The pace of banking is faster than the headlines. In the past 12–18 months, various international banks have been implementing and testing on-blockchain payment infrastructures, tokenized deposits, and 24/7 clearance solutions that enable the transformation of treasury processes from batch-oriented and office-hours dependent to flow-oriented money processes.

In this regard, Citi has successfully integrated tokenized deposit rails with its treasury stack that enables corporates to immediately push liquidity across borders at any time of the day. This is no theoretical application since Citi’s token services are operational projects that enable corporates to connect with an always-on clearing service. (citigroup)

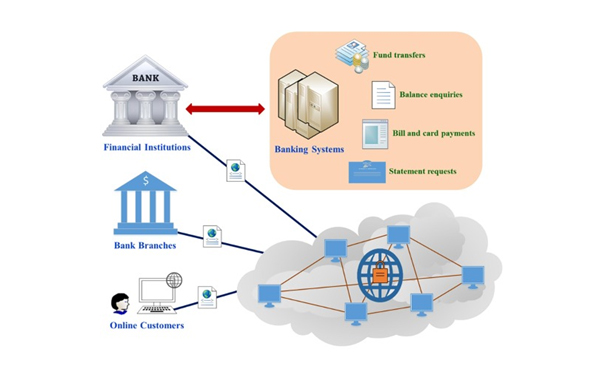

Citi’s token rails enable instant 24/7 cross-border payments. (Image Source: ScienceDirect.com)

JPMorgan wields a similar trend with the rebranding and expansion of its work in Onyx to Kinexys, a bank-level, tokenised deposit ledger and payments rail that facilitates real-time international money transfers. The bank has already successfully tested 24/7 dollar clearance with other firms with production agreements across Asia and Europe.

UBS, Barclays, and various other world-class institutions are also experimenting with private ledgers and tokenized money pilots that enable minute-level settlement rather than multi-day correspondent hop transactions utilizing tokenized money or wholesale stablecoins. The aim is to mitigate the overdraft risk of daylight overdrafts, FX settlement risk, and the “waiting room” effect that plagues treasurer operations.

Why It’s Important

The Treasury departments are concerned with certainty. When transactions are processed in minutes rather than days, it means that companies maximise working capital management with less need to set up costly ‘Buffer balances’ to mitigate Intra-Bank float Leakage. Tokenization allows banks to ‘program’ deposits as ‘objects’ that are moveable ‘instantly’ over ‘chains’ with regulatory oversight.

What’s Happening Now

Short and rough facts

- Tokenised deposits are becoming banking products. Major banks are bundling tokenised deposits to enable corporates to transact based on on-chain bank balances with no impact on deposit accounts and regulation.

- 24/7 clearing is moving from pilot to production. Partnerships and client pilots show banks offering 24/7 dollar clearing and immediate rails to multiple banks to their institutional treasury customers. This means eliminating traditional cut-offs and shrinking settlement times.

- Interoperability and collaboration are key. The banks collaborate with fintech companies, exchanges, and infrastructural projects to weave the threads of custody solutions, price oracles, tokenized securities, and connectivity together.

- A regulatory environment influences the offering. The banks construct these offerings within regulatory parameters such as tokenized deposits from depository institutions, permissioned ledgers, and cautious stablecoin use. The commercial movement onward occurs amidst regulator interaction.

A Treasury Desk’s Day Before And After

Before:

The treasury manager wakes up to his inbox full of wires pending, cut-offs imminent, and maybe some international payments stranded in correspondent tiers. Liquidity forecasts are conservative due to uncertainties surrounding payment timings.

Instead:

The payments move through a continuous rail. A US dollar invoice sent from Singapore is settled to the beneficiary’s account within minutes. The treasury group can then see balances in real-time and in aggregate form for tokenized deposits made with multiple banks; automatic FX hedges are generated to mitigate risk.

This is anything but cinematic fantasy. The banks, such as JPMorgan, are no less capable with Kinexys technology; customers in India are already taking advantage of “anytime dollar” capabilities through banking partnerships.

How Banks Get 24/7 Liquidity

The game has three components.

- Tokenization Of Deposits. Instead of transmitting traditional wire messages, banks issue on-blockchain tokens that represent rights to a bank deposit. These tokens are transferred instantaneously between parties on permissioned/hybrid ledgers while the underlying book and regulatory safety nets are maintained by the bank. Citi and JPMorgan’s solutions fall within this category.

