JPMorgan is coming out of the prototype phase and into actual on-chain banking. The bank recently introduced a permissioned USD deposit token for institutional customers JPMD and is deploying software that lets those clients transfer bank money onto public blockchains 24/7. And while that, reporting says, will let institutional customers use Bitcoin and Ether as collateral on loans under a custody, managed environment. Together, they indicate a concerted effort to move traditional bank balance-sheet business natively onto blockchains but keep it on regulated banking rails. (decrypt)

JPMorgan redefines the link between crypto and traditional finance. (Image Source: Live Bitcoin News)

Why It Matters

- Tokenised bank deposits allow institutional money to flow on-chain in real-time, rather than waiting for slow, business-hour-constrained settlement windows.

- The use of Bitcoin and Ether as collateral offers institutions another way to finance crypto exposure without the need to tap unregulated counterparties.

- By keeping tokens permissioned and anchored to covered deposits, JPMorgan places the technology as an adjunct to banking, rather than a replacement.

The News Behind The Headlines

You don’t have to be a crypto insider to feel the weight. Imagine your business could move USD between counterparties in seconds, around the clock, with the same legal protections you expect from bank deposits. That’s what JPMorgan’s deposit token proof-of-concept aims to demonstrate. The bank has placed JPMD on a public Layer-2 network, Coinbase’s Base, but access remains permissioned to institutional clients. This hybrid marries the composability and velocity of public blockchains with anti-money-laundering and know-your-customer controls.

In the meantime, its suggestion that institutions can use Bitcoin and Ether as collateral for loans brings crypto assets onto a more responsible balance-sheet basis rather than as speculative fads. Rather than having clients go off-platform for crypto lending, JPMorgan is proposing a bank-regulated path through third-party custody and regulated lending practices. For corporate treasurers and fund managers, that kills frictions and diminishes legal uncertainty.

How JPMorgan Is Putting The Pieces Together

JPMorgan’s approach is intentionally modular and incremental:

- Tokenised Deposits (JPMD): A deposit token is a tokenized on-chain form of USD deposits that can be routed between institutional wallets 24/7. It’s a permissioned token built as a proof-of-concept on Base, intended for institutional rails only, not retail.

- Permissioned Custody And Access: Issuance and distribution stay strictly in JPMorgan’s control. Third-party custodians and bank oversight stand between on-chain tokens and the balance sheet of the crypto universe, a nod to compliance experts and regulators.

- Collateral Programs: Having BTC and ETH serve as collateral in certain programs, the bank aims to free capital and create lending products in which crypto would be a more secure underlying collateral, but within bank risk regimes and custodian stewardship.

- Plugging Into In-Place Markets: Tokenized deposits work best when everybody involved (counterparties, clearinghouses, custodians) is working off the same standards. JFK, sorry, JPM is dragging partners and customers along to ensure that the token does indeed have utility within institutional workflows.

The old gods are melting.

JPMorgan, the stone fortress of traditional finance, is now accepting Bitcoin and Ether as collateral.

The very asset designed to burn their system down is now being woven into its core. Clients can pledge their crypto, held by third-party custodians,… pic.twitter.com/ul4nQmrSs4

— Shanaka Anslem Perera ⚡ (@shanaka86) October 24, 2025

The Practical Pay-Off: Less Costly, Quicker, Programmable Money

For institutional treasurers and traders, the benefits are self-evident. Tokenised deposits reduce settlement from days (or even hours) to practically zero. That minimizes counterparty risk and decreases pre-funding needs. It also facilitates programmable finance: smart contracts can settle derivatives when events deliver them up, manage cash, or disburse a payroll, all with bank-grade custody and compliance packaged in.

By taking crypto as collateral, institutions are able to fund positions or gain access to liquidity without needing to sell long-hold crypto. That would cut down forced selling and reduce squeeze-driven volatility.

What This Doesn’t Necessarily Change

It’s not a consumer stablecoin. JPMorgan’s deposit token is permissioned and institutional workflow-focused; it doesn’t aim to replace central bank money for consumers’ everyday use. And while tokenised deposits can settle between institutions or banks faster, cross-bank interoperability continues to depend on technical and contractual network effects. Others worry that if a significant number of large banks do not agree to back shared standards, tokenised deposits will only speed up transfers between those that already have them in place.

Risks And Regulatory Tightropes

Banks are prudentially regulated. Reducing deposits into on-chain tokens creates accounting, insurance, and reserve problems. Regulators would be keen to understand how deposit insurance maps to on-chain tokens, how tokenised balances clear to ledgers, and what the impact of a cyber attack would be. JPMorgan’s permissioned solution addresses those issues, but also suggests that the solution may not have the wide-openness decentralized crypto enthusiasts cherish.

