A Smooth Hack Strikes Confidence

On November 30, 2025, traders and liquidity pool observers immediately noticed something fishy: unusual token activity in a yearn-owned vault. In a single, ominous-looking transaction that took place at 21:11 UTC, a malicious actor managed to “mint” a virtually infinite unit of yETH, which represents a ‘basket’ of several liquid-staked Ether derivatives, before exchanging them for real assets. What exactly happened? About USD 9 million was stolen from Yearn’s stable ‘stableswaps’ pool, as well as its yEH-WETH pool.

According to reports, the attacker managed to transfer at least 1,000 ETH (approximately US$3 million) through the mixing service Tornado Cash soon after the exploit.

In this regard, Yearn was quick to clarify that the exploit was found in the legacy yETH, but not in its main V2 or V3.

Nevertheless, this vulnerability raises pressing concerns regarding the security of complex DeFi protocols, as well as the robustness of their corresponding smart contracts. (cryptopotato)

Yearn’s legacy yETH was hacked for $9M, revealing risks in complex DeFi contracts. (Image Source: Blocktunix)

What Is yETH And Why Did This Happen?

yETH is more than a mere token. Rather, yETH is a packaged investment in several liquid-staked ETH derivatives, so-called LSTs. Essentially, individuals who hold yETH hold a stake in a portfolio of LSTs.

However, behind the scenes, the yETH pool was operating with a customized version of “stable swap” logic, as opposed to the conventional, battle-tested implementation that most popular pool contracts use. This customized implementation contained a mathematical glitch in its minting process. When this was triggered, the contract enabled users to mint ridiculous amounts of yETH, in the hundreds of trillions, within a single transaction.

Having the fake yETH, the attacker withdrew real ETH along with liquid staking derivatives from linked liquidity pools on Balancer as well as Curve within minutes.

In technical terms, this can be classified as an “infinite-mint” attack, which is a traditional vulnerability within smart contracts, as well as being complicated through non-standard code associated with derivative staking products. (banklesstimes)

Fallout: Money Lost, Trust Eroded

- The first effect is financial. Nearly USD 9 million was missing from the pool, with a minimum of 1,000 ETH that likely passed through Tornado Cash, which is effectively lost.

- More broadly, the exploit calls into question the robustness of DeFi protocols that employ intricate vault logic, customized swaps, and composite assets, particularly if such contracts reside outside of the most audited elements of the infrastructure.

- The users and the investment community are left with a new question: What might this mean for other protocols that have customized code or derivative-based products, if such a ‘legacy’ agreement was so aggressively exploited?

Indeed, for many, the yETH incident is a warning, or maybe even the loudest warning, that the pace of innovation that DeFi is falling behind on safety.

Just took some time checking the $9M @yearnfi yeth attack. While most people points out that the hacker minted a huge amount of yeth with a few wei of tokens (P1), I think this is not the only root cause.

The reason? The hacker actually DID NOT withdraw the minted yeth, only… pic.twitter.com/OEiXScWVS4

— Weilin (William) Li (@hklst4r) December 1, 2025

Context: Not The First Time, And Perhaps Not The Last

This isn’t the first security issue that’s arisen for Yearn. Previous issues with the protocol mean that even veteran participants aren’t safe from smart contract issues.

However, the case that differs significantly is the 2025 yETH exploit, as this vulnerability was not caused by a mere error or sudden market volatility, but was, in fact, a deep flaw that existed as a weakness in custom code, awaiting the right trigger that would uncover it. Thus, it seems remarkably similar to other severe DeFi bugs that existed in both 2024 and 2025, as mentioned in arXiv.

More recent scholarly literature refers to the relevant structural issue: many real-world failures do not stem from isolated bugs, but from so-called “exploit chains” that consist of “protocol design issues, external dependencies, governance issues, traditional implementation bugs, or some combination of the above”.

The yETH hack is no exception. On one side, this is a programming error (infinite-mint vulnerability). On the other, this is a design choice: to incorporate LSTs within a so-called composite token, with non-standard swap patterns, tied up with several other external pools.

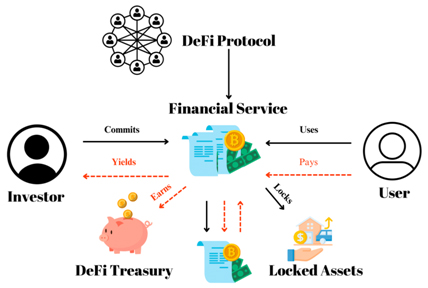

The Human Side: What This Means For Users

Think of yourself as a regular DeFi user. You deposited ETH or liquid-staked ETH because you were hoping for yield, diversification, or you may have diversified your assets so that you invested them across multiple protocols. You believe that protocols such as Yearn conduct security Audits.

