The U.S. Federal Reserve decides to cut the policy rate by 25 basis points and halts the process of quantitative policy tightening. Markets start reacting to it in just hours: major cryptos go down, while volatility reaches new heights because investors begin to revalue the new inflation hedge in less than an hour with loosened monetary policies. The price of one Bitcoin falls below the mark of US$109,000, while the total market cap of the global crypto market falls. There is only one question in mind: Does monetary easing help crypto, or is there something to the story that is very weak? (economictimes)

Fed rate cut rattles crypto as Bitcoin slips below US$109K. (Image Source: CCN.com)

What Happened: The Mechanics In Plain Terms

The Fed reduced interest rates by 25 basis points and announced it would stop shrinking the balance sheet. The decrease in rates should make it even cheaper to borrow, and it should theoretically lure investors to search for higher-risk investments with higher rewards, even in cryptocurrency markets. The action in the market shows it doesn’t work that way. Some markets go up, and others go down. Markets are far more complex than that.

Nevertheless, the view of politicians and forward guidance is of comparable importance to the policy itself. Markets can be unsettled by the encouraging yet indecisive Fed outlook, while volatility punishes uncertainty swiftly. The current signals of the Fed on the future timeline instill more volatility than the actual policy cut itself.

The Early Market Performance: The Numbers That Matter

Within 24 hours, the price of Bitcoin corrects by a few percentage points, while the values of Ethereum and other altcoins start to follow suit in line with the market trend. The market capitalization of cryptocurrencies is expected to go back below major psychological markers in line with market risk aversion moods across the world in general.

At the same time, equities and the U.S. dollar see mixed action while the stronger dollar and aggressive rhetoric can play havoc with the risk-on impact of the rate cut, resulting in erratic and downright puzzling action where correlation rules between stocks, dollars, and crypto go haywire. (economictimes)

What Makes It Such A Double-Edged Sword For Crypto

On paper, loose policy is good for risk assets. The lower the yields, the less the marginal benefit in holding something that doesn’t yield: that is, in principle, why “crypto is digital gold” works.

The First Edge: It Promotes Liquidity

Lower rates and the pause in quantitative tightening policies enhance the liquidity position in the market in the medium term, thereby improving risk appetite in the process. This might help aid crypto prices if funds leave for higher-yielding alternatives.

Second Edge: Confidence

Rate reduction might pose challenges to the economy as well. The investors feel there are safer investments elsewhere if they understand the Fed action in that light, resulting in cryptos dropping in prices, ironically enough! When investments come in but with no confidence, cryptos suffer in performance. This has been witnessed in the current market performance.

The Players: Traders, Funds, And Positioning Stories Of Jagged Turns

Crypto markets are very volatile because there is hefty leverage and congested positioning. If funds and leveraged players see a soft landing and the Fed action does appear to validate that, flows start to flow to risk assets. But if trend shifts or macro headlines start to reappear, portfolios reposition very quickly.

The cost of margin borrowing goes lower with every cut in interest rates, attracting levered buyers. On the one hand, it accelerates selling pressures in light of uncertainty, while on the other hand, it accelerates extreme selling pressures in light of extremely low market sentiment, thereby making every single line-break in the Fed or every single presentation in the market an event in itself.

Lower rates fuel leveraged bets, but uncertainty keeps crypto on a knife’s edge. (Image Source: Nairametrics)

Its Current Real-World Significance: Who Is Hurt/Affected

Individual investors feel the trickle-down effect in terms of the ripple effect in their portfolios. The hedge funds revalue volatility hedge portfolios. Institutions watch custody flows, on-ramps, and if the corporate treasuries ease crypto derivatives regulations. Small businesses contemplating crypto payment salaries watch FX prices and market liquidity. The trickle-down effect of the Fed action extends to all adoption and planning levels.

For conventional investors, the situation is dire: macroeconomic policies can reverse the equations of short-term risks within one night only. For institutional investors, the situation is trickier: Interest Rate Cuts impact returns only if confidence and regulation work in sync. The story would now face the test of real time, with cryptocurrencies’ independence from monetary policies on trial. (decrypt)

The Story Being Investigated: Inflation Hedge Or Macro Plaything?

Crypto must demonstrate it has uses other than being an investment instrument: it has to be more than “buy, hold, and pray.” Lowered rates offer it a stress test to see if it has any other uses aside from monetary functions.

