Wall Street is no longer operating in the experimentation phase. Large banks, asset managers, and market infrastructures are implementing operational blockchain networks, tokenization platforms, and custody solutions that will provide institutional balance sheet access to cryptos. This reshapes capital flow management, risk management, as well as the relationship between supervisors and markets in today’s digital asset environment. (pwc)

Wall Street’s blockchain shift is redefining capital and markets. (Image Source: Politico)

Why This Matters Today

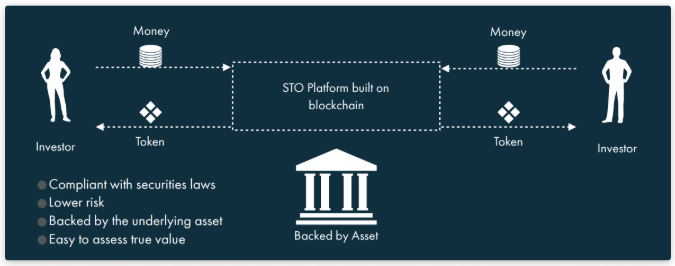

For years, the crypto industry operated in the shadow of retail, where the excitement lies. This is gradually changing as institutions offer scale, structures, and solutions such as insured custody solutions and tokenized securities that large capital allocators utilize. A bank is making a profound statement on the plumbing of the markets whenever a fund subscription process is tokenized, as well as when a regulated token offering is enabled on a trades exchange.

A Story To Place This Moment In Context

Take a mid-sized fund manager in Sydney as an example. They no longer require three days of settling funds. Instead, the fund manager resorts to a tokenized fund unit that settles instantly on a regulated blockchain. They get to fractionate their allocations, track rights instantly, and cut the costs of collateral. This is not a hypothetical scenario either. What is being introduced in the sector is exactly this. Providers of fintech solutions, including banks, are competing to make this promise a product.

What “Wall Street’s Blockchain” Looks Like Today

It is not one chain, one product. It is a multilayered process of development:

- Platforms that tokenise representation of real-world assets, such as stock, bonds, funds, and property, as digital tokens on a blockchain. So-called tokenisation platforms release templates and pilots of such solutions.

- Institutional custody wrappers, as well as insured custody wrappers that help eliminate a primary entry barrier to the sector for pension funds and insurers. They can interface with the conventional back-office systems.

- Network partnerships: banks and exchange groups select certain blockchains/permissioned networks that will ensure settled payments comply with regulations in some instances, even develop those networks in collaboration with public blockchain protocols. This model enables a connection to existing financial infrastructures. (fsb)

Players: Incumbents, Asset Managers, Market Tech

BlackRock, large custody banks, as well as a few large commercial banks, are not simple spectators. They use tokenization experimental solutions as well as productized ETF infrastructural solutions. Large fintech companies, as well as DLT experts, are collaborating with exchanges to launch online regulated trading platforms. This is significant since each of these possesses a particular expertise that is required by institutions.

Applications Of The Theory In Financial Markets

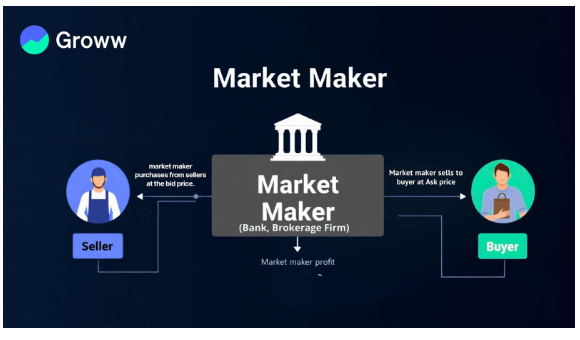

- Speed and Liquidity: Tokenized instruments will settle much faster. This will reduce credit exposure to the counterparty and free collateral. Market makers will be able to offer new intraday instruments.

- Ownership and Access As A Fraction: Tokenization enables fractional ownership of what until then had been illiquid or costly asset classes, such as commercial property or private equity.

