The unexpected end to the U.S. government shutdown after a record-breaking 43 days has brought the nation’s capital back into action, and that’s important for the crypto world. The fact is that the government agencies that were forced to lay dormant during the government shutdown are now able to resume work on regulations, the courts are back on schedule, and politicians can move forward with bills that were stalled during the crisis. (apnews)

After 43 days, U.S. agencies and lawmakers are back, reviving momentum for crypto. (Image Source: The Currency analytics)

Why It Matters For Crypto Markets

Regulation is the backbone of institutional capital. It is where the likes of the SEC and the CFTC put the brakes that large financial actors are hesitant. They require a regulatory clarification of hundreds of millions of dollars, even of the sort required to put billions into action for trading. The government shutdown stalled the former for weeks. The federal government’s reopening reactivates the approval and enforcement

The Market Reaction Instantly

Markets are a response to certainty: The uncertainty caused by the government shutdown provides an early indication of a beneficial effect to Bitcoin, which is showing stability and a degree of recovery after the political cloud lifted. The data shown through fund tracking of digital assets reveals a large degree of outflows over the past few weeks-Coin Shares alone reported a total of US$1.17 billion of outflows within a short week, reflecting the rapidity with which such allocations are undone during times of uncertainty.

The Regulatory Runway Reopens

Two things happen when the shutdown is over that affect the real world: agency staff return, and the deadlines are back in play. Legislative bills that were stalled in committee and floor action could see movement. Insiders suggest that the SEC and the CFTC will ramp up their itemized priorities, such as the spot-ETF filings, stablecoin regulations, custody regulation, and tokenization guidance, before the end of the year. This is important because getting a regulatory thumbs-up could mobilize significant funds that are currently sidelined.

REGULATORY CLARITY IS FINALLY HAPPENING

The Senate’s Market Structure Bill, expanded @CFTC oversight, and new ETF approvals mark a turning point.

$Crypto’s next phase isn’t a dream anymore — it’s being written right now. pic.twitter.com/7pDRZQe3W4

— COACHTY (@TheRealTRTalks) November 11, 2025

How Institutions Monitor And Decide

The three signals the institutional funds follow are the degree of legal clarity, product safety, and macro liquidity. During the government shutdown, the weakest of these signals was that of legal clarity. Going forward, the key events the institutions will be impatiently waiting to see are the announcements of the SEC, statements of the CFTC concerning the laws of commodities, and any decisions of Congress to revive and modify the bills related to crypto. Of these, any positive progress will trigger further allocation of funds back into the Bitcoin-linked instruments such as spot ETFs, no-leveraged ETPs, and crypto custody offerings.

What The Pause Meant For Capital

Data suggests that during the period of the shutdown and the resultant volatility, investors scaled back on spot Bitcoin ETFs and other investment structures. The spot-linked U.S. Bitcoin ETFs registered noticeable outflows during recent trading sessions as a result of hedging risks and a shift to cash and government-backed assets. Yet not all investment buckets emptied during the period because specific alternatives and niche ETPs registered increases, reflecting the selective return of risk appetite.

What a “Regulatory Comeback” Might Look Like

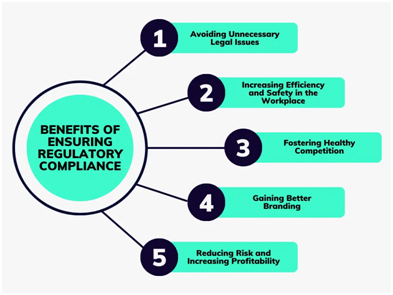

A regulatory comeback is not a single moment but a series of steps because it involves guidance, enforcement priorities, and interpretative letters, all of which reduce legal uncertainty.

Approvals and Filings

Progress on decisions related to spot ETFs, custody approvals, and token listings is key. Each approval acts as a direct investment inflow, signalling confidence to the market.