This exploit breaks that faith. Suddenly, even traditional pools, resting quietly in the wings, awaiting any kind of active upkeep, begin to resemble landmines. Your money can be ‘locked down’ in a ‘stable’ agreement that secretly harbors a deficiency merely waiting for ‘the wrong trigger.’

Even “stable” DeFi pools can hide risks, putting user funds in danger. (Image Source: MDPI)

What The Recovery Effort Looks Like

However, to its credit, Yearn was quick in its response. It identified the exploit within hours, reported it publicly, and began the process of recovery. Teamwork with other outside developers, such as Plume and Dinero, helped the protocol recover 857.49 pxETH, worth approximately US$2.4 million in today’s value. (theblock)

Although this isn’t the entire cost, this helps show the benefit of decentralised, on-chain finance: its traceability. A benefit of blockchains being public is that law enforcement can trace the movement of the tokens, see who possesses them, and, in some instances, reclaim their value, so long as that value isn’t laundered.

However, many assets remain untraceable. Swapped assets that are passed through services such as Tornado Cash will likely become untraceable, so the person who supplied liquidity will never see payment.

At this stage, however, the yETH pool is shut down, with the dual concern on the part of Yearn, together with auditors, being addressed, and this vulnerability is also being examined, along with other legacy contracts for such issues.

Legacy Code Is A Threat

Many DeFi projects develop over time. Legacy contracts, if unchanged yet still operational, may harbor lurking risks. “Legacy” must be considered as more than harmless.

Smart Contract Dependence: Caution Is Required

Finances on the chain depend on code. This code must be audited again and again, but this may not always be sufficient. Just as recent studies show, most large bugs comprise a chain of weaknesses, as opposed to isolated bugs.

Need For Better Standards & Transparency

Protocols will ideally target modular, standardised, reviewed elements (not bespoke reasoning), especially for widely used derivatives or staking contracts. Transparency concerning active (and audited) contracts is important.

Regulatory & Insurance Implications

With the increase in popularity of DeFi, regulators and insurers may show more interest. Security exploits such as yETH can spark interest in minimum security requirements, audits, or even insurance regulations for cryptocurrencies.

The Anatomy Of Recovery: What Happened Next

After the attack, the on-chain researchers, along with the team behind Yearn, were swift in analyzing the exploit path, freezing the involved pools as much as possible, as well as reclaiming the assets deposited into their control. Yearn announced that pxETH, worth US$2.4 million, had been recovered, with Yearn’s involved contract being a legacy yETH product, excluding its core V2/V3 Vaults.

And this quick assessment is so important. When bugs happen in DeFi, the speed and transparency that matters most is exactly how much value you can save or lose. And the teams that figure out the paths of the transactions, that talk to the exchanges, that provide updates, they prevent confusion, prevent panic. This example illustrates that even if you don’t save everything, quick transparency helps.

Yearn quickly traced the hack and recovered $2.4M, highlighting the value of transparency in DeFi. (Image Source: Yellow.com)

Technical Fixes: Code, Tests, And The “Defensive Programmer” Mindset

- The exploit relies on a preventable set of issues: unchecked math calculations, as well as unexpected Token behavior, within custom implementation paradigms. Below are the specifications that must be adhered to for all protocols.

- Coders should steer clear of bespoke finance primitives if possible. Standard, battle-tested contracts (Curve, Uniswap) don’t appear without purpose. Custom swap or minting code increases risk. When necessary, such functionality must be abstracted behind minimal, well-documented interfaces.

- Formal verification for critical math. Apply formal verification tools or symbolic execution for checking invariants such as value preservation, maximum mintable supply, slippage amounts. Formal verification tools might not be able to detect all issues, but they significantly minimize surface area for arithmetic and rounding errors.

- Scaling property testing. Implement property tests that fuzz input variables, model edge situations as well as combinatorial ones (reentrancy, interaction with fees, self-destruct scenarios). These should run as part of CI with every commit.

- In-chain invariants. Implement a cheap sanity check that will enforce a limit on the mint or swap size. An on-chain circuit breaker can also be added that will prevent minting if there is unusual activity.