- Operational Cost Savings: There will be fewer third-party processors, fewer reconciliation issues, and automated corporate actions, making operations less costly. Cost-conscious executives and trustees will be attracted by this advantage.

- Regulatory Intersection: It is beneficial to have fast settlement speeds, but authorities emphasize protecting investors, transparency, and assurance of shareholder rights in tokenized formats. This is because some regulatory authorities warn of tokenized products that do not necessarily represent conventional shareholder rights, implying investor education tasks.

Tokenisation speeds settlement, cuts costs, and opens access to new investors. (Image Source: Groww)

Risk: What Institutional Managers Consider

In institutional management,

“Institutions require predictable risk-return profiles. Tokenization has introduced new vectors:”

- Custody Concentration: As large custody holders possess private keys/custody rails, control remains concentrated unless self-custody solutions continue to exist. This extends to systemic risk.

- Operational Risk & Smart Contract Risk: DeFi products involve code and interlocking systems. Well-audited code can act in unexpected ways when scaled.

- Regulatory Uncertainty: “Jurisdictional patchworks” mean that what constitutes a tokenized security in one jurisdiction can differ in another, possibly impacting tokenized securities across borders.”

Where We See Live Adoption Today: Real Projects, Not Just Slides

Various specific examples demonstrate the transition from lab to ledger:

- Main banks involved in fund tokenization solutions, as well as tokenized settlement solutions, aim to optimize subscription and redemption processes for both asset managers and investors.

- Units of exchange and market infrastructure that use blockchain-based trading platforms approved by national regulatory authorities for tokenized securities. They are expected to interact with central bank payment systems, as well as conventional clearing systems.

- Industry groups partnering to choose public blockchain platforms on which to build settlement layers, showing commitment to integrating traditional finance systems with new blockchain technologies.

Tokenisation is moving from pilots to live, regulated markets. (Image Source: JustCoded)

How Custody Is Being Reconsidered In Institutions

Insured, regulated custody is the key. Institutional participants require that:

- Legal frameworks of custody that imitate client protections afforded to traditional custodians.

- Integrated operational platforms where custody, reporting, taxation, and compliance are native rather than bolt-on functions.

- Insurance & auditability, which refer to high investment in audits, cold chain architecture, key management, & insurance schemes by custody providers. This enables risk committees to say yes.

It is important to consider the relevant policy and regulatory environment that you must keep track of. Regulators are enabling as well as warning. They use progressive approvals of market-infrastructure businesses as a way of saying that tokenized trading will be approved if investor protections are adequate. At the same time, certain risks identified by the regulator include issues with tokenized equities, as they lack the rights of shareholders. This is expected to influence product development and launch timelines. (world-exchanges)

Real-World Relevance: Where This Impacts People And Institutions Today

A firm’s treasury can utilize tokenized cash equivalents to manage liquidity. Wealth managers can offer fractional ownership of private markets. Exchanges can offer a 24/7 source of liquidity for tokenized products. This automatically impacts retail investors in one waymore institutional buying will lead to increased sources of liquidity and a tighter spread. Industry participants will see new roles in token governance, ledgers, and asset servicing on-chain.

A Cultural Shift In Banks And Asset Management Organizations

This is as much a cultural moment as a technical one. A firm that had a “speculation” attitude towards blockchain is today housing DLT product groups in securities ops and trust divisions. It is a marked transition from “crypto theatre” to “crypto infrastructure” where “reliability, auditability, and regulatory alignment” trump everything else.