Legislation

Congress may reopen discussions on rules related to stablecoins and reporting. Even small parliamentary progress is positive, showing markets that legislative clarity is advancing.

Institutions are drawn to sequence and predictability. When agencies move forward, funds can return far more quickly than is often understood.

Real-World Example

Consider a Melbourne-based institutional desk managing a global digital asset portfolio for a family office. During the shutdown, the desk reduces weighting to spot Bitcoin ETFs and increases cash allocations to mitigate operational risk. On the morning the shutdown ends:

- Risk managers update legal briefing documents.

- Compliance officers request SEC responses to FAQs.

- The chief investment officer orders a staggered rebalance if a positive regulatory indicator appears.

This scenario illustrates that flows are not a drastic reaction but a multi-step procedure following the removal of uncertainty.

Regulatory clarity triggers a gradual, step-by-step return of institutional funds. (Image Source: Metricstream)

Why Bitcoin and Only BitcoinMatters More Than Ever

“Bitcoin is typically a kind of regulatory canary in the coal mine: it has the strongest degree of liquidity and the most developed product suite that includes futures and spot ETFs, and custody offerings. Accordingly, a regulatory shift offering a promise of a stable regulatory environment for Bitcoin is very likely to attract funds at a rate faster than that of other smaller tokens. Still, the regulators’ response to related Bitcoin offerings such as custody, lending, and futures to spot arbitrage will influence even the return of Bitcoin itself.”

Dr. Saturday E, “Regulatory Challenges and the Road to Sound Cryptocurrency Regulation”

Factors That Might Halt The Resurrection

The reopening of the government does not remove the macro and structural risks. Higher interest rates, the threat of geopolitical shocks, and even news of enforcement could tamp down the moves. Further, agency statements that are permissive but cloud the details could slow the reopening of the institutions, since institutions require details of operations, such as insurance of custody, taxation, and what constitutes a security.

Places To Start Searching For The Early Appearance Of The Return Of Capital

Watch these metrics:

- Flows Into ETFs (Daily/Weekly): Turning back into positive from net outflows would be the strongest indication.

- Whale Accumulation On-Blockchain: Whale transactions to a reputable custodian are significant.

- Derivatives Basis and Futures Premia: A narrowing basis suggests that the demand for cash is increasing.

- Press Releases Related to Regulation: Approvals of the SEC and the CFTC serve as catalysts.

What The Institutional Players May Do Next

A graduated return is what you should expect. Major asset managers, such as large pension funds, are used to a gradual introduction of risk through pilot programmes involving small investment sums, further management of assets, and then full investment if the risk of challenges to the management structure and related laws is low. Large investment sums for hedge funds could materialise through derivatives and arbitrage very much sooner.

The Overall Market Implication

The regulatory return could reconfigure the market structure because there could be enhanced visibility of the regulated product, tighter spreads, and even volatility could be reduced because of the immediacy of the prices triggered through the discovery of the prices.

Quick Look Before Delving Further

The U.S. government is reopened, and federal regulators are back to work. This alone triggers a reaction throughout markets, legal departments, and product groups. The review and approval activities that were paused are resumed, and the immediate reaction of the institutional investor is to shift from “wait and see” to scenario planning.

The Reopened Machinery: What Actually Restarts

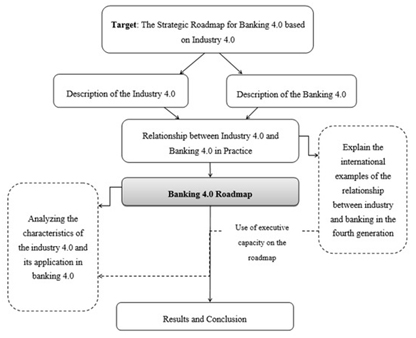

As the regulators return to work, three of the operational levers are triggered:

- The Decision Timetables Are Back On Track: The review periods and legal deadlines that were put on ice are restarted. This brings certainty to the calendar risk for fund managers and issuers.

