2025 is a tipping point. Tokenized real-world assets (RWAs) ranging from mature government bonds to fractional property are on-chain and now a multi-billion-dollar market. Companies and fund managers no longer see tokenisation as something that is lab-done; they’re issuing products settling faster, bypassing middle-office frictions and opening up front-running access to new investor groups. (MarketWatch)

As that, in the meantime, data analysis, routing and automatically replying due to sophisticated models and automation systems begin sitting next to ledgers. That combination speeds up treasury operations, allows more intelligent tokenised bond marketplaces, and gives rise to new services like programmable funds and perpetual settlement. Participants who combine smart automation with ledger technology are capturing investor interest and winning institutional pilots. (Yahoo Finance)

Regulators are moving from rhetoric into rules. UK and other financial center regulators have now moved to make it easier for tokenised funds and clarify how on-chain accounts map through to existing financial law. Those measures are intended to attract traditional investors without putting prudential safety at risk. (Reuters)

2025 is the breakthrough year when real assets go on-chain, faster, and open to more investors. (Image Source: Shamla Tech)

What’s New In 2025: A Swift, Snap Summary

- Scale: Tokenised RWAs scale to low-tens of billions on public and permissioned blockchains, driven by tradable, income-generating securities such as short-term government securities and money-market-like products. (MarketWatch)

- Institutional Focus: Asset managers, exchanges and custodians launched production-grade tokenised securities and funds, not pilots. (Forbes)

- Convergence: Smart automation (models that think with datasets, workflow management and routing optimisation) converges with ledger primitives to auto-settle, auto-validate compliance and speak to investors. (Yahoo Finance)

- Rules: Regulators in the large markets are providing guidance and consultation papers to tokenize money in the regulated area. (FCA)

Why It Matters In Human Terms

Imagine that a Brisbane businessman wants to invest in part of an office block. Instead of waiting for months of paperwork, he purchases fractional ownership tokens or a share of revenues. The transaction is completed immediately; records of ownership are transparent and audit-proof. To investors, it eliminates gatekeepers and offers ultimate liquidity. To administrators, it eliminates midnight spreadsheet surgery and manual reconciliation.

Then imagine a fund manager who wants to rebalance tokenised exposures in bonds. Intelligent automation handles liquidity, risk constraints and market microstructure. It sends trades to the most favorable venues available, settles, and reconciles the fund register on-chain with compliance landmarks in regulators’ line of sight along the way. That eliminates human processes and reduces human oversight. Those everyday efficiency gains are why institutions are sitting up and taking notice. (MarketWatch)

How Intelligent Automation Complements Ledgers (Not A Substitute For Them)

Ledgers give a tamper-evident, shared book. Intelligent automation (data-consuming software that acts and makes decisions) brings orchestration and judgment to the book.

- Trustworthy Data and Oracles: Automation depends on high-quality, auditable price and event streams. Oracles tick off-chain facts (title histories, interest payments) to on-chain agreements.

- Automated Compliance: Rules-based validation (KYC/AML, investor accreditation) is embedded in onboarding procedures; automation discovers exceptions for approval.

- Programmable Payouts: Smart contracts can stream back return, impose vesting and covenants, automation determines when and how those contracts trigger off of real-world occurrences. (xbto.com)

- An example from today: tokenised treasury bill with daily coupon. Cash flow is reconciled, coupon accruals are guaranteed, and real-time ledger tokens are aligned so that investors can view second-by-second balances, putting an end to reconciliation nightmares for custodians and asset managers. (MarketWatch)

Where Tokenisation Is Having The Greatest Impact Today

Government and Corporate Short-Term Debt: These are the largest and most liquid on-chain issuances of RWAs. Institutions like such underlying assets have standard trading and legible legal claims. (MarketWatch)

Tokenised Money-Market Instruments and Funds: Fund units are being fashioned by companies as on-chain tokens in order to speed up NAV calculation and provide permanent liquidity windows. The UK already has more specified tokenised fund rules. (Forbes)

Real Estate Fractionalisation: Tokenisation of property grows, but with increasingly more friction generated off-chain from title and administration nuance. Platforms work with custodians and registries to map legal ownership onto tokens. (growthturbine.com)

Commodities and Other Assets: Tokenisation makes fractional access and simpler transfer mechanics available to all asset classes, from art to private equity tranches. (Medium)