Banks are moving from crypto hype to real blockchain use. (Image Source: International Banker)

Case Snapshot: A Bank Develops A Tokenization Product (Compressed)

A universal bank telah berhasil mewerpakan satu proses pendaftaran tabur yang berstatus fisik ke satu proses yang menggunakan tokenised process. Masyarakat berlangganan menggunakan token digital, transaksi berlalu di satu buku yang menjual aksi korporatik secara otomatis. Struktur bank yang diberita melakukan proses pemindahan yang lebih cepat serta biaya jurnal ulang yang ditekan serta proses audit yang lebih lancar. Sekali pilot sukses, maka proses itu ditransformasikan ke proses produksi yang telah disetujui undang-undang khusus dari sektor krisis, maka yang

What Could Go Wrong

A custody model that overly concentrates in a small group of issuers with a lack of sufficient interoperability tools between them and differences in interpretations of tokenized instruments’ rights by various regions’ supervisors may result in a fragmented environment of tokenized instruments’ liquidity that confuses fund investors.

What The Data Shows: Measurable Effects Of Markets

It is a mixed bag, but adoption is measurable. Industry sandboxes, pilot projects, and increasing numbers of operational payments demonstrate tokenization is migrating from pilot to product.

Tokenisation, growth, opportunity scale: Industry sources and the provision of infrastructure place the scale of tokenised real-world assets (RWA) at a massive level, trillions of dollars of assets that are potentially tokenisable (illiquid property, private credit, funds, corporate bonds). As described in the commentaries of the DTCC market infrastructure is the scale of opportunity is a multiple-trillion-dollar industry if the environment is appropriate.

Volume increments in tokenized products: Major custody banks and payments arms publish pilot volume data and produce transactions vaporware. White papers with transaction data demonstrate substantial pilot volume data in tokenized deposits and processed transactions from JP Morgan Kinexys (previously Onyx). Surveys from State Street and various custody banks publish data indicating a substantial number of institutional investors hold a small allocation today (frequently under 1% of AUM), yet a significant portion of them intend to boost exposure as product maturity enhances. This suggests a phase of adoption where today’s allocation is small, yet intentions are robust in the future.

Effects Of Settlement And Market Structure: In a regulated exchange environment where tokenized securities operate, the benefits of direct settlement and interoperability are emphasized. Recent approvals in Europe of DLT trading systems demonstrate that markets are soon to accept blockchain as a legitimate means of settling the funds transfers that accompany trades. This is a gain that is structural in nature rather than operational.

Infrastructure Roles Who Builds What (And Why This Matters)

Institutional adoption of blockchain is not a vendor story. It breaks out into a variety of tracks.

- Firstly, bank-led platforms/rails (permissioned & hybrids): JP Morgan’s Kinexys (renamed from “Onyx”) is a model of this: bank-owned rails that interconnect corporate clients, custody, and other banks, to tokenise deposits, loans, and settlement as a bank-level service. These solutions are attractive to those who prefer to leverage existing banking relationships.

- Custodians and trust companies (custody + issuance): Custodians like State Street are developing a custody stack, as well as research highlighting the importance of a custody grade sufficient for institutional scale. They frame custody as infrastructural products: legal structures, insurance, audit trail capacities, and holistic reporting solutions. This reduces a significant entry barrier to institutional capital.

- Market Infrastructure (Exchange, Clearing House, DT): Collateral AppChain & Industry Sandbox initiatives of DTCC demonstrate that incumbents are attempting to develop network-agnostic frameworks for tokenized collateral & settlement. Also, if exchanges obtain regulatory approval to operate DLT-based trading systems (e.g., BX Digital/Stuttgart Exchange), they set up a regulated environment where tokenized securities can be traded & settled on-chain.

- Tokenisation, issuance platforms (fintech layer): Companies like Paxos and other regulated token issuers offer the plumbing layer for stablecoins, tokenized securities, as well as issuance. This is important since they are the on-chain anchors that investors use. Please note that regulatory enforcement determines the viability of a company as a partner.

Public Blockchains Vs. Permissioned Chains

A strategy of multiple chains is employed by the institutions: permissioned chains that emphasize a level of control with a degree of privacy; public chains (and permissioned uses of public technology). A review of analyses by TechTarget and the industry identifies Ethereum, Hyperledger Fabric, Corda, and others as platforms under consideration.