Concentration is another danger: if tokenized deposits succeed but are offered only to a limited group of banks, the banks acquire disproportionate power over on-chain commercial cash flows. That breeds competition and system-risk concerns that regulators will be compelled to investigate. (fsb)

JPMorgan’s on-chain move raises new regulatory and security concerns. (Image Source: WallStreetMojo)

Competition And Market Context

JPMorgan is not the only one. Pilot projects are underway at the large banks, asset managers, and custodians on money-market fund tokenisation, tokenised Treasuries, and deposit tokens. Citi, Goldman, BNY Mellon and others are experimenting with adjacent use cases. JPMorgan’s differentiator in this case is scale and intent: the bank is building both the plumbing and client-facing interfaces and is doing so on a public Layer-2, and not just on private blockchains. That hybrid gamble may accelerate adoption if it hits the optimal balance between openness and control.

Practical Reality: A Short Sketch

Take an Australian international trading desk in Sydney needing to settle a USD equity transaction against a New York counterparty at 2 am AEST. They currently need to wait for New York bank hours and correspondent bank settlement. With tokenised deposit, counterparties can settle in real-time on-chain, freeing capital and eliminating overnight settlement risk. Sydney desk, which is holding Bitcoin as a strategic position, can use BTC to collateralise short-term USD liquidity borrowing without having to close the trade all, once more, under bank-monitored custody. It’s not future fantasy; it’s the simple value proposition JPMorgan is presenting to its institutional customers.

Who Wins, Who Waits With Bated Breath

Early Winners: Behemoth fund managers, corporate treasuries, hedge funds and crypto-native institutions with institutional relationships who suck up velocity and regulated rails.

Doubtful Players: Smaller banks and non-bank payment firms who may end up holding the bag based on the token standards of the largest banks. Regulators are watching too; they do not wish modernization to create new systemic vulnerabilities.

Sceptics: Observers worry that tokenised deposits will merely shift existing frictions and re-form them in digital form, creating new central points of failure or strengthening market incumbents. The Financial Times has stated that deposit tokens are a long way from being a payment innovation unless broader interoperability follows.

The Tech And Legal Plumbing Behind The Scenes (Brief)

Under the hood, you’ll find familiar blockchain elements, smart contracts, public Layer-2 rails, and programmable settlement, but wrapped in bank-grade permissioning, KYC and custody workflows. Legal teams draft contractual terms tying on-chain tokens back to deposit accounts, while auditors and regulators examine reserve treatment, insured balances and reconciliation procedures. That legal scaffolding makes the difference between an experimental token and an enterprise-grade banking instrument.

JPMorgan fuses blockchain with banking compliance for secure on-chain finance. (Image Source: link.springer.com)

Real-Time Notification To Practitioners And Markets

- Expect additional pilot programs from incumbent banks over the coming months as they race to set norms.

- Institutional crypto markets should see closer integration with bank liquidity, removing some execution risk for large players.

- Regulators will demand to know about insurance, reserves and cross-border implications. The long-term tokenised banking model is waiting on those answers.

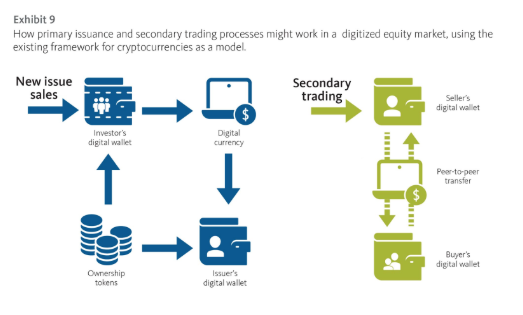

How The Plumbing Really Works: Step By Step

- Issue And Legal Attachment: JPMD is a right to a USD deposit with J.P. Morgan via Kinexys. Legal contracts tie the on-chain token to the deposits ledger in such a way that a token holder on-chain has the same contractual right as an off-chain depositor. That connection is important; it’s how banks contend that on-chain tokens aren’t “crypto money” but tokenized banking obligations.

- Permissioning And KYC: Permissioning is available for access to JPMD. Users need to meet identity and compliance checks. The permission layer blocks anonymous players from accessing the token and maintains AML/KYC controls in place while still allowing institutions to interact on a public Layer-2.

- On-Chain Transfer And Settlement: After the issue, JPMD moves between wallets on Base (an Ethereum Layer-2). Transfers settle on-chain in seconds to minutes, depending on Layer-2 finality, permitting near-instant liquidity flows outside of banking hours. That’s the key operational benefit.