If Bitcoin and larger tokens continue to progress higher after the easing, the inflation hedge argument becomes more viable. Alternatively, if they continue to fluctuate or trend lower, there would be an emphasis on correlation with market sentiment and market ease of access to assert that the crypto market functions in parallel with other risk assets in terms of market performance. The current market trend is not refuting or confirming any argument at this stage.

What Analysts Are Saying: Themes, Not Quotes

There are three themes pointed out by experts:

- Positions matter it is very much related to overcrowded sectors and leveraged flows.

- Policy trumped headlines or vice versa: it can be trumped by forward guidance or uncertainty coming from the Fed.

- The time horizon makes it clear which outcome to expect: in the short term, there is more volatility, whereas in months, if there is an improvement in macro fundamentals, loosened monetary policy encourages risk assets.

Euphoria masks real-economy erosion. The FCI shows markets easing ahead of the Fed—ATH stocks, soft yields, & tight spreads fuel a reflexive loop of momentum, not resilience. Beneath the liquidity tide lie rising repos, bankruptcies, and layoffs—the cracks easy money can’t hide https://t.co/NqOtDIRxet

— Kong Kong Kubs (@3benson) October 29, 2025

Where It Goes Next: What To Watch This Week

Three things to keep an eye on: Fed rhetoric/speeches, inflation numbers, and market liquidity data. Also, the correlation between bitcoin and stocks and between bitcoin and USD. If the correlation between bitcoin and stocks goes higher, it shows that bitcoin is being viewed more as a risk asset than an inflation hedge.

What Matters Structurally in the Fed’s Action: Three Related Processes

The Fed’s policy can be treated as one event with impacts in three channels:

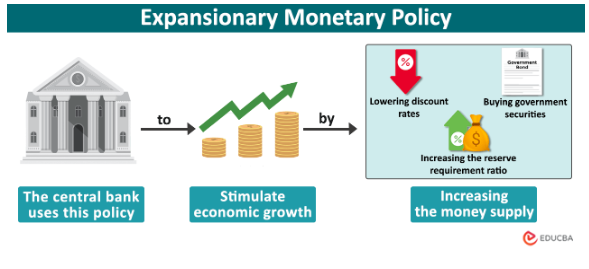

Liquidity Channel

The end of QT policies and lower interest rates would imply more reserves in the bank and better terms for funding. More funds might move to where the higher returns are, which would include crypto if that is where funds decide to go to earn higher returns.

Signal Channel

This might be interpreted in either of two ways: it might be taken to signal weakness in the economy and the need to fill in missing growth areas, or it might signal problems with growth rather than confirmation of reflationary processes being in place and working effectively. There are also forecasts about “buy the rumour, sell the fact” cases to emerge in different scenarios.

Positioning & Leverage Channel

The crypto market features very high leverage ratios. Even small market news leads to large market price movements in accordance with the combination of funding, margin, and market positioning factors. It helps in lowering the borrowing cost, thereby encouraging leverage, while it escalates the risk of large unwinds in case market sentiment reverses.

These forces work with and against each other. Liquidity trickles in slowly, while market sentiment evolves very rapidly. The net outcome would depend on which of these forces becomes more dominant in the days and weeks that follow the policy announcement. (researchgate)

The Fed’s move fuels liquidity but sharpens market risk. (Image Source: EDUCBA)

Case Study: The ‘Buy The Rumour, Sell The Fact’ Pattern: The Play-Book

There are very good lessons from history. Markets tend to go to the level where there is an easing of policies, and after reaching that level, they correct with the actual easing because they would have managed prices in advance to capitalize on the ease in monetary policies.

What has been happening has been happening in the prices recently. The crypto goes higher before the Fed meeting, and it goes lower after because of traders locking in profits and reevaluating risks in accordance with the Fed’s guidance on the crypto market. This process goes on and on until there is something different to tell in the macro story, perhaps indicators of low real yields or ETF flows to crypto.

Markets often follow the ‘buy the rumor, sell the news’ pattern during FOMC meetings, as expectations are priced in ahead of the announcement. https://t.co/kAENPimH7o pic.twitter.com/72tb4kdAfV

— Crypto | Stocks | Freedom (@Wealthmanagerrr) October 27, 2025

Behavior in Organizations: Who Moves and Why

Institutional

- The action taken by the Fed has different meanings to different market players.

