Japan’s Financial Services Agency would require cryptocurrency trading platforms to maintain “liability reserves” to provide compensation for customers in the event of hacks, unauthorized withdrawals, or system failures. This proposal for the regulation of the cryptocurrency market is expected to surface in the government’s Financial System Council report soon.

That’s the clear message: regulators want cryptocurrency operators to plan for the worst because they don’t want their customers to suffer. This is relevant for people who trade in or build on blockchains in the Asia/Pacific region, such as in Australia or Japan, or in any other region for that matter. (Yahoo Finance)

Japan may force crypto platforms to keep reserves to cover hacks and losses. (Image Source: The Shib Daily)

Why It’s Relevant Now

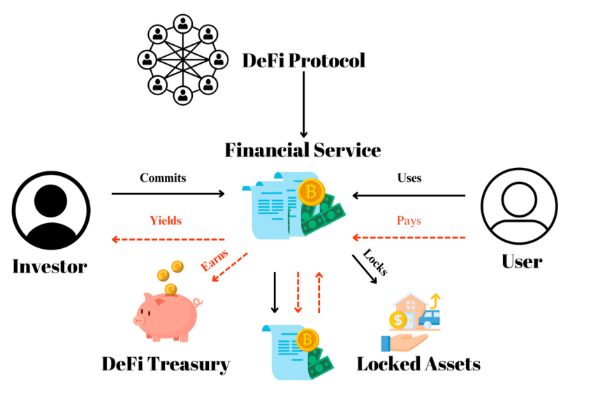

Crypto exchanges are the point where software, finance, and trust meet. When it works well, customers get fast settlement and access to the market. But if not, through hacks or failure, customers lose money, and the market shakes. This proposed regulation by Japan lays more emphasis on the ‘liability’ in the same way that finance does: having a ‘buffer’ from the sudden event to the payout process.

That’s Important For Three Reasons:

- Direct protection for consumers: So long as the reserve exists and governing regulations specify the terms on which the reserve must make disbursements, the refunds become more feasible.

- Market confidence: Awareness of the need for the exchange to maintain a cushion against runs that occur out of sheer market panic.

- Regulatory precedent: Japan is a financial heavyweight in the world. Its future course on regulations may set precedents for other countries. Japan’s model may emerge as the template.

How The Reserve System Would Function In Simple English Language

Consider the reserve like an emergency savings account that the exchange must build. Thus, the way the FSA handles the reserve function doesn’t provide an alternative for good security procedures and also serves as the ultimate safeguard.

Likely Contentious Areas In The Design Will Include:

- Size: How is the reserve calculated fixed percentage of customer liabilities, through a sliding scale based on volume sold each month, or something in between?

- Liquidity and geography: Is it necessary to keep the funds local? What form do they take: yen, high-quality liquid assets, stablecoin collateral?

- Access rules: on what basis is the funding spent, and who checks the decision?

- Segregation: Are client assets segregated from the business assets of the company, or is the reserve held as an overlapping layer of protection?

Initial observations suggest the FSA will seek exchanges that want to hold customer funds onshore and establish clear contingency plans. This means that platforms must now think beyond the ‘hot wallet / cold wallet’ divide to demonstrate legal forethought in the event of compensation plans.

How This Could Affect Exchanges & Users

For Exchanges:

- Capital planning: There will also be the need for improved capital management on the part of platforms.

- Product design: Certain high-risk products or functionalities may increase in cost to maintain or migrate to custodial models that satisfy reserve requirements.

- Compliance costs: Smaller markets might find the new rules too costly. Exchanges might occur.

For Users:

- Lower Tail Risk: At least the reserve reduces “all-or-nothing” risks of losses that occur in many hacks.

- Effects on behavior: Customers might prefer the regulated exchange to the offshore one because of the existence of visible reserves; the ‘regulated’ brand now means more.

Reserve rules boost user safety but may raise exchange costs. (Image Source: MDPI)

Background: Legal Aspects Surrounding Japan’s Regulation Of Cryptocurrency

Despite all that’s been going on in the world of crypto, Japan’s approach hasn’t been one of inaction. Over the years, the government has been imposing strong obligations on firms. Additionally, the community is engaged in deliberations on whether some cryptocurrencies qualify for the status of financial products. This includes regulations about insider trading. This effort by the FSA relates to the stablecoin initiative being developed in conjunction with the banking community. In related news, the government is reported to be discussing stablecoin projects with top banks.