Case Studies: Real-World Production Techniques That You Can See In Practice

JP Morgan – From Onyx to Kinexys: Tokenized Deposits & Treasuries

JP Morgan develops a blockchain subsidiary called Kinexys and describes the process of tokenized asset production and depositing. They also undertake the first public transaction of tokenized treasuries on a public blockchain network, as well as collaborating with a custody partner in tokenized debt adoption. This is a bank that integrates client relationships, settlement capabilities, as well as the development of a ledger system.

BlackRock: Tokenised Funds & Institutional Distribution

BlackRock has indicated and rolled out tokenized fund offerings that rely on existing asset management, distribution and custody relationships. As a scale manager like BlackRock, the promise of tokenization is operational efficiency and a new constituency of investors (fractional, institutional, worldwide). Coverage in the press focuses on BlackRock’s vision for tokenization.

Deutsche Bank & KfW – Regulated Tokenized Bond Issuance

This is evident in a tokenized bond offering, where Deutsche Bank acted as a book runner for KfW, reflecting the viability of conventional bond issuance on tokenized rails with approval from the relevant authorities in Europe. This particular transaction demonstrates tokenization in a sovereign/quasi-sovereign environment rather than consumer-level tokens.

$8.3B worth of real-world assets are now on-chain and the banks are finally joining the race.

For years, they ignored crypto custody. Now, they’re racing to tokenize trillions in cash and securities.

Goldman Sachs, Citi, and BlackRock are quietly rebuilding the… pic.twitter.com/nFDzD9jwPY

— Renta Network (@RentaNetwork) October 30, 2025

BX Digital/Stuttgart Subsidiary – Approval Of Regulated DLT Trading System

Switzerland’s national regulators approved a trading environment that uses blockchain-based settlement systems, proving that national supervisors will accept DLT TSS structures under strict controls. This is irrefutable evidence that regulated markets can move the process of trading as well as settlement to DLT without compromising supervisory goals.

Custody Metrics & Institutional Risk Posture

Custody is the gatekeeper: “Low current allocations, high intent.” A large-scale survey shows that most orgs today hold not much more than a small allocation to digital assets, but signal a greater allocation as a result of improvements in custody solutions and regulations. It is a classic “wait-and-see” attitude until custody solutions and regulations are in line with fiduciary norms.

Custody concentration risk: As the large banks and trust companies grow in the custody business, there is a risk of operational concentration. This concentration eliminates certain risks (insured custody, audited custody), introducing new risks of operational failure with system-wide controls that concern supervisors. This is a concern of institutional committees.

Insurance & legal wrappers set the adoption rate: Custody funds that commit to insurance initiatives, legal title simplification, and combined report adoption will accelerate institutional sign-offs. Otherwise, most risk committees will not allocate long-term money.

Regulatory Environment: The Importance Of The 3 Big Levers

Rights & Disclosure Norms: Authorities require that rights of shareholders, dividends, & governance rights in tokenized instruments be explicitly disclosed. Deceptive instruments pose warning indicators & restrict access.

Market Infrastructure Approvals: A lack of approval means that exchanges/clearing organizations will not allow DLT-based trading and settlement systems to operate. Approval is important as tokenized markets gain acceptance. Approval in Switzerland is a positive initiative, as well as sandboxes in other countries.

Stablecoin & Payments Policy: Tokenized settlement requires well-functioning, regulated settlement currencies (stablecoins, central bank digital currencies). Policymaker views of stablecoins influence the use of liquidity channels suitable for tokenized financial instruments. The role of central banks, commercial banks, and regulated stablecoin issuers in tokenized settlement is important.

TokenSuite: Operational Infrastructure for Regulated Digital Assets

TokenSuite provides a unified operating layer for compliant digital asset lifecycle management, including issuance, KYC/AML onboarding, investor operations, payout automation, permission controls, reporting and… pic.twitter.com/p2XRWCEqjS

— tokenforge (@tokenforge) November 2, 2025

Also Read: North Korea Cryptocurrency Hacking Hits $2.84 Billion In Global Thefts

Actionable Checklist For Institutions & Wealth Managers (Practical Steps)

If you oversee institutional capital or counsel trustees, here is a concise operational checklist to prepare:

- Organize a working group that is cross-functional. This group needs to include legal, compliance, custody, operations, as well as investment groups. Tokenization is relevant to each of them.