- Untouched but upgradable patterns with prudent gatekeepers. When working with proxies, always ensure that upgrade rights are decentralized and conditional. Time-locks, multisig contracts with multiple signers, or governance proposals can limit the risk of centralized control.

- Simulate exploit chains. Attackers chain together multiple weaknesses across protocols. Perform red team exercises that chain together likely exploit steps across external pools and oracles to identify failures in the cascade before they occur.

Such requests would not qualify as exotic, but rather as engineering hygiene adjusted for financial applications. Financial application invariants indicate that variables such as bank accounts must be protected in their own right.

More Effective Audits, But Not Only Once

Audits remain necessary, but as shown in the yETH incident, they are not sufficient on their own.

- Continuous Auditing: Make audits more like subscriptions, not project-based. Perform them after large changes, updates within dependencies, and periodically for existing contracts that remain valuable.

- Auditor Diversity: Different auditors identify different issues. Employ a combination of human audits, automated scanners, and scholarly reviews to cover all bases.

- Public Bug Bounty Upgrades: Increase bounty rewards for high-level contracts and implement a rolling bounty program that includes competitions for exploit simulation. An engaged community can often identify bugs faster than professional auditors.

- Post-Audit Disclosure: Transparency builds credibility. Users benefit from a clear remediation roadmap that shows fixes are underway. Opacity breeds rumor, and rumor breeds speculation, which can jeopardize both trust and law enforcement efforts.

Governance And Operations: Handle Legacy Code As If It Were Hazardous

Legacy contracts that remain operational always pose predictable risks of future losses. Protocols must identify, categorize, and assess all on-chain code, treating legacy elements as hazardous material.

- Implement Sunset Or Deprecate Old Contracts: If a contract is no longer useful, implement functions to migrate assets to new contracts. Old contracts must not silently remain usable.

- Monitoring Dashboards: Maintain dashboards to track unanticipated minting, liquidity changes, and sudden approvals. Notifications should go directly to governance councils and security teams.

- Crisis Multi-Sig And Security Teams: Protocols require well-staffed, responsible teams that can operate seven days a week, either through existing contributors, third-party teams, or hired security personnel.

These operational steps transform passive transparency into active defence.

g26z

The legacy system collapse is the governance flaw where founder incentives are detached from the token’s long-term health, leading to early dumping and unmanaged supply. @AlignerZ_ Protocol mandates Perfect Alignment through code.

—> Flawed Premise: Founder Greed: Founders… pic.twitter.com/ziaKNHCGad

— H B O (@HBO_data) December 2, 2025

Market And Investor Implications: Retail And Institutional

Retail users learned once again that yield does not equate to safety. Institutional clients face a simpler calculation: either operational risk is managed, or capital is not deployed.

- Change in Retail Dynamics: Expect a tempering of indiscriminate yield-seeking. Audited, well-managed, and standardized pools will become more desirable.

- Institutional Onboarding Will Slow Or Shift: Fund managers and custodian banks will demand stronger service-level agreements, third-party insurance, and legal clarity before using DeFi-native products.

- Secondary Market Effects: Protocol tokens may experience sell pressure during incidents, but effective incident management supports recovery. Transparency is increasingly valued in protocol markets.

Market coverage shows how price downturns occur instantaneously during breaches, highlighting the extraordinary impact of vulnerability events on protocols.

DeFi hacks hit trust and adoption, but transparency aids recovery. (Image Source: Research Tree)

Insurance, Standards, And Regulatory Oversight

Tools such as yETH illustrate the slow integration of DeFi with traditional finance.

- DeFi Insurance Transformation: Expect more robust policies, fewer ad-hoc arrangements, and more parametric insurance tied to specific failure modes. Companies will demand proof of continuous audits, multisig safeguards, and operational resilience before obtaining coverage.

- Standards Bodies Formation: Industry consortia, auditors, and academia will develop minimum security standards for staking wrappers, composability, and multisig governance. While non-binding, these standards will be industry-driven, akin to the PCI standard for payments.

- Regulatory Focus: Regulators will increasingly monitor systemic risk and consumer protection. This does not necessarily mean DeFi will be banned, but it may require more transparency, incident reporting, and mandatory custody for firms providing DeFi services. (techbullion)

- Challenges With Tornado Cash And Similar Channels: Regulators will highlight services that obscure asset flows as reasons for stricter anti-money laundering rules.