This Is The Context: Why It’s All Important

Liability reserves are no fix for the securities industry. This infrastructure for regulation simply encourages cryptocurrency markets to behave in the way that’s expected from banks.

Relevance To The Real World: Scenario

Consider the middle-sized Japanese equivalent’s overnight ‘clever hack’ of its ‘hot’ wallets. Applying the new method.

‘It declares an incident or alerts contingency plans.’

- The auditors & regulators acknowledge the loss & applicability of the reserve requirement.

- The reserve fund serves to cover predetermined areas of customer losses or all of them during the process of the forensic analysis.

- Customers get reimbursed sooner compared to the unregulated outcome. Less confidence shocks. Trading resumes.

That process cuts the human cost-people don’t lose life savings waiting months for resolution limits the spillover within the system if one platform fails.

NEW: Japan’s Financial Services Agency will require crypto exchanges to hold liability reserves to compensate users for hacks or security breaches, per Nikkei report. pic.twitter.com/vR1v18sifK

— Cointelegraph (@Cointelegraph) November 25, 2025

Issues In The Design & Controversy Points

Nothing is flawless. But the reserve system also poses some questions:

- Moral hazard-yes, would the exchanges, being assured of guarantees, cut back on security measures? Reserves must come along with effective regulation along penalties.

- Who bears the cost? Customers might indirectly contribute to the reserve through fees. Otherwise, the reserve might require firms directly. That would negatively impact the welfare of customers. Additionally, it will be costly for start-ups.

- Cross-Border Complications: Crypto is global. What about cross-border complications if the reserves are within the domestic system? Can cross-border users make claims too?

- Transparency versus security: how much revelation of reserve levels is needed without endangering the related security posture?

To what extent the reserve might improve safety without distorting incentives remains a function of careful rule writing and public engagement on audit standards.

Market Response Up to Now

But industry observers do seem to be cautiously behind them because having a consistent flow of transparent compensation improves the confidence level. Getting hurried regulation done in an unrealistic world doesn’t seem like good advice from anyone. Talking about the subject is underway, that’s good. Well, regulators, exchanges, and custodian banks now all have the same goal in common: work on the safe rails for their business or lose clients to something safer.

How Australia Should Watch And Learn

It offers many lessons that firms in Australia could appropriate without needing to adopt each aspect:

- Evaluating stress-testing compensation structures: How quickly would the Australian platform in today’s environment be able to compensate proven losses? How would it scale in a panicked setting?

- Add clarity on custody standards. Reserves are meaningful in the context of strong custody solutions, either through multi-sig best practices.

- Design cross-border claim processes. Since Australians are already using international cryptocurrency exchanges, having legal clarity on cross-jurisdictional payments is positive for all parties.

So, if Japan gets it right in the future, the playbook could set standards in terms of harmonising policies across the entire APAC region, meaning that the world’s largest platforms may have to draw up very clear-cut plans on how to provide emergency liquidity, activate rapid-response compensation protocols, coordinate with cross-border supervisors, and maintain transparent disclosure frameworks that satisfy multiple regulatory regimes simultaneously.

Just wrapped up @AusCryptoCon with @kucoincom and was pleasantly surprised by the Australian crypto scene.

On the surface: mullets, short shorts, moustaches, flat whites everywhere. It looks like an Instagram trend, but it’s really a lifestyle. People surf in the morning, talk… pic.twitter.com/sk39KioT2t

— Lucie (@brightmisslv) November 24, 2025

What Regulators Must Answer Is A Simple But Brutal Question. How Big Should The Reserve Be?

Four Methods Of Determination Are Plausible. Each Carries Its Strengths And Weaknesses.

Fixed Percentage Of Customer Liabilities

Determine the reserve percentage equal to X percent of all customer balances. Simple, clear, and auditable. But it’s also blunt. Such a fixed rate could undermine customers during periods of peak withdrawal risk, but could burden businesses during low periods.

Tiered Scale Based On Risk Profile

Smaller markets must pay a smaller percentage. Large-volume business platforms require higher rates. This approach aligns capital with system risk. However, the system is now subject to the challenge of defining the cut-off levels.

Volume & Volatility-Weighted Model

Correlate the reserve size with the recent trading volume and volatility of assets: When the assets traded on the exchange are volatile or experiencing sudden acceleration in growth in the assets traded on the platform, the reserve needed by the exchange also fluctuates.

Stress Test/B+

Scenario stress-testing approach for the system: much like the banks do now. Baseline against a hypothetical ‘big hack’ or ‘big run’ outcome. Use their estimates for losses. Leave ‘em with a ‘buffer on top’.