- Liquidity Rails And Intraday Nets. The need to maintain significant buffer balances with banking partners worldwide is eliminated with on-chain settlement. Rather, the banks and companies can direct settlement transactions via shared ledgers and execute settlement cycles whenever the need arises, often continually. The development projects such as Fnality and Partior seek to establish centralized rails for wholesale settlement functions in various fiat currencies.

- Orchestration And Finality Of Settlement. Raider contracts and middleware packages oracles together facilitate post-trade reconciliation processes, FX legs, and DvP processes. These are made compliant by banks and enable almost-instant finality with the use of trustworthy off-chain inputs. Examples include collaboration with Chainlink and Ondo.

Institutions are stuck using traditional settlement methods because current blockchains can’t guarantee compliance at the protocol level.@KeetaNetwork changes this by embedding regulatory controls into the base layer.

Cross border settlement today often requires banks to… pic.twitter.com/ANR4pPWnXX

— Delphi Digital (@Delphi_Digital) October 30, 2025

Real Clients, Real Choices

The corporate treasuries face challenges in making trade-offs. Their advantages include faster speeds and efficiencies in working capital management, while migration activities and counterparty decisions are their challenges.

For example, with “mid-sized” exports from Asia that hold “large dollar buffers,” instead of the usual risk management solution that provides financing lines to mitigate “overnight unknown” FX risk, there would be banking collaboration to facilitate “24/7 clearance,” significantly lowering borrowing costs due to “minute-level known” FX risk management.

What banks are offering this service is custody management, the issuance of tokens, ledger management, and reconciliation solutions packaged with APIs that enable current treasury management solutions to integrate without requiring fundamental transformation. Citi is one bank that is actively pitching this solution to allow companies to tap into APIs or web banking instead of revamping backend operations.

The Regulatory Tightrope

Due to such considerations, regulators need to be sure that banks hold deposit protection and KYC/AML measures. It has been seen that banks do not give customers standard stablecoins.

Rather, the most promising approaches retain the bank as the issuer of the tokenized claim; the company has a tokenized form of a deposit with the regulated bank. This addresses possible frictions with regulation and puts the bank squarely within current regulatory regimesbut achieves on-blockchain speed and programmability.

Nevertheless, there are some outstanding areas related to international data transfers, the prudent treatment of tokenized assets, and the impact of CBDCs on bank-issued tokens. The banking industry must configure architectures that can evolve to adjust to the effect of these policies without disrupting activities involving clients. (fsb)

Banks use tokenized deposits to ensure compliance while enabling fast, adaptable blockchain payments. (Image Source: Flagright)

Risks And Mitigants

- Operational risk: “There are new failure modes with new rails,” says David Treat. To mitigate these risks, banks opt to implement permissioned networks, redundancy, and fallback to traditional wires.

- Liquidity fragmentation: Too many competing rails could potentially lead to liquidity fragmentation. Interoperability initiatives, such as sharing platforms for instance, Fnality and Partior, and collaboration among banks to establish joint broad liquidity pools, will be critical in this area.

- Counterparty concentration: Corporations must be cautious in choosing banking partners. Banks mitigate this through multibank integration and the presentation of combined balances across multiple institutions through treasury dashboards. Citi and JPMorgan highlight operability across multiple banks in their messaging.

The Competitive Perspective: Banks Vs. Fintech Companies

Fintech firms are the ones that innovate stablecoin networks and fast settlement processes; banks use trust, existing customers, and regulatory licenses. The most successful models within the next few years will be hybrids that combine fintech firms’ agility with banking credibility.

For instance, projects supported by banks that use fintech middleware are more viable. They allow treasuries to gain the speed that fintech companies possess while maintaining bank custody and governance. Recent agreements and pilots depict this mix.

Banks and fintechs combine speed and trust for faster, regulated payments. (Image Source: Jellyfish Technologies)

What Treasury Teams Need To Consider Today

- Can this bank enable the tokenization of deposits and realize real-time settlements within our key corridors? (Explain demo requests.)

- How does the bank manage custody, reconciliation processes, and failed settlement fallbacks?

- What is the legal documentation that is appended to the balances that are tokenised? Are these deposits covered?

- What is the integration between FX hedging and on-chain settlement, and can FX execution be automated on settlement triggers?

- What are the operational SLAs that will be supported by the bank?