- Custody And Collateral Procedures: Crypto is used by the bank with recourse to contractual promises and regulated third-party custodians as collateral. Custodians hold BTC/ETH, the bank holds perfected security interest, and the terms of the loan are margin triggers, haircuts and liquidation procedures, all pre-agreed. Reporting confirms JPMorgan claims such structures for managing volatility and legal sophistication.

- Accounting And Reconciliation: Token balances on-chain are reconciled with the bank’s general ledger through periodic or near-real-time reconciliation. Accountants verify the alignment of token holdings with book records, and reserve treatments determine whether the tokenized liability shows as part of the deposit base or as a separate instrument, a significant accounting consideration. Clarity in the law and reserve treatment are emphasized in JPMorgan’s communications under the pilot. (marketsmedia)

JPMorgan ties blockchain tokens to real deposits for fast, regulated transactions. (Image Source: Markets Media)

Counterparty Risk: Banks’ Crypto Collateral Modeling

- Compelling banks to formalize multiple risk inputs on the use of BTC and ETH as collateral:

- Price Volatility And Haircuts. Banks apply conservative haircuts such that the value of the borrower’s collateral is greater than the loan exposure even during stress scenarios. Let us assume a higher haircut on crypto compared to liquid sovereign bonds. Regulators and internal risk teams model tail events to calibrate them.

- Liquidity Risk. In case of borrower default, the bank needs to be able to sell collateral without going too far out in markets. That leads banks to very liquid on-ramps and contract provisions to have liquidation windows.

- Custodial Counterparty Risk. The custodian becomes a critical node. Custody arrangements must include segregation, recoverability guarantees and insolvency or cyber hack playbooks. Be cautious of banks that depend on big regulated custodians and have a failover.

- Operational And Legal Enforceability Risk. Banks stress-test the legal infrastructure cross-border to keep security interests legally enforceable. That affects cross-border lending and collateral treatment under local insolvency regimes.

Accounting And Regulatory Treatment The Unknowns (And Likely Results)

Regulators and auditors will be interested in three things:

- Treatment of Reserve And Deposit Insurance: When a token may be considered to be an insured deposit, the bank must account for the on-chain balance mappings to insurance frameworks. JPMorgan says the token is linked to insured deposits, but the nuance is a function of legal form and jurisdiction.

- Capital And Liquidity Reporting: Tokenised deposits may be included as deposit funding in the event of liquidity ratios, which might reduce banks’ funding costs. However, if tokenised flows result in increased intraday volatility, supervisors can request a higher buffer. Public pilots will indicate supervisors’ tolerance.

- Operational Resilience And Cyber Regulation: Regulators will apply whether on-chain protocols have operational resilience. Public Layer-2 usage emphasizes third-party infrastructure risk and contract SLAs. Banks will have to show they are able to recover services and reconciliation of balances in stress.

Bottom line: pilots like JPMD will provide direction for accounting practice, but full regulatory clarity will be time-consuming and require regulator discussion.

Practical Playbook For Treasurers And Asset Managers

If you have institutional crypto or cash exposure, here is a helpful checklist to prepare for JPMD-type rails and bank-offered crypto collateral.

- Map Out Use Cases To Begin With: Determine where instant settlement solves real pain points: cross-border payables, real-time margin calls, intraday FX swaps, automated settlement of tokenised securities.

- Do A Legal And Tax Analysis: Get advice on how tokenised deposits interact with local deposit protection schemes, taxation treatment, and insolvency law.

- Model Haircuts And Liquidity: Stress Test Simulations under various price movements and horizons of liquidity for crypto borrowing. Factor in custodian charges and liquidation slippage.

- Choose Custody Partners: Employ custodians with institutional roots and openly disclosed recovery terms. Choose multi-custodian arrangements where there is greater exposure.

- Re-Design Treasury Infrastructure: Make TMS (treasury management systems) on-chain confirmation capable and reconcile to general ledgers. Expect integration work with the custodian and bank APIs.

- Set Boundaries And Control: Create internal policy regarding permissible collateral types, concentration levels, and escalation procedures for margin calls.

- Pilot And Begin Small. Utilize small controlled trials and a mutually agreed counterparty to pilot settlement speed, reconciliation, and ops processes.

- Work Your Bank: If tokenised rails exist from JPMorgan or another bank, request a doc on legal terms, custody, audit trails and disaster recovery and get those commitments in writing.

This playbook is designed to convert a headline opportunity into working steps with reduced execution risk.

JPMorgan offers treasurers a roadmap to adopt tokenised deposits safely. (Image Source: Broadridge)

What Industry Voices Are Saying

JPMorgan introduces JPMD as an institutional vehicle for 24/7 settlement on public rails without compromising compliance and legal certainty. The bank calls Kinexys the operating subsidiary for this end.