- The Staff Work and Engagement With The Stakeholders Are Resumed: The compliance officers, examiners, and analysts start picking up the letters, meetings, and consultations. It starts a new cycle of public communications speeches, FAQs, and guidance.

- Congressional Floor Action May Be Revived: Legislation involving stablecoins, reporting, and/or market structure issues may go back into committee and/or the calendar. And even small steps forward influence risk models for long-term funds.

These mechanics matter because the behavior of institutional funds is driven by a desire for clarity, not press releases.

The Way the Flow Maths Work

The allocation of funds through institutions is a complex procedure. It involves:

- Approval of the investment strategy by the portfolio of investment committees.

- Review of custody and counterparty risk by risk departments.

- Approval of the investment memo by the compliance department.

During a government shutdown, one of these links becomes inactive, slowing the process.

Staged Reallocation

Once operations resume, institutions “warm up” through a phased approach:

- Pilot Allocations: Small exposures to assess custody and liquidity aspects.

- Scaled Positions: Larger buys after pilots achieve operational KPIs.

- Full Allocation or Reroute: Either a substantive role within Bitcoin-regulated products, or a shift into alternatives if regulatory gaps are not addressed.

Since approvals and guidance reduce legal uncertainties, the timescales between piloting and scaling are shortened. This explains why ETFs and custody enhancements are often more impactful than public relations.

Data We Cannot Ignore

Market nervousness has been evident over the past weeks. CoinShares reports ongoing weekly withdrawals of around US$1.17 billion, led by Bitcoin and Ether. This is a significant rebalance, not a minor tremor.

Intraday Volatility

Spot Bitcoin ETFs have also shown notable intraday volatility. Recently, there was a day with almost US$870 million in outflows, demonstrating how quickly risk management actions occur at ETF desks and within institutions allocating funds. ETFs serve as a direct representation of how institutions are allocating capital into Spot Bitcoin.

Regulatory Momentum

Earlier this year, regulatory changes reduced listing requirements for spot commodity ETFs, creating a structural environment that facilitates future product development. This shift in the regulatory landscape allows revived agency operations to approve and review transactions more quickly than before.

A Practical Road Map: What Institutions Watch This Week

For those managing institutional risk and funds, the following are key pulse checks:

- Daily and Weekly ETF Fund Flows

A return to steady inflows after a period of net outflows signals the start of re-risking. Track trends from Farside, SoSoValue, and daily ETF provider numbers. - Regulatory Bulletins and Interpretive Letters

Short Q&A sessions or staff guidance can quickly clarify the law, reducing uncertainty for institutional investors. - Custody and Insurance Notifications

Updates on new insurance schemes, SOC reports, and attestations help remove operational hurdles for fund managers. - Institutional On-Chain Behavior

Ongoing transactions of funds to reputable custodians (rather than cold wallets) indicate sustained demand and institutional activity. - Derivatives Metrics

Narrowing basis, tighter spreads, and rising open interest have historically preceded larger cash flows into the market.

Together, these factors provide a more complete picture than any single data point, giving insight into institutional movements and market confidence.

Institutions track key signals to gauge market moves. (Image Source: MDPI)

Real-World Implication: The Custody Stage Is a Bottleneck or a Gateway

Institutional movement is not driven by regulation alone; execution-safe custody plays a critical role. Custodians must be audited, insured, and operationally sound, often acting as the gating factor for large allocations.

Firms evaluate key practical aspects, such as:

- Whether custodians are segregation qualified.

- Adequacy of insurance limits.

- Levels of solvency.

- Ability to handle in-kind ETF redemptions.

- Speed of executing large over-the-counter transactions.

The Good News: This year’s market structure is moving in the right direction.

The Bad News: Details matter. Even an accommodating SEC stance can be hampered by poor custody practices. Conversely, strong custody and operational prudence can attract conservative allocators, enabling smoother institutional flows.