Those banks that answer such questions with practical APIs and regulatory guarantees will acquire large corporate clients.

Quick Wins For Corporations

Keep it small; pilot the payroll process in one corridor or shift to make periodic payments to one tokenized corridor. Monitor the timings of settlement, FX slippage, and working capital effect. If seen in DPO and borrowings, then further expand the process.

Technology integration is possible; almost all banks have APIs and plug-and-play components that correspond to current treasury management systems. Ask to gain access to the sandbox environment and run parallel settlements to reconcile.

How To Think About Integration: A Treasury Playbook

Looking at on-chain liquidity as an “additional lane” of payments instead of “an alternative to all the things that you are doing” is the key to managing risk efficiently and extracting quick wins.

Begin by identifying current flow mappings. What are the high corridors, key counterparties, and pain points: FX timing risk, corridor delays, intraday funding requirements? Zero in on one or two areas that provide instant ROI, such as payroll in one currency in a corridor, suppliers’ pre-payments, or intercompany nets.

Next, evaluate connectivity choices:

- API Access to Bank Token Services: A direct and low-latency connectivity option to the bank’s token issuing and payments APIs. You can use it to check balances in real time and to initiate payments. Many banks offer token issuing and API services integrated in one package.

- Permissioned Ledger Gateways: If your banks are maintaining permissioned/hybrid ledgers, then you will receive controlled (read/write) access to the ledger through authorized nodes/middleware approved by your banks. This solves the requirements of corporates who need tight control over visibility/governance on settlements.

- Multibank Orchestration: Use an orchestration layer or treasury middleware that combines token rails from various banks. Here, there is no vendor lock-in. Many banks are incorporating multibank models in their product descriptions.

Ensure your integration is incremental, run the parallel settlements, on-chain and legacy, for at least a month to reconcile the differences, and then implement in production environments with low traffic.

Use on-chain liquidity as an extra lane; test, reconcile, and scale gradually. (Image Source: Medium)

Example Technical Flow – API + On-Chain DvP – FX Payment

Below is an outline of a simplified practical process that a treasury team might embark on to integrate bank token rails with on-chain DvP:

Pre-Trade Preparation

The treasury system makes use of the REST API to receive current balances and available intraday lines from Bank A. In return, the bank’s API provides the current token balance and the settlement window.

Match And Net

The treasury then combines the outstanding payables and receivables and sends a net settlement message to the orchestrator middleware.

Mint / Lock Token

Bank A places a tokenized form of the deposit that exactly represents the settlement amount in an escrow smart contract.

FX Leg Executed

At the same time, an FX execution engine receives a trigger; it transmits the FX order to the chosen liquidity provider and then sends an execution confirmation to the smart contract.

DvP Final

The smart contract then releases the tokens to the beneficiary’s ledger account after the FX execution is confirmed. The confirmation of settlement is received through webhooks to the treasury system.

When Transactions Occur Electronically

The treasury TMS receives the settlement notification and automatically posts the accounting entries; there is an audit trail (hashes and timestamps) that provides on-blockchain finality.

This minimizes failed payment windows and simplifies the automation process of treasurers to protect the FX risk linked to settlement events.

Case Studies That Count: What The Press Releases Actually Show

Citi – multi-currency expansion: Citi combines its token offerings with 24/7 USD clearing and extends its euro capabilities and footprint in Dublin, clearly aiming to facilitate real-time international liquidity for enterprises. That is banking services – no pilot here.

JPMorgan Kinexys: Deposit Tokens – The firm offers deposit tokens referred to as JPMDalongside guaranteed 24/7 same-day transfer services on its permissioned network. The tone with regard to messaging here is more about bank-backed tokenization at the level of deposits rather than stablecoin.

Fnality & Partior – shared infrastructure:

The infrastructure providers within the market, such as Fnality and Partior, invest in the development of the DLT rails that are designed to be regulatory compliant and are intended to be utilized within the wholesale environment to facilitate PvP and intraday repos. The banks are behind these infrastructures to enable continuous settlement windows and to remove correspondent routes. The latest investment and transactions carried out indicate that there is momentum behind these initiatives.

They mean that tokenization has come to be marketed by banks as a service offering to clients – APIs, SLAs, reconciliation – rather than as a research prototype.