Market commentators note the move is important but cautious: deposit tokens assist banks on which institutions already have faith, they argue, but will not displace full payments infrastructure in a single night. The Financial Times cautions tokenisation is only going to be revolutionary should several banks agree to utilize shared standards.

Coverage of JPMorgan’s plans to take BTC and ETH as collateral highlights how the bank will be mitigating volatility and legal complexity with third-party custodians and aggressive margining. That could open up debt-funding channels to crypto holders who otherwise would have turned to non-bank lenders.

Practical Risks And Mitigants: A Quick Toolkit

- Risk: Legal Ambiguity Regarding Deposit Status: Mitigation: contractual transparency; request issuers to provide statements and opinions of law confirming deposit status and insurance.

- Risk: Crypto Price Shocks: Mitigation: haircuts, intraday margin calls, liquidation circuit breakers, and pre-arranged OTC liquidity facilities.

- Risk: Custodian Insolvency or Cyber Loss: Mitigation: multi-custodian strategy, insurance top-ups, and contractual segregation with detailed recovery procedures.

- Risk: Layer-2 Network Disruptions: Mitigation: fallbacks of legacy rails, settlement windows off-chain and manual reconciliation playbooks.

Also Read: Crypto Market Reaction to Inflation Data: How US CPI Figures Could Shake Bitcoin and Altcoins

Market Structure And Longer-Term Impacts

If tokenised deposits and bank-backed crypto collateral take off, expect these repercussions:

- Shorter Corporate Treasury Cycles: Treasuries can use cash to maximize with real 24/7 action, decreasing idle cash and pre-funding needs.

- Bigger Institutional Crypto Liquidity: Banks offering regulated credit against crypto can break free from shadow lenders and centralised concentrated counterparties.

- New Plumbing For Tokenised Assets: Tokenised securities and real-world assets are about to lift off, and tokenised cash facilitates atomic settlement flows to make the holy grail of reducing settlement and counterparty risk easier. Kinexys’ cross-chain experimentation is shaping the future.

- Regulatory Guidance And Standardization: The award will be given to individuals who help establish interoperable standards and cooperate with regulators ahead of time. Without going along, tokenization can shatter rather than expand liquidity.

Bottom Line: Pragmatic Modernization, Not Revolution

J.P. Morgan’s moves are pragmatic rather than ideological. They don’t make crypto the monarch; they integrate crypto and on-chain primitives into institutional banking’s toolkit. For asset managers and treasurers, the challenge to come is one of turning potential into solid procedure: legal certainty, risk-conservative models, custodian strength, and reconciliation procedures. For markets, the change can be incremental but extreme, relocating settlement, collateral management, and liquidity arrangements into a 24/7 regime under regulated hats.

Frequently Asked Questions

- Q: Will they take custody of my BTC if I collateralize it with JPMorgan?

A: Ensure to anticipate that the bank will utilize regulated third-party custodians as well as contractual collateralization. The bank may not custody client crypto directly, but instead will rely on custody partners as well as security interests in law. - Q: Retail clients, can they utilize JPMD?

A: Not in pilot. JPMD will be rolled out to institutional customers in permissioned access. Retail access would constitute a separate legal, regulatory and operating effort. - Q: When will it scale?

A: Scale is subject to interoperability, regulator clarity and client uptake. While pilots prove technical feasibility, wide adoption involves common standards and regulator confidence timescales are unlimited. - Q: What is a deposit token precisely?

A: A deposit token is a digital blockchain token that represents a bank deposit. In JPMorgan’s case, JPMD represents USD deposits and allows institutional clients to transfer that balance on an open Layer-2 without sacrificing legal relationships back to the bank ledger. - Q: Is JPMD a stablecoin?

A: Not consumer retail. JPMD is acting as a stablecoin in the sense that there is USD value locked on-chain, but it is permissioned and bank deposit-anchored, not an algorithm or third-party reserve construct. Institution rails-based. - Q: Will on-chain balances be insured by JPMorgan?

A: The bank clarifies that JPMD is an insured deposit (under customary legal arrangements), but specifics are in jurisdictional law and regulators’ and insurers’ definitions of on-chain tokens. Legal professionals are still defining these provisions more clearly. - Q: Accepting Bitcoin and Ether as collateral does JPMorgan endorse crypto?

A: It is framing it as enabling customers to use crypto as collateral — a tool in regulated finance — instead of selling crypto as a retail product. It is a useful step to meet customer demand while limiting risk through the vehicle of lending terms and custody. - Q: Will this transform retail banking?

A: Not immediately. Current pilots cater to institutional clients. As interoperability and regulatory certainty rise, tokenised rails can theoretically have an effect on retail products one day, but that is a mature phase.