Also Read: Are Crypto Privacy Coins Still Relevant in 2025?

Scenario Analysis: Three Possible Paths

- Momentum + Follow-Through

- Regulatory bodies issue clear and actionable rules.

- Custodians provide attestations.

- ETF fund flows turn positive.

- Institutional capital returns, liquidity tightens, and price volatility decreases over time.

- Mixed Signals

- Regulators issue lofty statements but leave essential details unanswered.

- Institutions proceed slowly with pilot programs.

- ETFs experience heightened volatility.

- Policy Noise / Macro Shocks

- Economic, political, and geopolitical shocks occur alongside unclear guidance.

- Allocators remain sidelined.

- Outflows continue, and capital reallocates to safe havens.

The success of the marketplace depends less on the reopening itself and more on the follow-up actions that ensure clarity and operational readiness.

Playbook for Mutual Funds and Advisors

For professionals advising institutional funds, key steps include:

- Legal and Scenario Analysis

- Write memoranda analyzing the law.

- Draft scenario memos considering possible agency actions.

- Stress-Test Custody Relationships

- Request recent affirmations, insurance documentation, and redemption runbooks.

- Ensure custodians are operationally ready to handle large transactions.

- Refine Execution Plans

- Execute trades using limit orders, blocks over-the-counter, and VWAP algorithms instead of market orders.

- Monitor Regulatory Updates

- Check the regulatory calendar daily.

- Staff letters or minor guidance changes can alter hedging and allocation strategies within hours.

Conclusion

The end of the U.S. government shutdown restores the regulatory framework critical for institutional crypto investment. Bitcoin is likely to benefit first, but capital will return gradually through phased allocations as custodians, ETFs, and agencies resume operations. ETF flows, on-chain activity, and regulatory updates will signal the pace of this return, showing that market recovery depends on clarity and operational readiness, not headlines alone.

Frequently Asked Questions (FAQS)

- Q: Is the crypto sell-off a direct result of the government shutdown?

A: It definitely contributed. The effect of the shutdown heightened uncertainty, and institutional risk managers adjusted their risk management practices accordingly. Data from digital asset fund trackers revealed considerable withdrawals during that time. - Q: Which regulators will start moving the fastest after the shutdown?

A: The SEC and the CFTC are the first that come to mind, as these organizations play a large role in ETF and derivative markets and in classifying token sales as securities versus commodities. Both are expected to emphasise year-end milestones. - Q: Does this imply immediate inflows into Bitcoin ETFs?

A: Not necessarily. Institutional investment often happens in phases: understanding, pilot re-entry, and then scaling. One approval or speech may trigger flow, but sustained investment growth requires sustained clarity and readiness. - Q: What’s the implication for Bitcoin and altcoins?

A: Bitcoin could benefit first due to its market depth and product development. Altcoins may lag or derive benefits depending on whether token listing regimes and DeFi are supported by regulation. - Q: What should retail traders watch for?

A: Short-term: Monitor ETF flow reports, key agency announcements, and market liquidity.

Long term: Observe improvements in custody and any legislation that provides tax and reporting clarity. - Q: How quickly might the CPPIs rebound?

A: They could return in phasespilots in days to weeks after clearer guidance, and full allocations over months. The speed depends on the readiness of custody and the clarity of the regulatory message. - Q: Will ETFs vacuum up all institutional business?

A: No. Many large institutions employ dedicated custody and over-the-counter trading for large positions. ETFs act more as a bridge and a discovery mechanism. - Q: Is a single day of outflows a sign of a failed comeback?

A: No. Single days of large moves are common during stressful times. Trends over days or weeks matter more. Recent single-day outflows have been tied to macro events, not a rejection of the business model. - Q: What’s the key regulatory change that will get the market moving?

A: Fundamental guidance related to custody and ETF functioning, along with a clear definition of tokens, moves the needle the fastest.