- Retailer traders are headline traders. They are known to be action-oriented and can trigger cascade-style exiting on derivatives market platforms.

- The hedge funds and prop traders are looking for directional alpha and volatility trades. They make adjustments to their delta and gamma risks very quickly, and sometimes they go short on “fade” after the cut takes place.

- Long only institutional funds (pensions and endowments) take time to make any moves in crypto markets. They wait and pendent any macro trend volatility before making any crypto-related investment strategies.

- ETF managers keep close watch on flows, and any change in the real yield curve and weakening of the dollar can spark ETF flows that can greatly modify market structure, which is what analysts would be waiting to see. (jpmorganchase)

The Key Point

Liquidity has to come from somewhere, but only patient, unleveraged capital can properly facilitate price discovery in the market. It would seem, however, that the major price driver in crypto markets is currently impatient; unleveraged capital and volatility are the key ingredients.

The Art of Technical Analysis: Technicals and Market Microstructure, The Thin Places Hurt Most

When market depth declines, even small market orders imply prices being moved. Data from the stock market shows less market depth after meetings, resulting in stronger retracements and higher market slippage in large market orders. Smaller markets imply larger market movements. This is why market cap declines even with good market signals.

Monitoring Funding Rates, Open Interest, and Exchange Order Book Depth

When there is negative funding and reduced open interest, it indicates to you that it is a short-term deleveraging process rather than being committed in the long term.

The Policy Prism: Regulation and Why It Matters Beyond Price

Monetary policy works in a macroeconomic environment where, in the year 2025, regulation takes an equally significant standpoint:

- The ETF and custody industry gets clarity on institutional flows. The rule makers facilitate custody, and institutional adoption of ETFs becomes expedited in any case, regardless of the Fed’s action on it.

- Those related to stablecoin regulation and banking laws constitute plumbing. Simplified monetary policies might facilitate the adoption of stablecoins, while unclear policies might constrain on-ramps.

- The macroprudential policies might imply different interaction scenarios between banks and cryptos. The current pause in bank QT makes it easier to calculate bank funding, while supervisory policies might constrain volatility exposure in bank prices.

- So, in simpler terms, even if the macro-related dial goes in the direction of ease, it is not the Fed that leads the institutional capital in the crypto market.

Stage 2 is happening:

1) Bitcoin, Ether and soon stable coins will be allowed by U.S. commercial banks as collateral because U.S. tech giants will force their customers (domestic to convert USD into stable coins in order to use their services.

2) U.S. tech giants will hold… pic.twitter.com/OedUcIfQky

— Eric Yeung (@KingKong9888) October 25, 2025

Institutional Adoption: Is It Indeed Maturing?

While some analysts feel that institutional capital has now become a force for stabilization, others feel that it is still very tenuous at best. The truth must lie somewhere in between.

Fed Rate Cut Shakes Crypto Market Game-Changer Put To Test

While ETFs and treasury allocations of crypto have brought in more assets, institutional investors are looking at crypto strategically. It’s only a small pie in the big bucket, not an on-ramp to cash or gold yet. For crypto to work on its own in the marketplace in terms of being an asset class for a store of value, you need institutional ownership across macro cycles, and we’re not there yet.

Scenario Planning: Three Possible Scenarios In 6 To 12 Months

In attempting to grasp the significance of the noise, there must be three different scenarios considered. These scenarios are valid and would depend on Federal communications, data prints, and regulator movements.

Dovish Pivot + Confidence Back In Play

Powell goes dovish, inflation expectations moderate, and real yields trend lower. Dollar falls, ETF/retail funds’ growth becomes more aggressive, cryptos start to de-link from equities. Volatility realigns with higher unlevered funds. This trend: bullish prices on the horizon.

The Mixed Signals + “Sell The News”

The Fed cuts but holds the hawkish tone. Markets treat it ambiguously. There is profit-taking in the derivatives market, while correlation to equities strengthens further. The crypto market lags because risk assets are repriced in the market. What one observes in such an environment is that the policy guidance takes precedence over the number in terms of cutting the rates.

Volatility In Policy + Regulatory Clamp-Downs

“Global political or regulatory shocks meet uncertainty at the Fed.” Funding dries up, loan terms evolve, and crypto “liquidity becomes more fragmented” because “volatility mushrooms while adoption languishes in the worst case” and underscores “fragility of crypto ‘independent store of value’ thesis.”