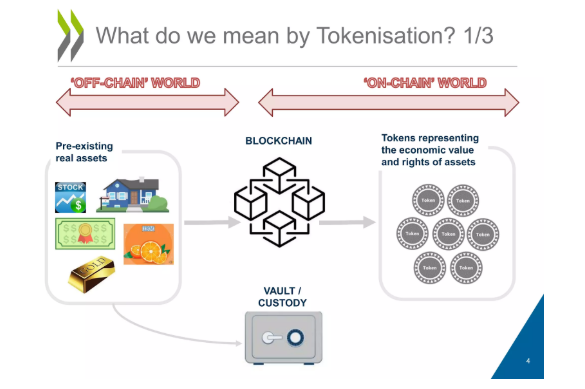

Tokenisation is reshaping debt, money-market funds, real estate, and even commodities. (Image Source: Slideshare)

Examples And Who Is Doing It (Names Are Important)

This is an imbalanced set of players driving this market: tokenisation platforms, custodians, exchanges, banks and specialist integrators. Fintechs and legacy asset managers get tokenised products out to market; specialist platforms simplify issuance and compliance tooling. Industry lists and analytics services monitor many of these live projects and providers. (suffescom.com)

At the same time, orchestration companies between ledgers and smart automation, those firms that combine enterprise streams of data into triggering smart contracts are hired and contracted to do pilots for brokers and banks. They are middleware to production deployment. (Yahoo Finance)

Regulation The Good, The Slow, And The Necessary

Regulators have to act in a balancing game. On one hand, tokenisation reduces costs and increases access. On another hand, legal certainty increases: what does a token stand for in current property, securities and insolvency law?

Recent UK public consultations and design documents indicate a pragmatic route: permit tokenised funds and have operational oversight without undermining current safeguards. Outcome and effect are to make an on-ramp simpler for mass market investors, although the devil would be in the speed of detail with which banks and funds add offerings. (Reuters)

Urgent regulatory issues are custody requirements, settlement finality, cross-border recognition, and whether tokenized product of a given type is a security. Successful companies that have won institutional mandates are those that build compliant structures legal wraps around technical screening. (Crowdfund Insider)

The convergence of global tokenization markets isn’t just a tech challenge—it’s a regulatory chess game @tZERO‘s recent insights highlight something crucial: while we dream of unified digital markets, regulatory fragmentation remains our biggest hurdle. But here’s what’s… pic.twitter.com/mUv8hxzaMD

— Wilson Ye (@wilsonye2025) October 15, 2025

Operational Issues Still In View

- Legal Mapping: On-chain tokens to adjudicable claims in the courts remains incomplete between jurisdictions.

- Custody & Fiat Rails: Move tokens or move funds and receive settlement finality from banks.

- Oracles And Reconciliation: In high-quality off-chain data an oracle might are needed to power automated contract execution.

- Interoperability: There are many token standards and ledgers; cross-chain standards and liquidity are in their infancy.

- Operational Risk: Automation reduces repetitive drudge but introduces systemic dependencies bugs, config errors or bad inputs that propagate quickly.

These are not risks of existence. They are engineering, regulatory and legal ones solvable with disciplined design, insurance, auditing and regulation debate. The next 18–24 months will tell which models scale safely. (xbto.com)

The Business Opportunity Who Does It Benefit And How

- Asset Managers: Lower administration cost, new product architectures (programmable fees, sustainable liquidity), and retail segment access. (Forbes)

- Treasury & Corporates: Lower settlement windows, lower counterparty risk, and improved asset-level visibility.

- Retail Investors: Partial ownership of previously institutional-only assets; greater secondary liquidity and price discovery.

- Fintechs & Middleware: New business models through issuance tooling, custody, compliance and auto-orchestration. (suffescom.com)

Early Signs Of Scale Numbers To Know

Some market players have tokenized RWA balances worth low tens of billions in 2025, which U.S. Treasuries and money-market-like assets account for a gigantic portion of them. The sizes confirm that tokenization is no longer niche anymore, now it’s an institutional mainstay discussion. (MarketWatch)

Tokenized Treasuries: The Backbone Of Scale

What’s Occurring: Tokenized short-term government debt on permissioned and public blockchains has been the simplest way to scale. Such bonds are high-grade, liquid and standardized and thus naturally extremely well-suited to on-chain markets. Aggregate RWA balances are approximately in low to mid tens of billions according to on-chain trackers today, with U.S. Treasury-anchored tokens comprising a majority percentage. (RWA.xyz)

How It Works: The Institutional cash manager provides excess cash to tokenised treasury-like instruments with same-day settlement. Traders settle within minutes, interest compounds continuously and token balances are visible on-chain. Automated compliance guarantees trades only end up in accredited holders. The result: faster cash management, lower reconciliation overhead and effortless switching between fiat rails and on-chain liquidity.