Practical Tips For Users: Decrease Your Risk Today

If you participate in DeFi, consider the following precautions:

- Review Contract Age and Audits: Prefer contracts that have been recently audited.

- Control Investments In Legacy Pools: If a pool appears “old but live,” avoid investing or limit exposure to a small percentage.

- Use Hardware Wallets and Manage Approvals: Revoke unneeded token approvals and avoid setting unlimited allowances for new contracts.

- Diversify Across Protocols: Do not concentrate investments in unique composite assets.

- Follow Proper Channels for Updates: Rely on official communication channels rather than social media for incident reports.

These measures cannot fully protect you but will help minimize risk and the potential extent of losses.

What The yETH Exploit Reveals About The Future Of DeFi

The 2025 yETH exploit is more than just a Yearn problem. It highlights that smart-contract risk remains unresolved.

- With the rise of DeFi and its layering of staking, derivatives, pooling, and yield optimisation, the system becomes increasingly intricate. Without proper security practices, even well-designed protocols can fail under their own complexity.

- Developers can take away a clear lesson: well-maintained, standardised, and audited code is invaluable. Introducing custom swap logic, especially for sensitive derivative assets, requires extreme caution.

- For users, the era of blind faith or “set-and-forget” yield farming is likely over. More careful investigation, measured exposure, and targeted engagement will become the norm.

In the broader crypto economy, events like the yETH exploit may accelerate the adoption of defined security standards, insurance frameworks, and regulatory clarity. Over the coming weeks, analysts and developers will scrutinise on-chain data, evaluate Yearn’s remediation, and examine other potentially vulnerable DeFi protocols. The 2025 yETH exploit may be remembered as a tipping point, shaping the future of decentralized finance.

Looking Ahead: A Realistically Optimistic Perspective

For DeFi to remain robust, the community must learn faster than attackers. The positive is that DeFi experts are already moving quickly. Improvements stemming from the yETH exploit will reward projects that implement higher standards, more rigorous testing, and proactive contract deprecation.

A bifurcation may emerge: a conservative layer offering standards-compliant, institutionally suitable DeFi, alongside a sandbox for highly innovative, high-risk products. Strong signalling of risk is crucial, allowing participants from retail to institutional to make informed choices.

Closing Thoughts

Permissionless finance is still code-driven and subject to human error. The yETH exploit is a serious threat, but not an insurmountable one. With proper engineering, continuous audits, strong governance, and prudent user practices, DeFi can advance into a more secure, yet innovative, ecosystem.

The incident is a milestone, not a headstone. It represents a reset: protocols can strengthen, users can gain wisdom, and the sector as a whole can mature. The coming year will be decisive not only for Yearn but for its peers across DeFi.

Frequently Asked Questions (FAQ)

- Q: Is on-chain recovery feasible?

A: Recovery becomes more difficult once funds enter mixers or are converted to off-ramp fiat. If attackers hold proceeds on traceable chains, recovery may be achieved through signature tracking, exchange collaboration, or court action, though outcomes vary. - Q: Does this increase gas costs or alter protocol design?

A: Not directly. However, more investment in security verification and transaction monitoring may occur, representing a soft cost rather than a gas increase. Network-wide gas trends remain demand-driven. - Q: Are liquid staking tokens particularly risky?

A: Liquid staking tokens (LSTs) introduce complexity by connecting on-chain staking, node operators, and derivatives. Composability risk arises when a breakdown in one LST impacts other derivatives. Due diligence is critical when using multiple LSTs. - Q: Does this exploit affect all Yearn users?

A: It was specific to a legacy yETH stableswap pool. Main V2/V3 Vaults, which hold most assets, remain unaffected. - Q: What exactly went wrong with the yETH contract?

A: The contract had an “infinite-mint” vulnerability, allowing an attacker to generate vast amounts of yETH in a single transaction and trade them for real ETH and liquid staking assets. - Q: Could this happen in other DeFi protocols?

A: The exploit highlights structural risks in custom or legacy smart contract code. Any protocol with bespoke logic, staking contracts, or derivative bundles that is not rigorously audited could be vulnerable. - Q: What measures can users take to secure their funds?

A: Perform due diligence on contract updates and audits, prefer standard, battle-tested contracts, and be cautious with complex derivative or staking contracts that have multiple dependencies. - Q: Will users who lost funds be reimbursed by Yearn?

A: Yearn has recovered some assets (pxETH worth US$2.4 million) and intends to refund affected depositors. Whether compensation will cover the full loss remains unclear.