Governance, Legal & Regulatory Checklist

What to check with legal and compliance before moving money on a token rail:

- Deposit status: Ensure that tokenised balances amount to a bank deposit (and not a cryptocurrency claim). The bank will advertise the tokenised deposits as bank liabilities; obtain this in writing.

- KYC/AML alignment: You must relate your AML profiles and screening to the identity scheme of the bank on the blockchain. Permissioned chains are conducive to mapping.

- Operating Fallback:

Contractual fallback to SWIFT/Wire in case of ledger outages with defined SLA credits corresponding to availability. - Data residency & reporting: Cross-border on-chain logs introduce new streams of records to verify if logs about transactions comply with taxation, FX regulation requirements, and national data regulation requirements.

- Custody and Segregation: Who holds underlying fiat? Validate segregated accounts and the right to call funds in the event of counterparty default.

- Audit and Forensics: Require auditability on the level of the transactions in the chain, and include in the contract a process to be followed by the bank in

The banks that are already issuing tokenized deposits would normally provide you with the legal schedules and playbooks, and leverage these to expedite the process of onboarding. (europa)

Operational Runbook – What Your Treasury Operations Team Does On Day One

- Day 0: Procure sandbox API keys; complete mapping of GL accounts and finalize formats for the reconciliation file.

- Week 1:

Execute test mint→transfer→burn transactions micro-scale. Test webhooks, callbacks, and confirmations on the ledger. - Week 2-4: Execute parallel live settlements on non-critical legs such as intercompany and measure time to finality, reconciliation mismatches, and FX slippage.

- Month 2-3: Roll out to payroll or suppliers corridors if Orion proves the reconciliation process decreases exceptions to below-threshold values.

Also Read:Crypto Market Reaction to Inflation Data: How US CPI Figures Could Shake Bitcoin and Altcoins

A Brief Roadmap: A 6-Month Program For The Treasury Team

- Month 0-1: Business case development and Corridor selection, and RFP to vendors.

- Month 1-2: Legal sign-offs, Sandbox API access, and Security reviews.

- Month 2-3: Parallel Settlement testing and Reconciliation tuning.

- Month 3-4: Internal Controls development, SLA agreements, and Going Live with non-critical corridors.

- Month 4-6: Scaling to High Volumes with Payments and increasing Hedging and LP capacity.

Final Thought: The Urgency Here

The shift to blockchain-enabled, 24/7 liquidity is no longer experimental and is reshaping corporate treasury operations. Banks like Citi and JPMorgan are proving that tokenised deposits and on-chain settlement can reduce FX risk, unlock working capital, and deliver real-time cross-border payments, all within regulatory guardrails. For treasuries, the message is clear: integrating token rails incrementally, leveraging APIs and orchestration layers, and collaborating with multiple banks offers a practical path to faster, safer, and more efficient liquidity management. The future of treasury is continuous, programmable, and always-on.

FAQs

- What is the difference between stablecoins and tokenized deposits?

A. Well, stablecoins are those that are administered outside banks. Permissioned tokenized deposits are administered within banks to retain similar regulatory rights. (Citi) - Does 24-7 Settlement reduce FX risk?

A. 24-7 Settlement closes FX risk windows faster but still retains FX risk – that is, risk due to movement of prices. Automation and distributed DvPs mitigate the latter. JPMORGAN - What banks are offering these services?

A. Some initial adoption has been shown by Citi, JPM (Kinexys/Onyx), and UBS, with others in Europe too. Fintech and infrastructural companies are also improving adoption rates. - Will this supplant SWIFT?

A. Not anytime soon. But on-blockchain initiatives enable other corridors to be settled outside of SWIFT. Correspondent banking can still meet other needs. -Swift - Will tokenized deposits also mean that firms need to set up node infrastructures?

A. Not necessarily. Most banks offer API and middleware connectivity; node connectivity is more typical among complex corporates. (Citi) - What about FX hedging if settlement is immediate?

A. Automation makes a difference. Use rule-based approaches tied to settlement triggers (micro-hedges already authorized) or combine FX algos with your orchestration engine. Timing risk decreases with on-chain DvP; hence, more reliable automated hedges are possible. - Will CBDCs render bank token services obsolete?

A. The advent of CBDCs shifts the perspective; however, bank tokenization supports CBDCs by incorporating familiar accounting and deposit insurance features to bank liabilities. The most likely outcome is that a hybrid model will evolve, with CBDCs targeting central liquidity and bank tokens targeting customers and services.