Why It Matters: Treasuries reduce the “legal mapping” risk that plagues other asset classes. Issuers and regulators find it easier to settle government debt, so they prefer scale in operating rather than inherent enforceability.

A Tokenised Fund That Actually Functions On A Day-To-Day

What’s New: Fund units are distributed by asset managers in token format. Ledger is a master register, real-time NAV calculation and direct-to-investor flows (no omnibus middle layer) enabled where regulation allows. Formal backing of such designs is predicted by the recent UK consultation document on fund tokenisation. (FCA)

Operational Flow:

- Legal Wrapper: the fund remains an authorised vehicle under local law. The token is proof of beneficial interest and refers off-chain to legal contracts.

- Issuance: tokens are credited to investor accounts after automated KYC/KYB and subscription settlement.

- Management: rebalances trigger smart contract upgrades and automated fee waterfalls.

- Liquidity: secondary trading may be traded on regulated exchanges or surveilled markets, subject to pre-trade surveillance.

Real Outcome: investors gain from reduced settlement windows, managers release back-office labor and direct-to-fund dealing liberates retail access in ways formerly costly or burdensome.

.@KAIO_xyz is building the missing infrastructure for RWAs.

Here’s how the flow works:

Fund Managers

onboard via Kaio’s registry

setting up compliant investment vehiclesInvestors

Investors commit capital

receive tokenised fund shares (Security Tokens) that are… pic.twitter.com/lBtLxhIcZg— Haris Ebrat (@HarisEbrat) October 17, 2025

Property Fractionalisation: Friction That Cannot Be Avoided, Measurable Upside

What’s Happening: Property tokenization enables robust over-the-counter access but involves enormous off-chain plumbing title administration, property managers and regulatory notification. Platforms supplement tokens with trustee agreements and custodial title to generate enforceable claims. (xbto.com)

Real-World Usage: Real estate landlord issues tokens, which are a share of revenue. Legal title is held by a trustee; rental shares are distributed programmatically to token holders. Oracles trigger occupancy and revenue events to power distributions. The technology reduces transfer frictions and facilitates secondary markets but the business still needs real estate operations and trust custodians.

Why Slower: Jurisdictional legal fragmentation and property-type requirements (tax, local approvals, strata bylaws) create complexity. And fractional exposure demand somehow still drives innovation.

Technical Primer Legal Wrapper To Secondary Trading (Step-By-Step)

Structuring The Legal Vehicle

- Determine if the token is a claim on debt, equity interest, or interest in a fund beneficially held.

- Form trust deeds, prospectuses or private placement memoranda formally linking on-chain tokens to off-chain rights. Legal certainty is the basis.

Choose A Custody Model

- Regulated custodians (MPC, institutional custodians) are appointed by institutional issuers rather than self-custody. Custody choices decide insurance, insolvency treatments and client credibility. Market lists of custody providers keep choices contained. (Alchemy)

Choose A Token Standard And Ledger

- Ride on top of well-proven token standards with transfer controls baked in natively (i.e., whitelisting, lockup and compliance hooks). Provide a public chain for liquidity or a permissioned chain for governance and lower gas fees.

Oracles And Trusted Data Feeds

- Off-chain facts (prices, title status, coupon events) must be supplied by trusted oracles. Provide redundancy and conflict resolution. Oracles are the “sensors” that enable smart contracts to react to real-world events.

Issuance, AML/KYC/KYB

- Automate onboarding using appended identity providers, sanction lists and investor accreditation verification. Use a human-in-the-loop exception framework; all cannot and ought not be automatic.

Trading Venues And Settlement

- Trade on regulated DLT-markets, operate an OTC marketplace or get linked to legacy exchanges. Finality of settlement must be as robust as fiat rails reconciliation engines correlate token activity and cash settlement.

Governance, Audits And Insurance

- Smart contract audits, operating audits, clearly defined roles (issuer, trustee, custodian) and insurance for custody and smart-contract risk reduce counterparty risk.