Application Guide: What Different Market Players Should Currently Do

Action will always beat equivocation. Here is the list, personalized by roles:

Retail Traders

Reduce leverage, enhance risk management, and avoid ‘all in’ trades on policy headlines. Rebalancing trades should be small over time rather than large directional levered trades.

Leveraged Funds

The key is to watch funding rates and develop contingency plans in the event of sudden de-leveraging. Option strategies must hedge Gamma in major Fed meetings.

Long Only Managers

Timing considerations after volatility events. DCA in context with risks associated with market liquidity and regulatory considerations.

Developers & Businesses

Operational resilience is key. FX volatility can be expected, and treasury planning must cater to pending cash flows rather than concentrate on crypto.

Also Read: Crypto As a Pathway To Homeownership Australia: Young Adults Regret Missing the Bitcoin Boom

The Human Moment: What It Portends To The Average Person

For small enterprises engaged in cryptocurrency payment trials, the most observable impact is operationally oriented with respect to price action, market spread, and FX risk volatility. For the saver, the headlines “Fed cuts” can be somewhat remote, with the situation defined within market values fluctuating in portfolios and ongoing discourses on where to place funds.

That human reality has importance. The markets are not simply points in an equation. The markets distribute investment funds, compensate workers, and even assist in decision-making processes. The Fed policy is one of the elements that condition individuals to utilize crypto technology either for speculative or payment and savings needs.

Final Thought: A Subtle Test, Not A Judgment

The current Fed intervention is only a stress test, not an exam to pass. It exposes structural issues: being reliant on leveraged funds, being less liquid, and facing regulatory risks. It indicates, however, where there should be steady policy orientation, lower real yields, and simpler regulations to persuasively accrue patient funds in the crypto market.

If you’re convinced that crypto has deep-seated promise, you can live with the messiness. Financial markets, in general, are where nothing is strictly proven conclusively and cleanly. “A useful take-away from this episode is that any story of crypto being a permanent independent ‘game-changer’ should henceforth carry with it this aside: crypto policy, likely to remain small, but not irrelevant to the macro game.” The crypto game must not lose itself in correlation with risk if it wishes to remain one.

https://youtu.be/034i4VVDr54

Frequently Asked Questions (FAQ)

- Q: Would a Fed Rate Cut Help Crypto?

A: No. Rate cuts can instill market conditions in which risk assets perform well, but crypto markets are primarily driven by market confidence and liquidity. If the slowdown hints at trouble in the economy or if there is any kind of confusion in Fed policies, crypto can underperform. - Q: What was the effect on the price of Bitcoin despite the cut?

A: The market: The market can interpret complex policy: a cut and careful word can trigger selling and risk aversion. Also, a stronger currency or sector shifts can undo the expected boosting effect to risk assets from the cut. - Q: Is halting the QT process good for crypto?

A: No. The halting of QT improves market liquidity, so it is positively viewed in risk assets. But it should be well managed in terms of policy timing and confidence effects. - Q: What should retail investors do now?

A: Understand position-sizing requirements, avoid over-leveraging, implement stop-losses, and pay attention to macro headlines. Distinguish between faith in crypto on one side and market noise on the macroeconomic policy-related headlines on the other side. - Q: Is crypto still a good inflation hedge?

A: The data is still mixed. While the reduction in rates supports the inflation hedge story, short-term market behavior indicates that crypto behaves similarly to risk assets in turbulent market environments. - Q: Is halting QT sufficient to fuel a bull market in crypto?

A: Not on its own. Unsuspending QT helps with adding liquidity, while sustained rallies require low real yields, certainty on regulation, and institutional funds, particularly unlevered institutional funds. - Q: If crypto were still correlated with equities, would it still be useful for diversification?

A: Correlations are dynamic in nature. If crypto has higher correlations with equities in risk-on periods, the diversification effect of crypto becomes less. But on a larger time horizon, crypto-specific features may resurface with maturity in terms of regulation, custody, and market infrastructure if they haven’t done so yet. - Q: Should investors treat crypto similarly to gold after a Fed cut?

A: No. Gold has depth in the market, institutional demand in periods of sovereign stress, and regulatory certainty. Crypto has yet to see sustained institutional demand in macro stress scenarios in the sovereign space. Class crypto investments are in the high volatility/higher risk category rather than gold substitutes.