More Pragmatically, The Winning Combination Is Often The Pedestal Percentage With Top-Ups Based On Volatility Or Stress Results. This Combines Clarity With Adaptability.

Which Of The Assets Qualify For The Reserve?

Not all assets are equally valuable in the wake of a disaster. Regulators need to classify assets for the reserve carefully.

- Cash: Yen/Major Fiat Is The Best Choice. Liquidity in payments is needed. Holding onshore fiat keeps the settlement process simple.

- Quality Liquid Assets: Government Paper, Shallow Bond Market. Such assets provide market stability but involve active portfolio work.

- Stablecoins Are Very Useful But Also Pose Some Risks. Agreed, regulators must establish strict terms for the collateralization of stablecoins. Algorithmically backed stablecoins pose some risks in terms of counterparty risk.

- Custodial Crypto Exists But Is Risky. Market-dependent tokens make valuation during the payout period difficult.

The ‘Safe’ Configuration Mandates The Core Fiat Component Along With A Small Percentage Of Very Liquid Assets. That Eliminates Risks In Processing The Refunds.

Governance & Access: Who Gets To Decide When The Funds Are Used?

This Is Where The Law Intersects With Judgment

- There Must Be Clear Triggers For The Disbursement Of Funds. Events must also be clearly defined. These include unauthorized withdrawals by parties, proven hacks, the filing of bankruptcy cases, or proven operational breaches.

- Independent Auditors. Losses must also be independently audited by an auditor who verifies the claimant’s eligibility for compensation. Authorities might either commission or accredit the firms for the purpose.

- Processes Subject To Time Constraints: Payments Must Occur According To Some Specific Time Pattern, Like The Provision Of Advances In 30 Days In Interim Payments Or In Six Months For Final Reconciliations.

- Appeal Procedures. Limited powers of appeal must be retained by the exchanges, but the appeals process should not be prolonged to delay customer relief. (fsb)

Rules and audits ensure crypto reserve payouts are fast and fair. (Image Source: Mohamed Nasser Law Firm)

Speed For The Victims Must Also Be Balanced By Due Process

Segregation, Priority & Creditor Hierarchy

Reserves must complement, rather than substitute for, client assets in segregated accounts. Regulators must detail claim precedence:

- Segregated Client Assets (First Priority) -These assets are beyond the reach of the general creditors.

- Liability Reserve Pool: The Second Level That Protects The Shortfall That Is Verified.

General Corporate Creditors – Last In Line

- Ranking removes the confusion in insolvency. It also helps in predicting the recovery process.

Cross-Border Complications: The Thorn In The Side

- Crypto is all over the place: “A Japanese rule is strong at home but conflicts with the international order.”

- Conflict of Laws: Remedies for the same person might be different in another jurisdiction. Courts might pass contrasting orders. Agreements for mutual recognition or harmonized standards are helpful. However, such agreements require negotiations.

- Enforcement and Location of Assets: When assets are situated on foreign nodes or custodians if the domestic reserves do not manage the problem of token retrieval.

Who Reimburses Foreign Clients?

Regulation must clarify whether the reserve also compensates purely domestic clients versus foreign ones. Adding more protection through wider coverage means more complexity in funding and liability.

After The Realistic Implementation Stages In The Cross-Border Rules

First, protect the home market customers and make interstate claims the next step within bilateral understandings.

Winners & Losers: Market Dynamics After The Reserve Rule

Winners

- Large, well-capitalized exchanges: These bear the cost of compliance. They brand the reserve requirement as an advantage. Market share moves in their favor.

- Other operators must partner with the regulated custodian banks for compliant custody.

- Professional insurance firms. There is a growing demand for top-up and supplementary insurance.

Losers

- Small, thinly-capitalized exchanges. This might either make them exit the market or merge.

- Risky token projects. Assets needing complex custody solutions might have high listing costs.

- Unregulated offshore platforms that do not face government regulation: Players will rush to those offshore spots in the short term. But in the medium term, the reputation-building process and travel bans make them less attractive.

Policymakers must also keep abreast of the risks of inadvertent risk concentration.

Technological Edge Cases: Blockchains That Misbehave

Regulators must be ready for complex technical situations:

- Forks and Chain Reorganizations: if the fork impacts the balances of assets held in the chain, then the chain on which the customer’s claim exists must be defined.

