utility and reduces execution risk.

- Security and Audit History: Stringent auditing and bug bounty schemes safeguard investor capital.

- Liquidity Quality: High liquidity allows for easy entry and exit, which is crucial for risk management.

Also Read: Bitcoin Price Drop Sparks Volatility Across Crypto Assets

Web3 Applications: More Than the Hype

Web3 addresses the practical deficiency of ownership in the Web2 world. In the contemporary digital economy, platforms own user data and algorithms decide reach. Web3 reverses this by placing value in the hands of users and creators. This basic change gives rise to sustained participation, and engagement fuels value.

How Investors Can Position Themselves

To begin, investors can use the following practical framework:

- Diversify Your Portfolio By Sector: Do not focus on a single token. Allocate across infrastructure, DeFi, real-world assets, and Web3 builders.

- Act On Data, Not FOMO: Monitor on-chain activity, developer activity, and adoption rates rather than social media noise.

- Precedence to Use Cases: Invest in tokens with protocol utility, network participation, and real-world integration.

- Track Regulatory Trends: Clearer legal environments often lead to larger institutional inflows.

- Learn and Adapt: Crypto evolves rapidly; remain open-minded but patient.

Key Risks to Consider

Growth potential never eliminates risk. Realities to face include:

- Volatility: Even powerful industries have sharp swings.

- Regulatory Changes: Rapid re-pricing can be caused by sudden shifts in the legal landscape.

- Adoption Hurdles: Technology does not guarantee mainstream success; user behavior and utility are what matter.

- Security Exploits: Vigilance and due diligence remain essential as systems evolve.

Conclusion: A Structural and Not Speculative Future

The future of crypto in 2026 will not be characterized by random booms, but by intentional development. The transition from price-chasing to value-building represents a transformation from noise to meaningful networks. For investors, it is time to align with systems that scale, solve problems, and serve users. The next generation of leaders will be decided by the extent to which they are integrated into the actual world.

Frequently Asked Questions

- What impact does Coinbase’s outlook have?

Ans: Coinbase sits at the intersection of institutional and retail crypto markets, so its outlook reflects real capital flows rather than short-term speculation. - Are these sectors suitable for beginners?

Ans: Yes. Although technical, they are grounded in fundamentals, making them easier to understand over time with proper research. - Does this mean Bitcoin and Ethereum are less important?

Ans: No. Bitcoin and Ethereum remain foundational and support many of the sectors Coinbase highlights, especially infrastructure and DeFi. - Is 2026 too far away to start planning now?

Ans: No. In crypto, early positioning often matters more than trying to time the market perfectly. - Are NFTs still relevant?

Ans: Yes. Their role has expanded beyond art into identity, memberships, credentials, and access rights. - Will institutional investors dominate crypto?

Ans: Institutions are increasing their involvement where frameworks support compliance, stability, and predictability. - How long should investors hold these trends?

Ans: Long enough to see structural adoption, which is usually measured in years, not weeks.