- Prioritize running scope-narrow, high-return pilots first. Begin with operations-related use cases (subscription/redemption of funds, short-term instruments, re-hypothecation of collateral) where the optimizer’s benefits of faster settlement times are clear.

- Screen and vet custody partners for legal wrappers & insurance. Ask for title transfer language, insurance ceilings, audit trails & recovery processes. Insist on integration with the existing stack of reports.

- Determine jurisdictional treatment. Tokenized instruments often present varying legal effects in international jurisdictions. Determine where shareholders’ rights, taxation, and investor protections are held.

- Establish failure modes and playbook executions. Model custody compromise, oracle failures, smart contract issues, and insolvency. Build operational playbooks and verify them.

- Engage in market infrastructure pilots. Take part in industry sandboxes and market infrastructure consortia to help drive interoperability and standards that benefit institutions.

- Educate trustees and end clients. Make sure product descriptions address issues of token-based legal ownership, voting rights, dividends, and corporate actions. (oecd)

Final Thoughts: The Inflection Is Real, But A Warning

We are at a point of inflection, not completion. It is the pace of banks, custody, and markets that is the defining indicator that, rather than experimentation, productization of the use of the ledger is occurring. This is altering plumbing, pricing, and product. Still, adoption is a prerequisite of custody strength, regulatory certainty, and interoperability.

Frequently Asked Questions

- Q: What is tokenization, and why is this important to institutions?

A: Tokenisation is the process of representing a real-world asset on a blockchain in a digital form. It matters to institutions as tokenisation results in reduced costs, faster settlement, fractional ownership, as well as new sources of liquidity in the case of less-liquid assets. - Q: Are tokenized stocks the same as owning shares?

A: This is not always the case. Some tokenized products reflect price exposure but do not necessarily offer shareholder rights such as voting rights and dividends. Regulators warn investors that they need to verify rights offered in tokenized products. - Q: Will banks reign over cryptos if they operate custody and token services?

A: Custody risk will be held by banks running custody rails that they control, which centralizes custody risk. This is a safety feature for conservatively managed funds, but one can question decentralization as a concept if a few giant institutions dominate custody. - Q: What blockchains are the institutions employing?

A: They prefer private/permissioned ledgers as well as public chains that possess the ability to scale as well as connect with the settlement systems. It is evident in new partnerships that involve multiple chains where businesses choose the appropriate ledger type. - Q: How fast will this alter the market structure?

A: Change is not even across the board. Some pieces, such as tokenization of private funds and short-term settlement, are progressing faster as they offer tangible operational returns. More fundamental changes to markets, such as tokenized equities in a broad range of jurisdictions, require regulatory standardization initiatives. - Q: Are tokenized securities secure in a fiduciary portfolio?

A: They can, if legal title, custody insurance, auditability, and regulatory certainty are in place. Safety is less about the books and more about legal and operational architecture. You vet those components thoroughly. - Q: Will tokenization compress the settlement cycle to seconds?

A: Technically yes on-chain finality, but practical finality is a result of integration with on- & off-chain systems (custody, central bank settlement, legal transfer of funds). Significant reductions will be expected where there is integration of the entire flow. - Q: What jurisdictions are leaders in adoption?

A: Some European countries, as well as certain US market infrastructure entities, lead in sandboxes and approvals; Switzerland, EU regions, and large US banks are also active. Positioning of local regulators influences speed.

Q: How will retail investors be affected?

A: Initially, this is indirect spreads will typically tighten as overall institutional liquidity increases. Also, the extent of retail exposure to tokenized instruments will depend on jurisdictional regulations and how distributors choose to offer tokenized risk exposure.