Asset Manager And Corporate Launch Checklist (Pragmatic)

Pre-Launch:

- Get legal approval that tokens can be enforced in your home jurisdiction.

- Choose an approved, regulated custodian and negotiate terms on insurance. (Token Metrics)

- Deploy Oracle redundancy and fail mode testing.

- Deploy a KYC/KYB and AML integration pilot.

- Smart contract audits and operating runbooks are finished.

Go-Live:

- Publish investor documents clearly defining token rights, lockups and grievance redressal.

- Restrict initial distribution to accredited investors where regulation is uncertain.

- Monitor order books, liquidity and Oracle health; maintain escalation procedures.

Scaling:

- Open secondary markets, extend custody partners, and bridge into institutionally funded prime brokers for liquidity.

- Act ahead of the regulators, they prefer companies that engage and speak about risk mitigants. (Baker McKenzie)

Tactical Implications For Retail And Institutional Readers

For Mass Retail Investors: opportunity fractional ownership puts it within reach of all, but with the same economic risk as the underlying. Select regulated products, open custody and simple exit routes. View tokenised products in the same way as any emerging asset class: read the documentation, check the custodian and become familiar with liquidity.

For Institutions: processing is sped up and cost is reduced by tokenisation and automation. Start with quality standardised assets (tokenised blocks of short-term debt or a fund) to pilot operating models. Start with custody and legal wrappers; drive programmable and liquidity components secondarily.

For Providers: reconciliation from ledgers to enterprise systems, trusted oracles, custody and compliance middleware integration represents the most glaringly obvious commercial opportunity. Individuals reconciling reconciliation and settlement finality will derive disproportionate value.

Tokenisation opens access, speeds settlement, and creates new infrastructure wins. (Image Source: MDPI)

Where Regulation Is Now (Short)

Big regulators are moving from probing questions to rule-making and formal consultation. The recent UK consultation to incentivize tokenisation of funds is an example: regulators must encourage innovation but protect consumers. Central banks remain cautious about stablecoins, and prudential regulators are concerned about deposit flight risk. Expect increasingly sophisticated rules treating tokenised products as financial instruments under current regimes, with operational requirements on custody and settlement. (FCA)

Also Read: The Heist That Backfired: A Tale of Hacker vs. Hacker

Frequently Asked Questions

- Q: Who owns the asset the token holder or the trustee

Legal form dictates ownership. Most issuances utilize a custodian or trustee to hold tokens and legal title as representative of beneficial interests in a trust deed. Due care must be exercised in reading offer documents. (Baker McKenzie) - Q: What is the treatment given to taxes?

Tax treatment is under local regulations. Withholding and capital gains regime, distributions of income are jurisdiction-by-jurisdiction. Tokenisation does not alter tax obligations; it alters traceability and reporting, and that can reduce complexity. - Q: What if a custodian becomes insolvent?

Regimes of control and arrangements of custody attempt to ring-fence client assets. For this reason, clean legal wrappers and decent custodians are needed. Insurance is useful but no substitute for legal certainty. - Q: What is a tokenised real-world asset

Tokenized RWA is a tokenized evidence of a right over an asset in the real world (debt, equity, property or commodity). The token holds the token’s right as described in the token standard and off-ledger from the perspective of law. (xbto.com) - Q: Is tokenised safe?

They share the same economic risk of the underlying assets. Additional risks include custody weakness, oracle failure, and legal uncertainty in certain jurisdictions. Properly regulated issuance with good custodians will neutralise these risks. (MarketWatch) - Q: Will tokenisation kill traditional markets?

No, not in the short term. Tokenisation optimises and complements; it removes frictions and creates new forms of products. Traditional markets and intermediaries will transform rather than perish. (Forbes) - Q: Where does intelligent automation stand?

It weaves data together, applies rules and initiates ledger action, shortening manual steps and accelerating settlement. It’s similar to the workflow engine that brings on-chain commodities to scale. (Yahoo Finance)

Finally, Action Paragraph: What To Watch In The Next 12 Months

Watch adoption where law geography is put in place: gov paper with short tenors, tokenised cash and structured commodity pools. Watch regulator consultations; their green papers usually detail the guardrails that determine how fast managers grow. Watch the evolution of custody, oracle resilience and where long-term liquidity is robust enough for retail. If you’re in the finance or fintech space, this is now essentially an engineering, product, and legal matter to watch and have nice, clean risk disclosure for. (RWA.xyz)