- Multiple Asset Claims: A hack might involve different tokens with different levels of liquidity. However, the compensation system must ensure the conversion of assets to the common unit of value. Such value is usually in fiat.

- Funds Were Traced Through Chains: Speed in tracing the funds becomes vital. Freeze or recovery mechanisms may lower the requirement for payouts. However, it mostly depends on goodwill between the entities.

- Smart Contract Failures: Where the losses occur because of errors in the custody contract, the applicable legal issue at this point becomes whether the exchange was sufficiently diligent in its use of the contract. Regulators must mandate the playbooks covering such technical variations for publication by the exchanges.

Also Read: Treasury-Tech Shift: How Big Banks Are Using Blockchain for 24/7 Liquidity & Cross-Border Payments

How Reserves Relate To Private Insurers & Self-Insurers

Reserves do not displace the function of the private carriers but instead provide a multi-tiered safety net: Various types of breach incidents are covered by primary insurance. There might also be exceptions. But reserve funds work like an immediate source of liquidity. Contingent capital lines (credit facility) ensure that the exchange heavyweight gets temporary funding during the time the settlement is being made. Smart policy-making promotes mixed models: Insurers cut expected losses, while reserve funds spread payments.

Crypto reserves provide fast liquidity alongside insurance coverage. (Image Source: WallStreetMojo)

Implementation Roadmap: Practical Steps For Regulators And Exchanges

- Pilot Phase: Begin with larger exchanges and specific asset classes. Evaluate trigger functions and payout procedures.

- Consultation Round: Refining of parameters by industry, technologists, and consumer groups.

- Audit & Reporting: Quarterly proof-of-reserve must come with independent audits.

- Gradual Scale-Up: Expand to more firms and different types of assets if the system is robust.

- Cross-Border Talks: Begin bilateral recognition and sharing of information in key countries.

‘A staged approach means less disruption with improved safeguards.’

Final Thoughts

Japan’s proposal for the liability reserve is not red tape for red tape’s sake. This system brings stability to the unstable world of foreign exchange. If carefully developed by regulators who understand the consequences of policymakers’ actions on the industry, the reserve system could cut the human toll of the failure of foreign exchange regimes. However, the devil is in the details. Misjudged reserve schemes bring about complacency, encourage accumulation, and drive business into the protocols. This is because effective reserve schemes make headlines in the chronicles of the better crypto landscape that serves everyone from individual consumers through institutional players to developers. (coindesk)

Frequently Asked Questions

- Q: How do “liability reserves” work?

A: Funds that an exchange must hold to settle customer losses in the event of hacks, theft, or defined operational failure, in the event the platform is liable, or in the event of successful breaches. - Q: Will the reserve system cover 100% of the losses?

A: Not necessarily. This could depend on system parameters set to limit the scope of refunds. Meanwhile, the system enhances outcomes rather than being purely guaranteed. - Q: When do the Japanese regulators plan on implementing the law?

A: According to various sources, the proposal is expected to emerge in the form of an ‘advisory report,’ meaning that regulators plan on incorporating updates in the 2026 ‘session.’ - Q: Are the other regions mandating the same for their crypto markets?

A: Regions do mandate capital and custody. However, the reserve system for the crypto market appears less widespread. Japan’s approach may enforce the reserve system for the industry in the future. - Q: How might reserve systems impact the trading fees on the platform?

A: Yes. To cover the reserve system through the cost of operating their business, they might affect their potential in the future. - Q: Can the reserve system make the crypto safe, like the bank deposit guarantee?

A: No. Bank deposit guarantees are backed by upstream legal structures. There exists no successful upstream reserve system within the industry. - Q: Who ends up funding the reserve system?

A: Various sources point out the reserve system for firm-funded scenarios. However, regulators also mandate the system in the form of a fee pass-through. Fiscal policymakers must strike the right note in their approach. Policy must seek harmony between justice and affordability. - Q: Can the reserve system decelerate the pace of innovations within the industry?

A: Yes. By imposing higher costs on the industry players. Nevertheless, the ideal approach promotes positive innovations. This includes better secure access to clearer custody solutions. - Q: How quickly might the victims expect the payout?

A: Yes. Fully developed models might provide interim payments quickly, in days to weeks. Final reconciliations will take longer. Policymakers must ensure the initial payout terms are maximized. - Q: Can reserves lower the threat of hacks?

A: Only indirectly. Reserves do no more than pay back the victims. - Q: Can the reserve system pose moral risks for the market?

A: Yes. Exchange operators might cut back on their investments in the system if bailouts are assured.